Looking for a development team?

We can help with design and development of apps for businesses and startups

Key takeaways

-

- In recent years, the global market for lending platforms was valued at almost $6 billion and is expected to grow by 25% every year until 2030.

- Transactions and personal data usage in the apps require an additional level of security and legal compliance.

- Must-have features for a lending app are registration, user profile, loan application form, payment log, notifications, transactions, and support service.

- At Purrweb, an MVP loan lending mobile app costs about $ 72,650.

What is a money-lending app?

A money lending mobile app is an application that allows users to take out loans or borrow money instantly on demand using digital technologies.

Money lending apps connect lenders and borrowers. Offering different types of loan, such as personal, business, car loans, or even mortgages. They are also divided by the kind of lender providing the loans to individuals and organizations:

-

- Banks

- Credit unions

- Individuals

Banks, as traditional providers of financial products, develop loan lending apps because they automate the process, improving the quality of service and the number of loans. However, there is a growing interest in alternative platforms, such as peer lending apps. In these apps, individuals can become lenders and invest in interesting projects or get more profitable loans than they can apply for in banks.

Often, such P2P lending platforms also become a place for donations people take for charity and other purposes. Before we go directly to the question, “How to create a loan app?” Let’s get acquainted with the current situation in the global market of mobile lending apps.

Lending apps market overview

The global economy is growing year by year. Digitalization helps the financial services sector to grow as it increases the issuance of loans, reduces risks, and improves customer service. In 2024, the global market for money lending platforms is equal to almost $10.91 billion. Analysts expect this volume to grow 26.53% year-on-year by 2030.

In addition to pushing digitalization, the coronavirus pandemic has also affected the market of loan lending mobile apps. The number of users has increased by 25% due to more people being able to handle administrative tasks without the need for face-to-face meetings. The number of customers who use online banking services worldwide is expected to reach 3.6 billion by the end of 2024.

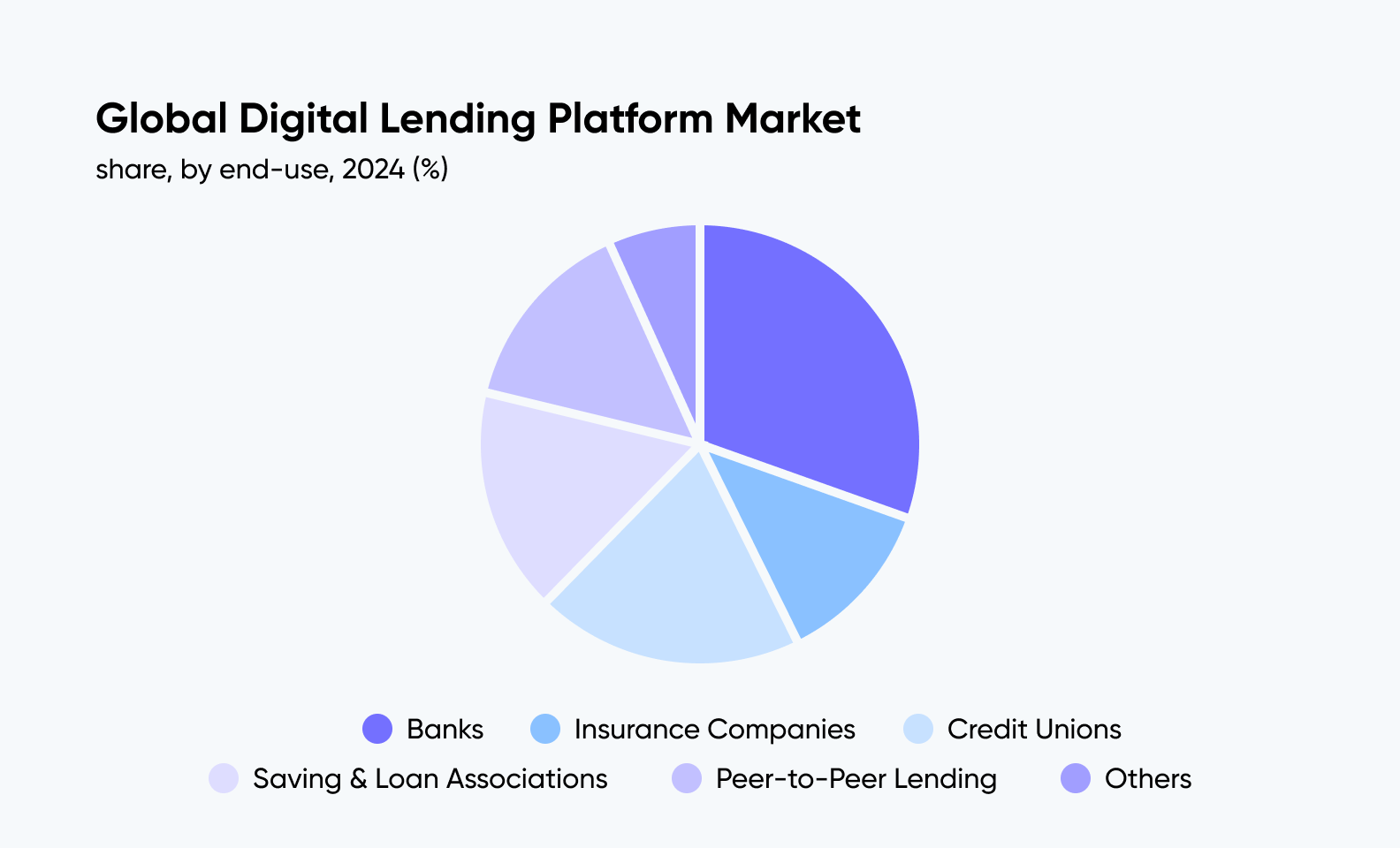

Over the last few years, banks and other financial organizations, including insurance companies, credit unions, and associations shared the spoils of the money lending apps market.

More on peer-to-peer lending apps

As we said earlier, peer-to-peer lending platforms (also known as P2P or direct lending) enable individuals to borrow money directly from other individuals, bypassing any financial institutions that usually serve as the middleman. With banks out of the equation, lenders can earn higher returns as compared to traditional investment products. At the same time, borrowers stand to benefit from lower interest rates — all because there’s no more need to adhere to strict regulations usually imposed by banks.

Most peer-to-peer loans are given to private individuals, but various legal entities and charities often use the services of P2P platforms as well.

But if there are no banks involved — then who sets the interest rates? It depends on the platform. In some cases, it’s a special algorithm that individually assesses the trustworthiness of each applicant based on their credit score and various risk factors. If the borrower is seen as reliable, the interest rate goes down — and vice versa.

Some P2P lending platforms, however, approach this in a completely different way and allow lenders to set interest rates all by themselves. This is called the reverse auction model: the lowest rate always attracts the most potential borrowers.

Peer-to-peer lending businesses generate revenue by collecting transaction fees that can be imposed on borrowers, lenders, or both. Nowadays, however, you’ll rarely see monetization models that target both sides — instead, peer-to-peer money lending applications charge borrowers exclusively (and mostly for their credit score service). The two most popular types of borrower fees are upfront payments for loan processing and small margins added to interest installments.

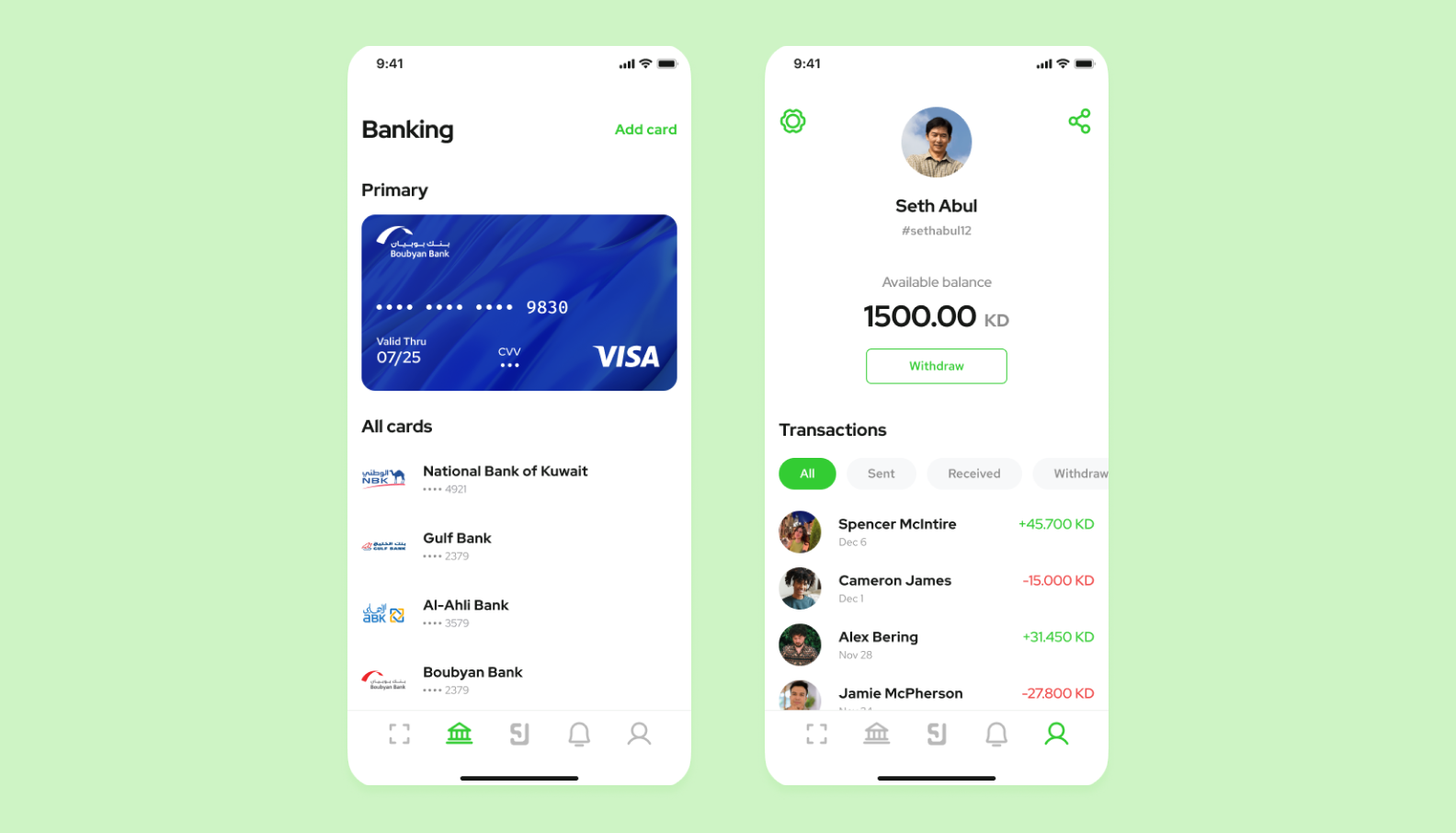

| ⭐ Purrweb’s case

We developed a P2P payment application for Kuwaiti residents. Even though that not everyone in the country uses online banking services, the client saw the demand for this application and wanted to test the idea by developing an MVP.

The client showed KEM to investors. In the first round, the project received $1 million in investment. The client continues to actively develop the application, which now has more than 100,000 users. |

How to create a money lending app?

Loan lending app development begins with an idea it could be a special feature that will help users solve their problems and distinguish you favorably among competitors. It will take eight steps to turn your idea into reality:

Step 1. Conduct an initial study

Before creating a money lending app, you need to conduct an initial study. Try to research the market and study similar applications, conduct a survey of the target audience, and find out what they would like to see in the loan app and what functions and services.

| Stages of the initial study | Questions to ask |

| Study the market | In order to better understand the market you’re entering, answer these questions:

1. What problem is your product/service solving? 2. Who else is solving the same problem? 3. Are they small or big? 4. What do customers say about them? |

| Research competitors | After you get an idea of how the market is structured, dive deeper and look at direct rivals:

1. What types of users are they targeting? 2. What are their strengths and weaknesses? 3. Are they going to build new products? 4. What features do they have that you like? |

| Define your competitive advantage | Focus on your product and compare it with existing services on the market:

1. What do you offer? 2. Do you price your product fairly? 3. Why do you build a loan app? 4. What do you do best? |

As a result, you will have a concept of creating a loan app, the main goals, user characteristics, and the app’s feature list. It will help your development team to build a loan app that will perfectly fit your idea.

Step 2. Get the legal part right

At this stage, you need to ensure legal compliance. Study consumer protection laws, usury limits and lending licenses. As well as this, it is good practice to hire a team of financiers and lawyers, and develop loan agreements, if necessary.

The main challenge of this step is to find the balance between user convenience, compliance with “Know Your Customer” (KYC) and anti-money laundering (AML) regulations.

While you want to make it easy and quick for users to sign up and access loans, you also need to follow the legal regulations to prevent fraud and money laundering.

Collaborating with legal experts to ensure compliance with regional, national, and international laws is crucial. Regulations in the fintech space are constantly evolving, and even top experts find it hard to keep up. To mitigate risks and ensure the app’s ethical and legal operation, having a good lawyer on board is simply a must.

Step 3. Choose a platform

To start lending app development, you first need to decide which platforms it will support. It may depend on your users. For example, most peer lending apps are available for private investors in a mobile app and for borrowers — in a web version.

If you are targeting mass consumers, then you can consider cross-platform apps that run on Android and iOS. Using frameworks such as React Native, you can speed up the application development process to just five months.

Step 4. Find a development team

There are three ways to find a team — take in-house, collaborate with freelancers, or sign a contract with an outsourcing company. The choice depends on your goals and objectives. The most optimal solution may be an outsourcing company that will give more guarantees of achieving results than freelancers. At the same time, it will cost less than hiring a complete development team. This is especially true for developing an MVP.

When looking for the right development team, make sure you check their expertise with your niche and verify positive reviews. Anyone can have a 5-star rating on Clutch or Trustpilot, but will they let you contact previous clients to learn more about their experience? That’s the question worth asking.

Step 5. Develop an MVP

MVP, or a minimum viable product, is the first yet fully functioning version of a product. It has all the necessary features for a user to complete the journey and provide feedback.

The main purpose of MVP is to test if your idea is viable in the current market, and it doesn’t stop there. Here are some of the reasons why you should invest in MPV first:

-

- Check the viability of your idea. No matter how good your idea is, you’ll never know if real people will start using it. That’s where the MVP comes in. By investing a small chunk of your resources, you can gauge your target audience’s interest in the product and don’t overinvest in the idea that won’t work.

- A chance to pivot. Sometimes, even though the interest is there, your solution can still fail, which means that you should try to pivot and find another way to solve the problems of your target audience. With a low price of the MVP development and the feedback of your audience — it’s easy to try again.

- First return on the investment. If the launch of the MVP went well and the target audience loves the first version — you can start to evolve your MVP into a fully-featured app. The best part is that you can reinvest the money that the MVP is making into further development. And the better the app will get — the more money you’ll get in return. You test the waters and see if there is an actual demand for it.

MVP has only must-have features, so the development process is fast and cost-efficient. Most MVPs get brought to market within 3-4 months.

For those who want to start a loan app, an MVP is the perfect way to test the market and validate the hypothesis of your product or service.

Step 6. Prioritize features

Prioritize features with the development team based on your strategic goals, target users, and budget. You can use the MoSCoW prioritization technique, which divides all possible MVP functions into four categories:

- Must-Have (M): Identify essential features crucial for app functionality, like user registration, loan application, and repayment. These form the core user experience and compliance aspects.

- Should-Have (S): Include features that enhance usability and user satisfaction, such as account management tools, personalized loan recommendations, and secure document uploads.

- Could-Have (C): List non-essential features that offer added value, like in-app chat support or additional payment methods. These features are beneficial but not critical.

- Won’t-Have (W): Consider features that are nice-to-haves but can be deferred. These may include advanced analytics or integration with third-party services.

Here is an example of how feature prioritization can look like for a money lending app:

| Category | Features |

| Must-Have (M) | User registration and profile creation. Essential for user engagement and compliance.

Loan application and approval process. Core functionality of the app. KYC and AML verification. Crucial for regulatory compliance and risk management. Repayment schedule and notifications. Vital to ensure timely payments and user communication. |

| Should-Have (S) | Account dashboard. Enhances user experience by displaying loan status and transaction history.

Secure document upload. Improves convenience for users submitting verification documents. Customer support chat. Adds user support for inquiries and assistance during the lending process. |

| Could-Have (C) | Loan calculator. Provides users with estimates for loan amounts, interest rates, and repayment terms.

Budgeting tools. Offers financial planning assistance and tips for loan management. Rewards and loyalty program. Provides incentives for timely repayments and app engagement. |

| Won’t-Have (W) | Advanced data analytics. In-depth insights into lending patterns and user behavior.

Integration with investment platforms. Offering investment options alongside lending services. |

Step 7. Create UI/UX design

A simple but stylish design will attract attention to your product. Pay special attention to UI/UX design (user interface and experience designs). It will help to create an application that people can use easily and comfortably.

Define target groups. The first thing to do is identify who will use your product and try to group them. Some designers start off by creating a user persona, a semi-fictional character based on an ideal customer. The main approach is to survey current or potential users and segment them by demographic and psychographic data.

Create a map of a user journey. Identify different scenarios of using your product and highlight goals, expectations, and pain points.

Come up with the design. Use the data you gathered to brainstorm how the design elements can help users understand and navigate your product. Create wireframes to plan the space on the screen, develop mockups and a UI kit with branded graphic elements.

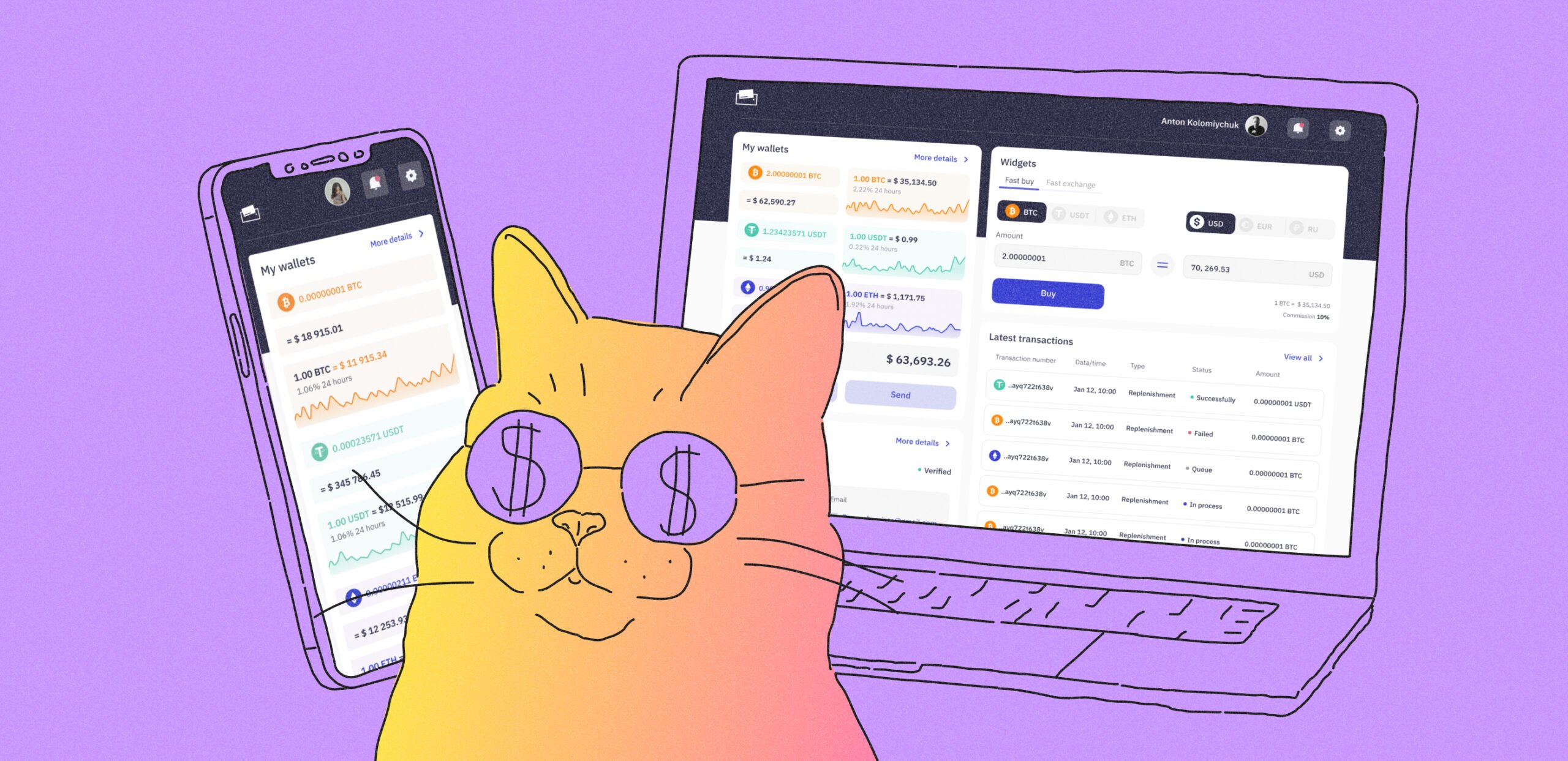

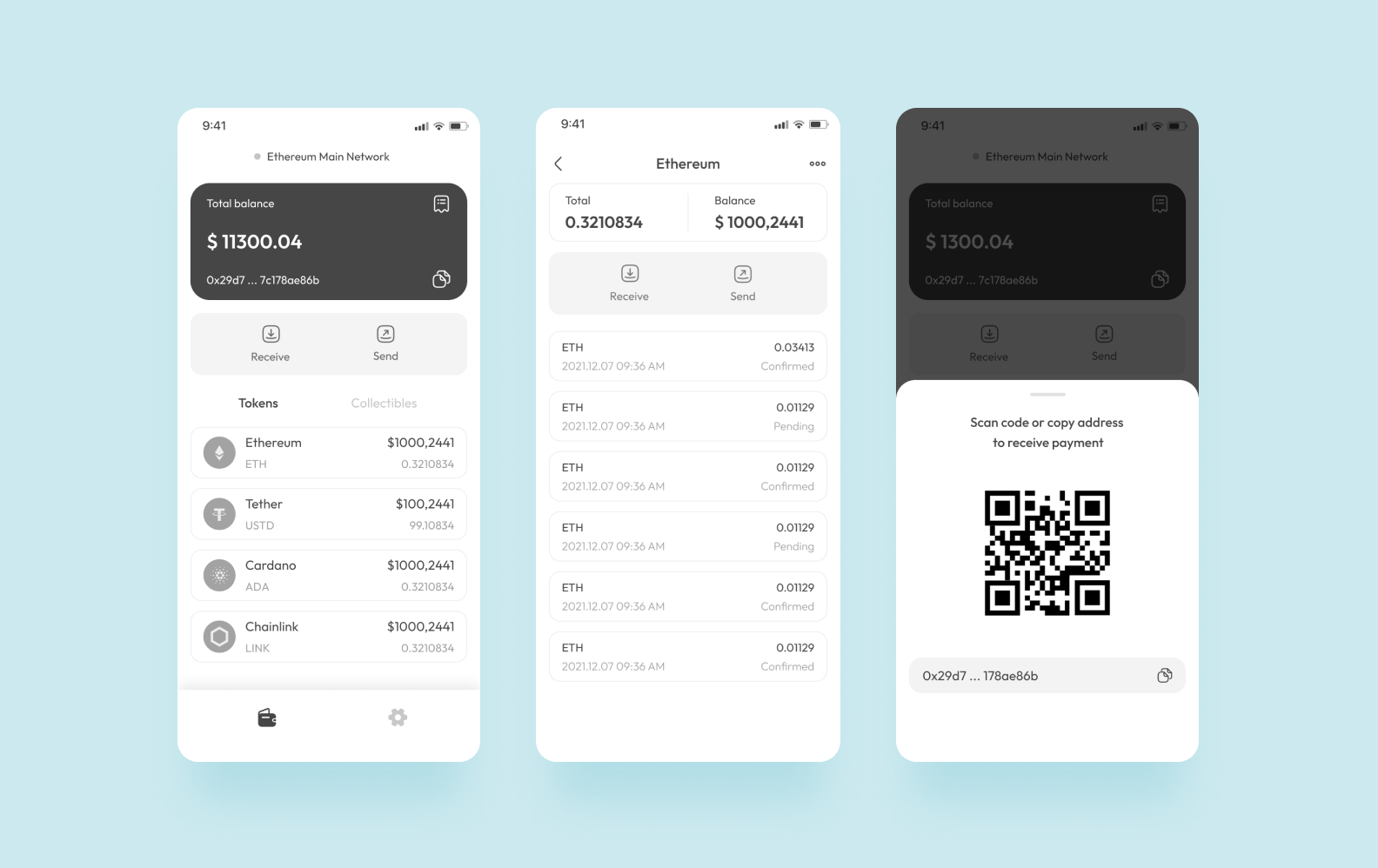

Wireframes from one of our crypto wallet cases

Step 8. Develop a full app

Lending app development has two parts: frontend and backend. To better understand the difference, think about a car.

Frontend development is like the car exterior — it’s what users see and interact with directly.

Imagine it as a wheel, the leather seats, a control panel you see when you first sit in a car. Loan app development includes things like coding, user interface (UI) design, UX design, layout, and interaction.

The backend is like the inside of the car with the engine and all the complex parts that work together to make it run smoothly.

Backend development involves building the systems that power a website or an app behind the scenes. It is the place where all transactions take place. Backend development includes developing security protocols or writing a code for integration with servers, which are responsible for storing users’ personal data and their authorization.

At this stage, you take your MVP further and enrich it with functionality to release a more complete and polished version.

And this is the final version of the crypto wallet we developed

Step 9. Test and launch

Before the app is released , testers check it for bugs. The goal is to identify and fix any issues or bugs that could negatively impact the user experience. This includes four stages: plan, do, check, and act.

-

- Identify requirements and test case scenarios and plan the testing.

- Run test cases on servers, networks, and devices.

- Fix bugs, check again, and perform regression testing.

- Close the cycle and evaluate the performance results.

The release of the app is not the end of the road. After launch comes an equally important stage involving the collecting of feedback and making data-driven decisions to improve the product.

The feedback can help you identify growth points and move the project to the second cycle of your loan lending app development by adding additional features, enhancing user experience, and updating the design elements.

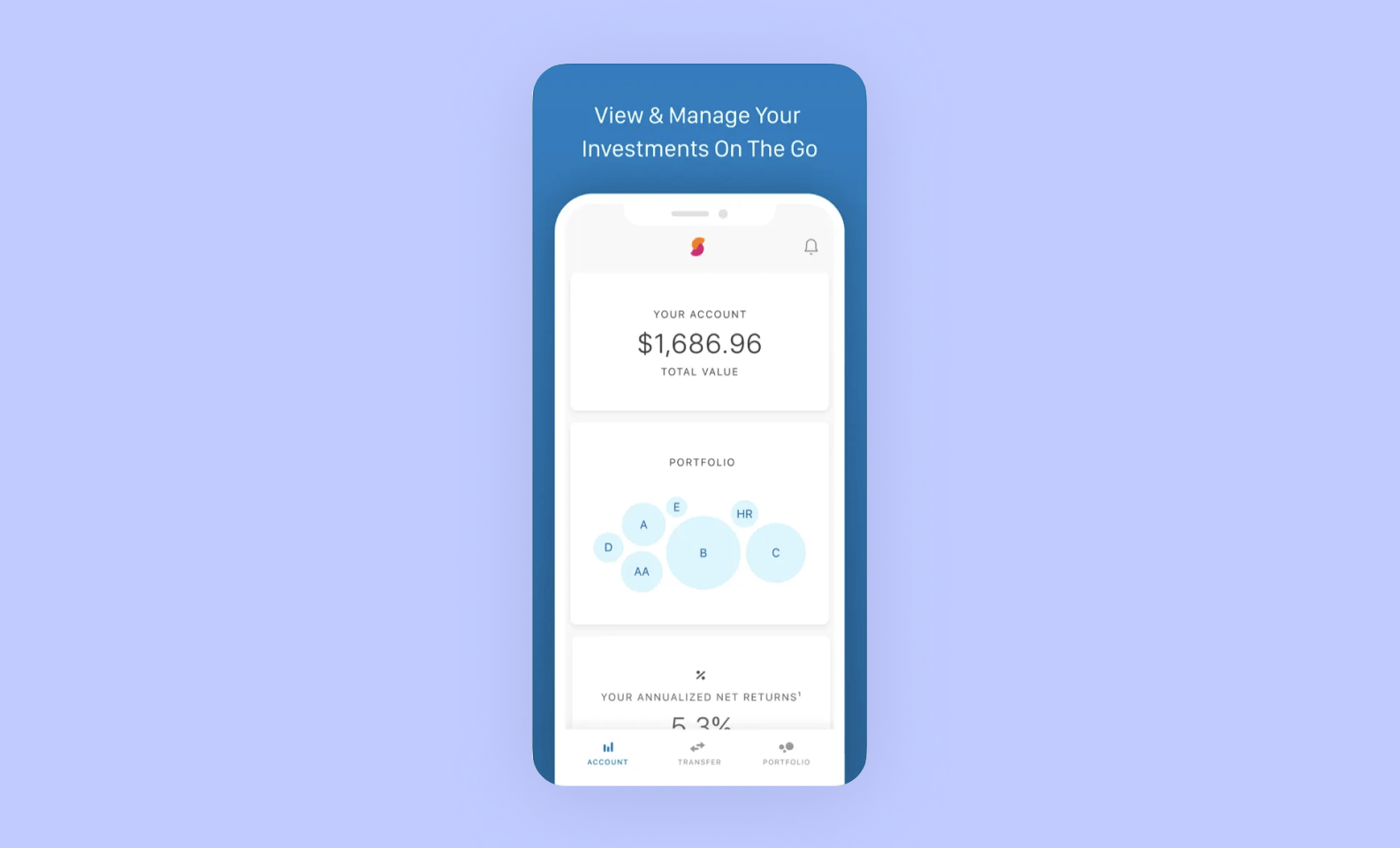

Top 5 consumer lending apps

To understand how to build a money lending application, let’s take a look at some of the well-known loan apps and their strengths.

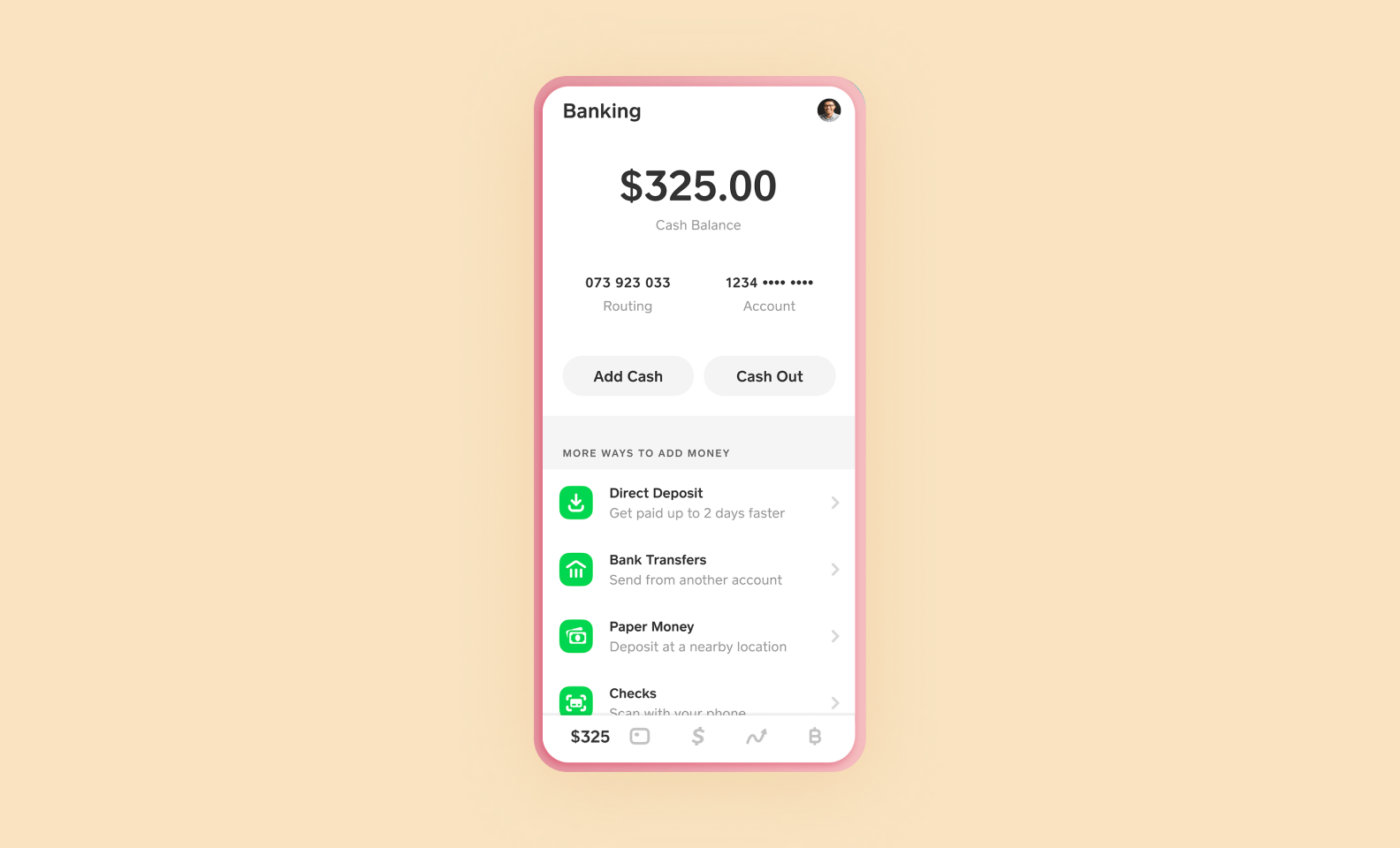

Cash App

Cash App is a money transfer mobile app available in the United States and the United Kingdom. It was released in 2013 under the name “Square Cash.” In 2018, the platform started supporting bitcoin trading, and in 2019, it launched its stock trading service.

App type: banking and peer lending app

Platform: iOS and Android

Number of users: 70 million people

Key features: money transfer, activity tracking, crypto trading

Why it’s good: the app allows users to send and receive money instantly, as well as invest in stocks and crypto. It is #1 in the App Store under the Finance category.

Prosper

Prosper is a platform that helps users manage their loans with ease. Customers can log into their accounts, make payments, set up automatic payments, or track the progress of their loans. The app also makes it easy to keep track of automatic payments, make a manual payment if needed, or opt-in to receive notifications on your phone.

App type: p2p lending platform

Platform: iOS and Android for investors, other users can use it on desktop and mobile browsers.

Number of users: 1.4 million people

Key features: loan management, 2FA authentication, automatic payments

Why it’s good: the app automatically recommends loans based on the borrower’s profile. It has been operating on the market since 2005 and already helped more than a million individuals, with the volume of loans amounting to $17 billion.

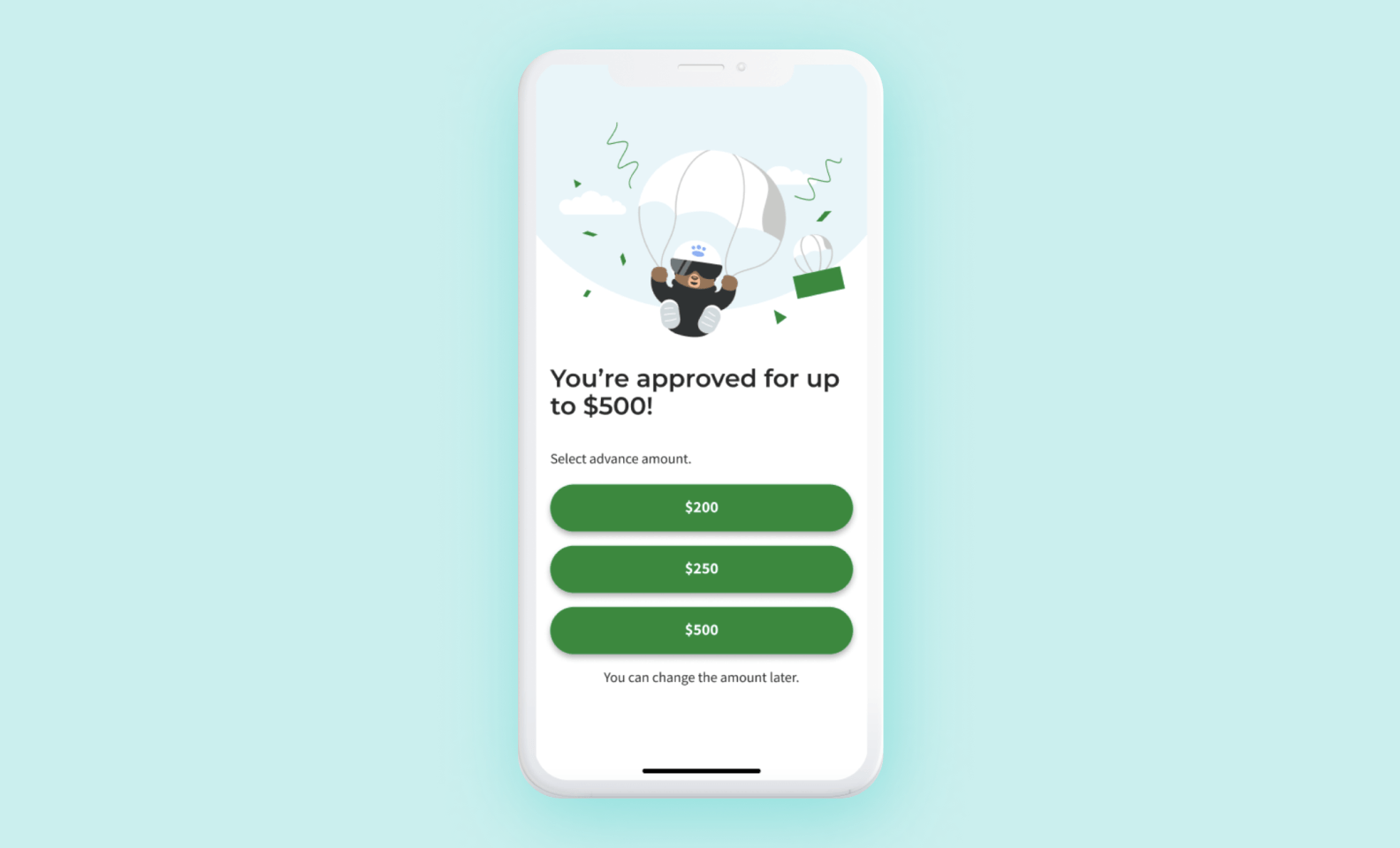

Dave

Dave is a platform for money management. It offers several products: ExtraCash loans, Spending Account, Side Hustle, and Goals Account with savings. ExtraCash offers a money advance with no credit check or late fees. It takes users only minutes to download the Dave app, securely link their bank, and send the money to a Dave Spending account.

App type: banking lending app

Platform: iOS and Android

Number of users: 5 million people

Key features: direct deposit, in-app loan application, interest rate calculator

Why it’s good: It is the best way to take small advance loans. It suggests users get up to $500 instantly without interest and credit checks.

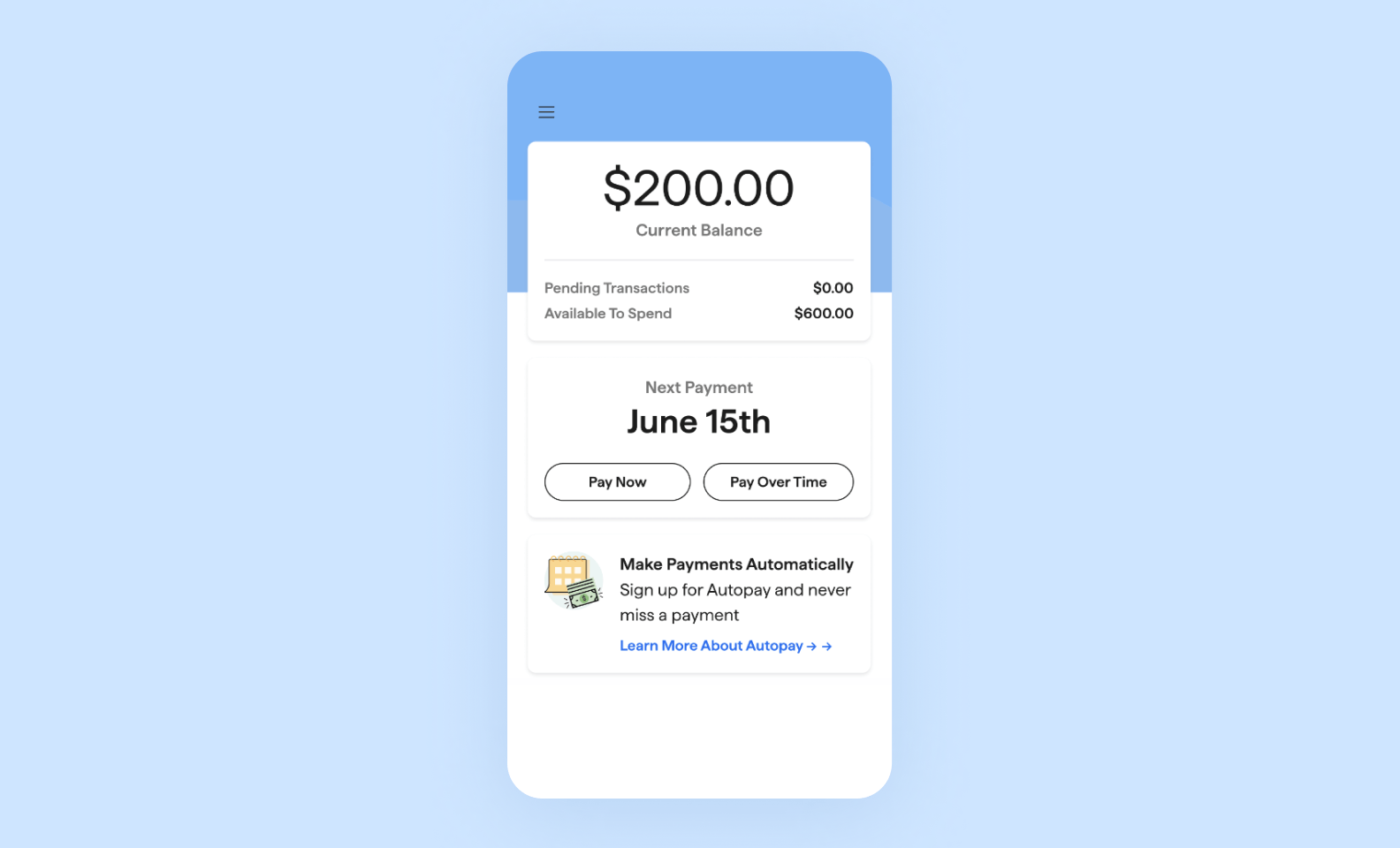

Possible

Started with a mission to help Americans break the debt cycle and unlock economic mobility for generations to come, Possible provides personal loans with no fees or late penalties. Customers can also get a Possible credit card to improve their credit score.

App type: banking and credit unions’ app

Platform: iOS and Android

Number of users: 3 million people

Key features: payment schedule, integration with most American banks, payment history

Why it’s good:The app allows you to get quick access to money with bad credit or without it at all. It charges a high interest rate, but it is still less than traditional payday loans. Borrowers can choose to change the repayment date.

Funding Circle

Funding Circle started as a peer-to-peer lending marketplace that allowed the public to lend money directly to small and medium-sized companies. In this model, businesses accessed lower interest rates than they would get at a bank, and the general public was able to make a return on their capital. In March of 2022, the company closed its lending option to “public investors” and focused on commercial loans.

App type: p2p lending app

Platform: iOS and Android for investors, and there is a mobile web version for other users.

Number of users: 120,000 businesses

Key features: in-app application process, fast customer support

Why it’s good: Small business owners can receive credit financing through crowdfunding investments. The loans have low rates, but in order to receive them, entrepreneurs need to have a good personal credit history and an established business.

Why are loan apps in demand?

Rent, bills, gas, inflation, unexpected hospital visits are some of the countless reasons someone might need a small and quick advance between paychecks. Money lending apps can be a useful tool for both sides of the process.

Benefits for borrowers

Before getting to how to create a money lending app, let’s briefly analyze why they are convenient for borrowers.

-

- Lending apps make life easier for customers by minimizing contact with banks and other financial organizations.

- Clients have the opportunity to receive loan money from anywhere in the world without visiting the office.

- You can manage your loans and cash receipts instantly.

- Personal and financial information is protected.

Benefits for lenders

As the lenders are banks and credit unions, they receive interest from loaning out their deposits and therefore, benefit from an benefit from a number of users of money lending apps. It also brings them additional benefits:

-

- No need for personal communication with customers, so lenders incur less operating costs and can focus on servicing and increasing the number of loans.

- Lenders can use KYC or “Know Your Customer” to protect them from scammers using the lending app for money laundering or other fraudulent schemes.

- Wider market reach.

- Improved credit products with the help of artificial intelligence capabilities and attract more clients.

In P2P lending platforms, individual lenders can find good opportunities to make money through loans and investments because:

-

- P2P lending platforms have a large audience of users so lenders have a choice of who they provide loans to.

- Lending apps check the credit score and documentation of the borrowers in order to prevent bad loans and fraud.

- Lenders can find interesting projects to invest in.

- Both lenders and borrowers benefit from lending apps, which has become possible thanks to mobile technologies.

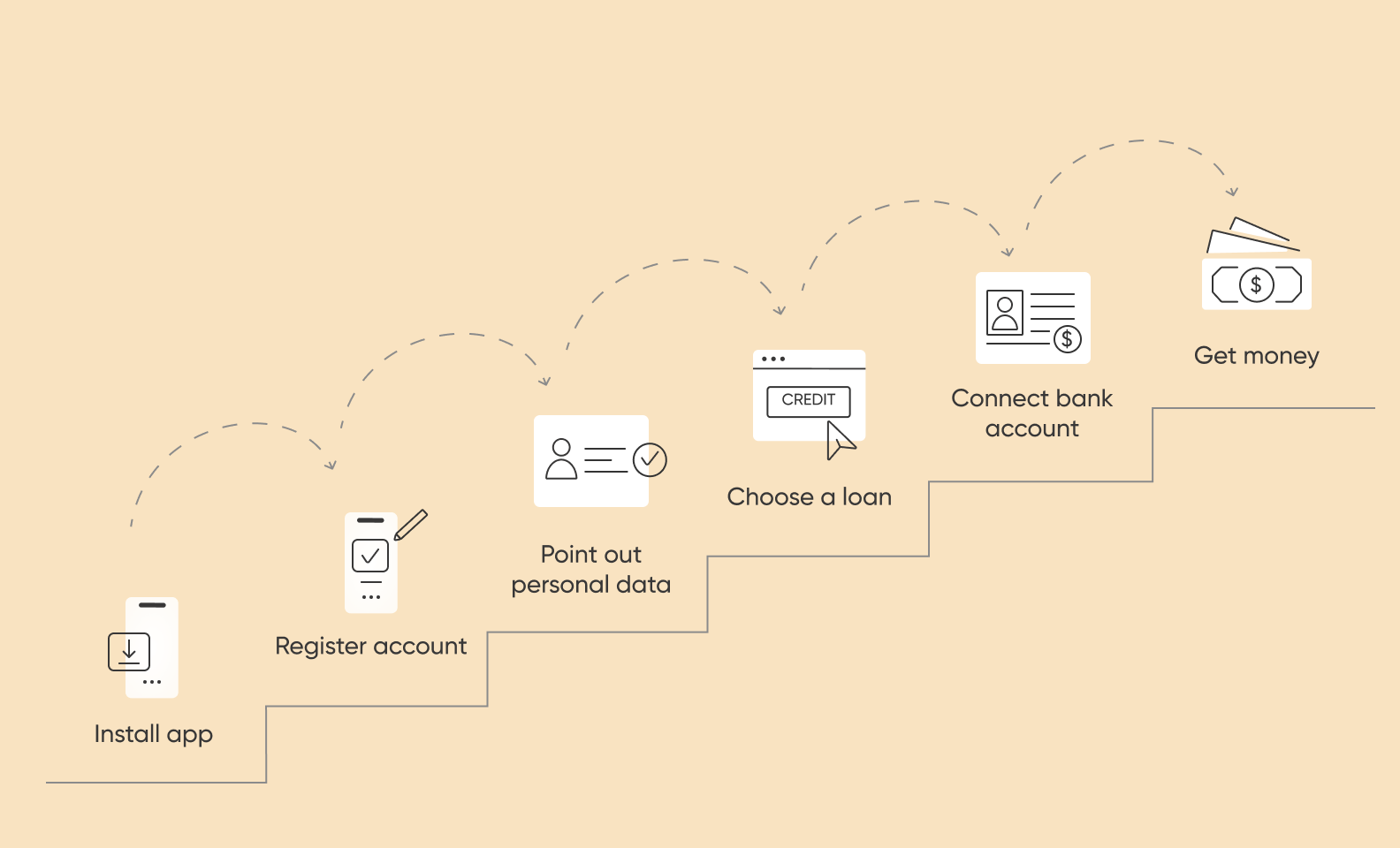

How do loan mobile apps work?

To understand how to create a money lending app, let’s focus on basic user scenarios. We will look at the stages of obtaining a loan, the main goal of your potential customers.

-

- The user downloads the money-lending app from one of the iOS App Store or Google PlayStore.

- Registers a new account and successfully logs in by entering username and password.

- Adds necessary personal data in order to prove credit standing.

- Chooses a loan from the app catalog using filters.

- Applies for a loan, specifying the sum of the credit and the expected repayment period.

- Connects their bank account to which the loan will be received.

- Gets approval and completes the procedure.

This is the main scenario when using a money lending app. Let’s take a look at must-have features that implement this process in your app.

Must-have features

A money lending app can consist of many functions that ensure the security and convenience of getting loans. However, we propose to consider the most basic of them for developing an MVP. This is the first version of the application, which you can release to the market quickly to test your idea and adapt it if necessary.

Registration

Registration should be simple so as to make it easier for users to join, while still meet the safety requirements. It is better to make sure that the user enters a complex password and a successful authentication, you can also offer them the ability to connect the verification of biometric data.

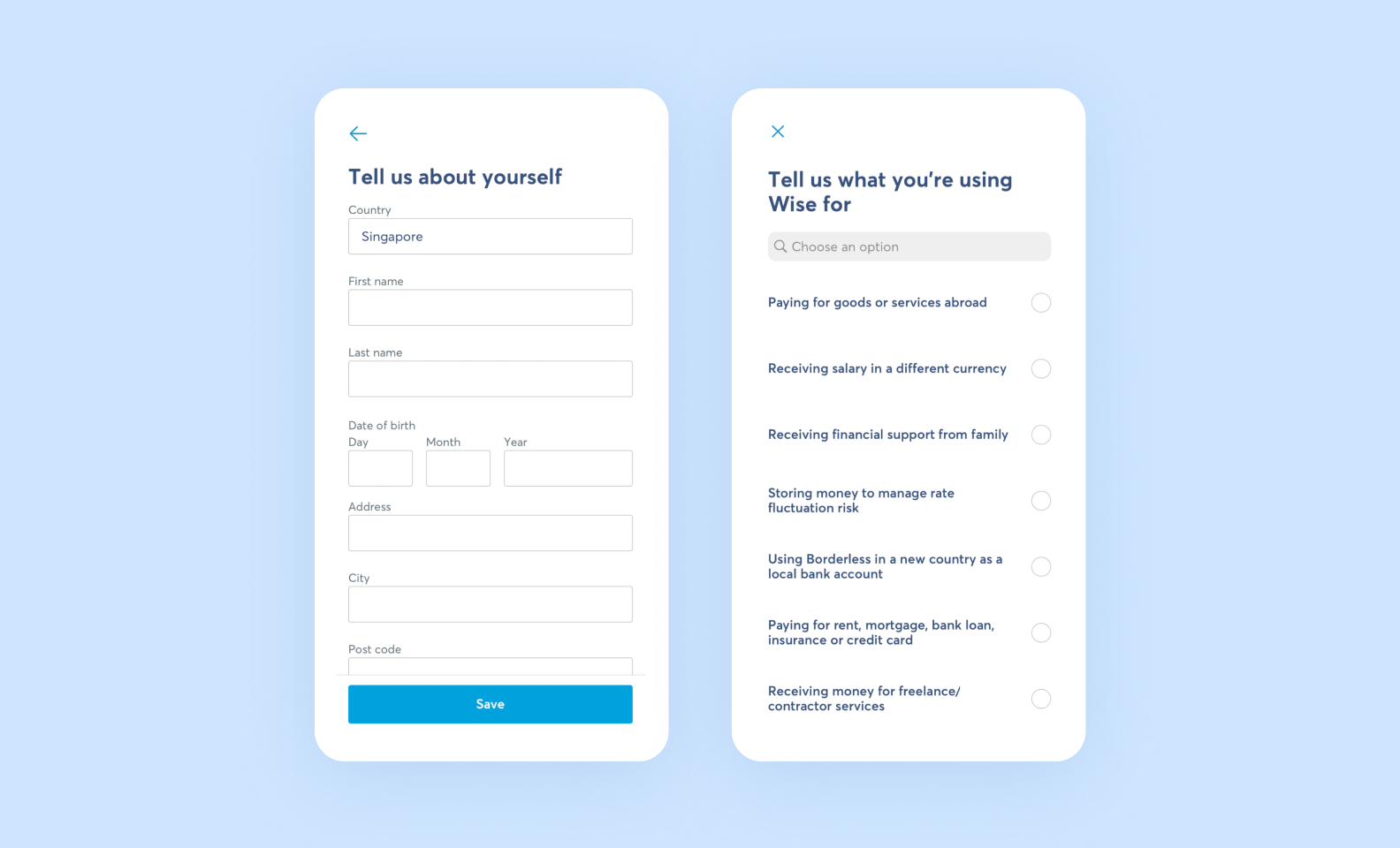

Registration form in Wise app is simple and has questionnaire, which can help adjust the app to specific user’s needs

User profile

All personal information about the user is stored here. It includes credit card, bank account details, government issue ID and other important data.

Loan application form

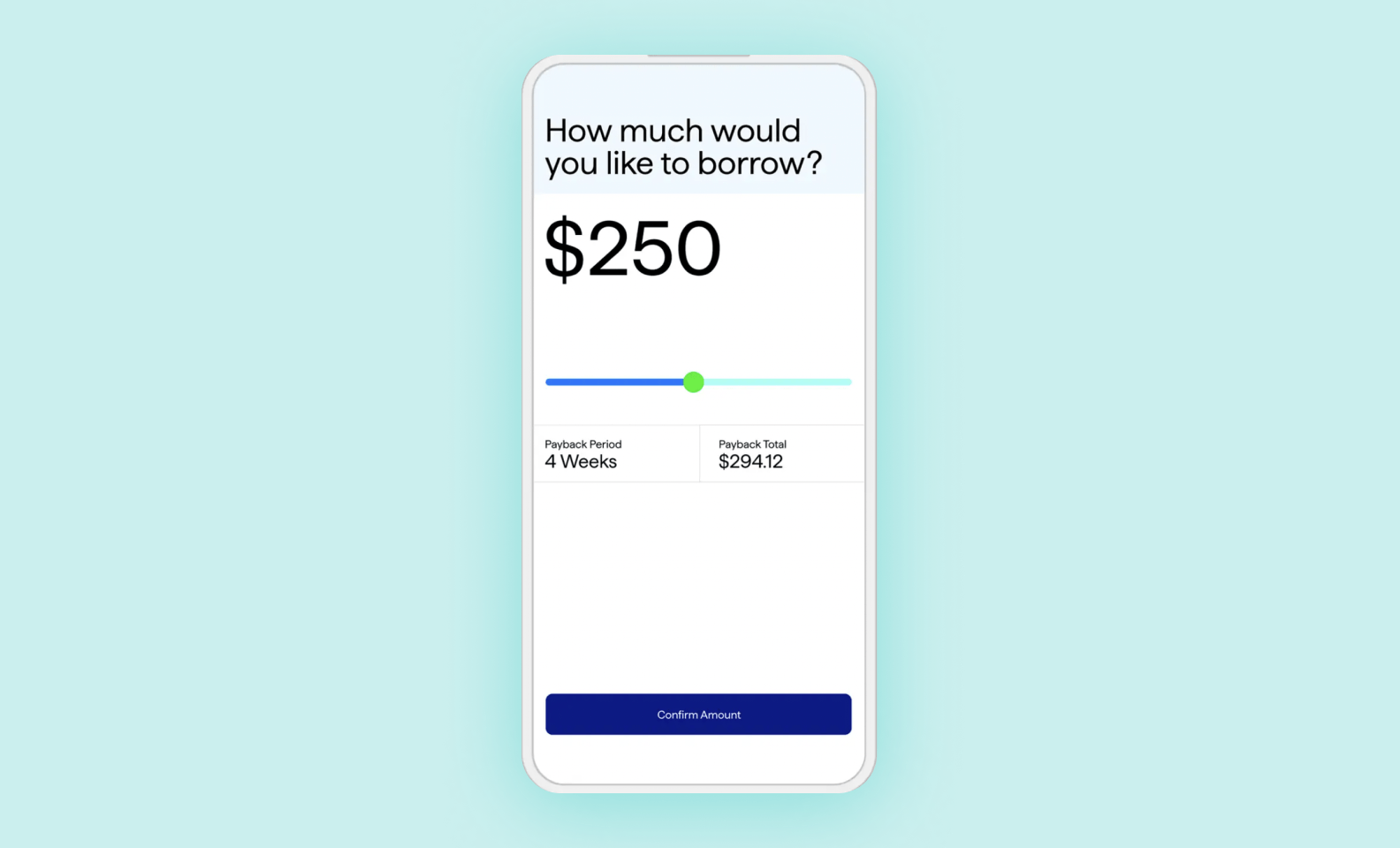

This is the main function of the instant loan app. It should be well-structured and divided into stages. Your app can guide users through these steps, display progress, and suggest the best way to fill in the fields. Because obtaining credit also depends on the accuracy of this information.

Payment log

Here, users can view their payment history, view pending payments, and fix the remaining amount of debt. An interesting idea might be the integration of a calculator that would display changes in loan terms when making early payments.

Notifications

Push notifications will inform users about the next payments or new profitable loans and refinancing promotions. Another way is to sync the app with widgets in a smartphone, which as you can see in the picture below.

Transactions

Having received a loan, the borrower should then be able to make monthly payments that cover both interest and the principal amount of the debt. Here, the app can also allow you to link your bank account to the loan and install auto payments.

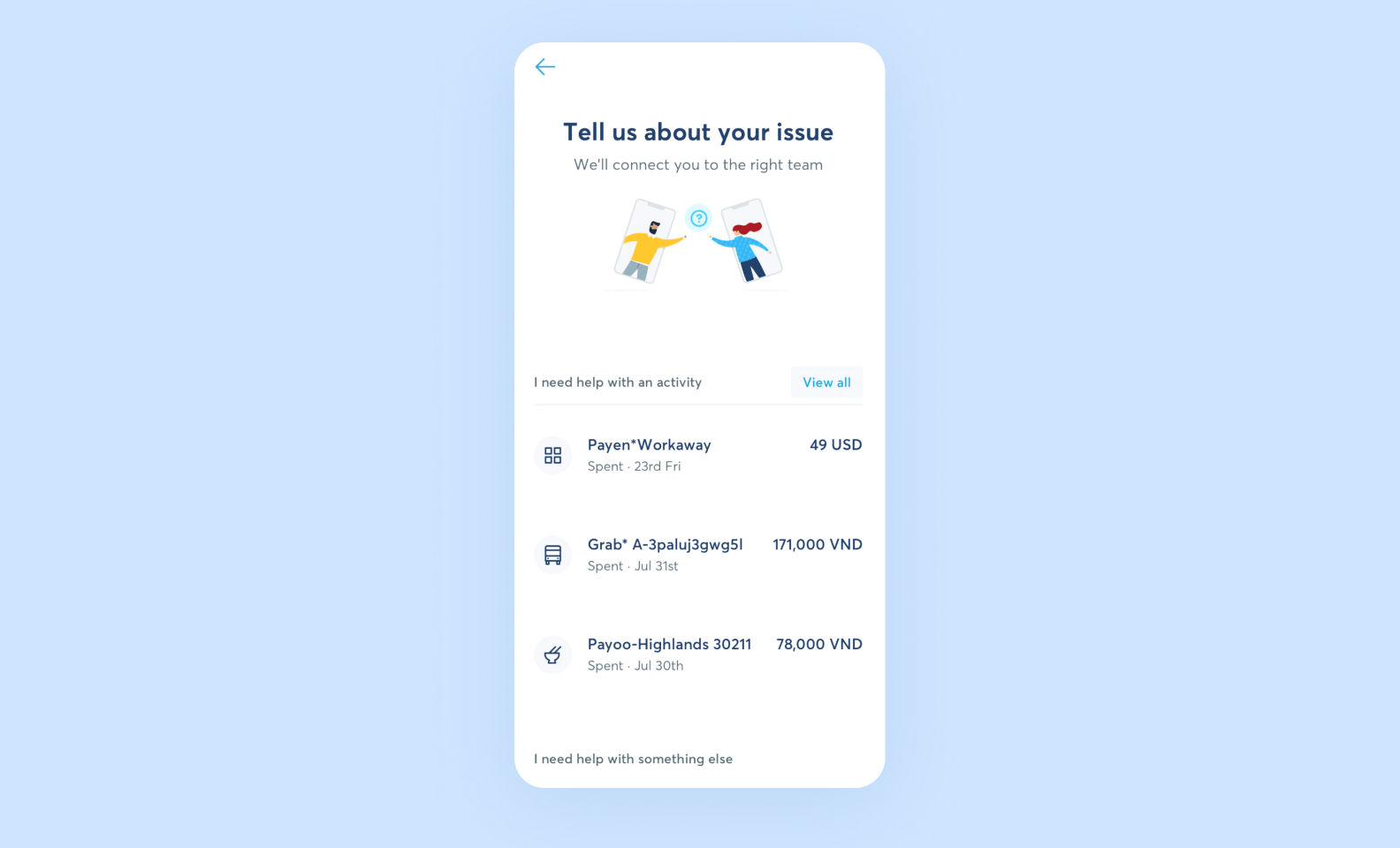

Support service

This can be a chat with the technical support service, which will help customers in using the cash lending app. You can also involve a lending manager who would advise users on credit products.

Security and legal compliance features

Everything about money requires a high level of security. This demand is especially strict for lending app development. Transactions and users’ personal data — everything should be under reliable protection. There are several ways to enhance data security and protection against intruders.

| Feature | Explanation |

| Authentication | The lending app must provide reliable user authentication. In addition to a simple set of login and password, there are several ways to control access. For example, two-factor authentication also includes verification by sending an SMS with a code. However, the most popular today is biometric authentication, which uses facial recognition or fingerprint scanning and is available in most modern smartphones. |

| Encryption | Any confidential information that users can send through the money lending app needs to be encrypted both in storage and transit. All servers that store keys and data must be protected from attacks and belong to the owner of the loan app in order to avoid privacy leaks. |

| Legal compliance | Also, pay attention to the legislation of the cities and countries where your lending app works. It is quite possible that it has specific requirements, including security issues. For example, the Gramm-Leach-Bliley Act (GLBA) specifically requires all businesses in the US to set standards to protect the security and privacy of Non-public Personal Information (NPI) of customers. |

Things to consider before you build a loan app

If you don’t want to get into hot water with your services, it is crucial to take into account these four main challenges when you build a money-lending app.

Fintech regulations you need to comply with

This involves figuring out what you need to do to comply with local regulations.

Imagine you start an app for the US market — have you considered federal acts or local legislation? If you are headquartered in California but have clients in Texas, do you need to comply with both states’ regulations?

Those are questions only a good lawyer can answer. When you intend to build a fintech product, having a legal consultant is necessary. The industry is heavily regulated, and it’s easy to overlook an important detail that could cost you a fortune to fix and in fines.

Stack of technologies to use

First, you need to choose a platform. Do you want a mobile app, a website, or a web portal?

The choice of the platform can depend on your target audience. For example, if you are aiming at the younger generation of users, a mobile app is a must.

Then, together with your development team, you have to evaluate the approach you want to take. You can opt for native development or cross-platform frameworks like React Native if you need to build both iOS and Android money-lending apps.

Another thing that can impact a tech stack for a project is the budget, your development team can suggest technologies that can save time and cut down the costs of a project, if needed.

Competitive advantage

This is the unique feature that stands you out from the competitors. The fintech market is highly competitive, the successful launch of a money lending app is a challenge in itself.

The earlier you define the competitive advantage of your project, the easier it will be to develop, promote, and market a product or a service.

Generally, there are three main types of competitive advantages: differentiation, cost, and focus. Depending on your project and target audience, your competitive advantage can be a niche you cater to, a lower cost of the product, or a mix of both.

Who can build your product?

Finding a reliable and experienced development team is always a struggle. The challenge is not just to find a developer but to pick someone who:

- has experience in your niche,

- worked with this stack of technologies before,

- has verified positive reviews,

- offers a quick turnaround and transparent pricing system.

How much does it cost to build a money-lending app?

Usually, the lending app development cost depends on the amount of work. To find out how much it costs to build a loan app, we have divided this process into basic stages. For each stage, we have specified lead time and approximate prices. This assessment is relevant for MVP and has a basic set of features.

| Stage | What we are doing | Estimation in hours | Estimation in weeks | Approximate costs |

| Project estimation | We discuss the idea of your loan app and estimate the costs and time needed | 8 hours | 0.1 weeks | free of charge |

| UI/UX design | We analyze user flow, create a prototype of the app based on it, design concepts for each individual page, and approve them with you | 151 hours | 6 weeks | $6,040 |

| Development stage | Our team builds the architecture of the money lending app, builds the client-side interface and its interaction with the server, as well as creating the admin panel | 1120 hours | 13 weeks | $54,810 |

| QA (Quality Assurance) | We check the application for any small bugs and fix them before launching the loan app | 400 hours | in parallel with the project | $7,200 |

| Project management | We plan the stages and terms of development so that you get a quality product as a result | In parallel with project | In parallel with project | $4,600 |

Purrweb, an MVP lending mobile app costs about $72,650. You can get an estimated budget for the project, after approving all the details of the project. If you’d like to get an individual assessment for your project from Purrweb, fill out the form below.

How to promote your lending app?

Promoting an online lending app effectively requires a multifaceted approach. Here are multiple ways to promote your new mobile application:

Content marketing. Create blog posts, articles, and infographics that provide valuable information about the benefits of using your lending app — then share them on your website and social media accounts.

Social media marketing. Maintain active profiles on popular social media platforms, such as Facebook, Instagram, X, and LinkedIn. This is especially important if your target market is a younger audience. In addition, we suggest that you engage with your customers, run targeted ad campaigns, and promptly respond to any questions that your subscribers may ask online.

Influencer marketing. Influencers in the finance and tech segments can help your app quickly reach the target audience — especially if you partner up with some big names. Since the content produced by these bloggers often feels more authentic than traditional advertising, their followers are more likely to trust them and consider actually trying out your app.

Referral programs. Encourage your existing users to refer friends and family to your app by offering incentives or rewards for successful referrals. This method is great for two reasons. First, referred customers are often high-quality leads because they are more likely to have a genuine interest in your product or service. And second, it relies on the powers of word-of-mouth marketing — meaning that there are almost zero expenses on your side.

Partnerships. Finally, you can collaborate with financial institutions, fintech companies, or e-commerce platforms to cross-promote your app. This will allow you to tap into their user base while also boosting your credibility — especially if you choose to collaborate with a reputable and well-established business.

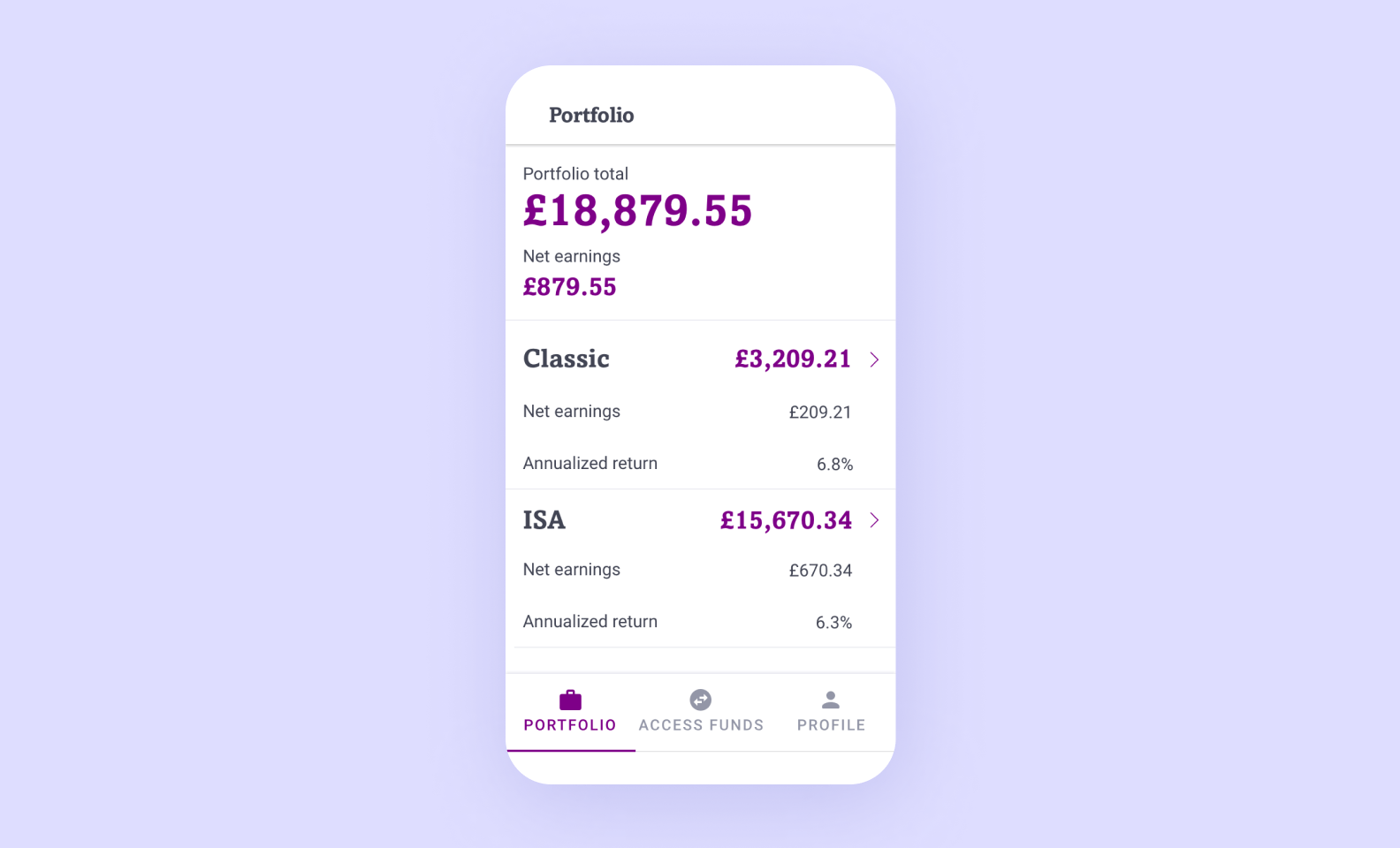

Our experience in creating fintech apps

At Purrweb, we have already created over 300 MVP applications.

For instance, we built the Broex wallet app for crypto investments. The main goal of this app was to make the purchase of cryptocurrencies as safe, simple and understandable to the average user as possible. That’s why we paid a lot of attention to the beginner-friendly design of the interface and security issues. We have implemented the KYC procedure in the application, which crypto exchanges, like banks, must execute.

Another example is a Fintarget platform for brokers and investors. We created the design of interfaces: investment account with payment system, dashboard with all statistics, and strategy pages. Our task was to make it simple, informative, and useful.

If you have any questions regarding loan lending app development, we will be happy to answer them and help you find the most interesting solution for your idea. Fill out the form below to get the quote for your project.

[wpim]