Looking for a development team?

We can help with design and development of apps for businesses and startups

We don’t mean spending late night hours on ‘stunning 50-plus page slide deck for your next big thing’. The days when someone gave $20K for nothing but a nice-packaged idea are gone. It’s 2019 and you have to bust your ass to convince someone to write you a big check.

In our previous article, we’ve analyzed the points that influence startup valuations. This time you’ll find what is also needed from you to create a strong and engaging investor pitch deck- actually, there’s something that investors expect to be in place. Get these 6 points lined up to decrease the risk of going home empty-handed (no article will eventually guarantee funds).

1. Problem

Not passion — leave it to your mom or girlfriend, because no one else gonna take it seriously. If you build a product around a fake problem (despite feeling passionate about it), you’re doing a hobby — there’s nothing about running a real business.

What’s gonna be a real problem? Everyday life happenings that make us mad. Whatever the problem is, it should be truly annoying.

Just like your wife’s teeth grinding that often keeps you awake at night

Just like your wife’s teeth grinding that often keeps you awake at night

First, ask yourself:

- Have I met enough ‘Yeah, hate that’ people?

- Is there a way I can ease their pain? Make something work smoother, smarter or faster?

If both answers are ‘YES’, show the problem ‘as it is’, then give a scenario of it with your solution behind it. This is gonna be a real drama where the drama is the pressing problem you’re aiming to solve. For that, get the proofs that the problem is not in your head.

Put a problem first. Then put the rest. Not vice versa

2. Solution

Once you’re done with the problem, prove that the way you’re gonna handle it really deserves money. The best way to do that is by giving something tangible.

Something like a quick demo is a way to go. Simply because it’s damn hard to convince someone with just words. That’s where a demo works better than a thousand words and actually shows your solution is alive and can be done.

In case there’s no demo to present, make up a few mockups or even draw screenshots on paper. Point out active areas showing how the product will work and take pics of them. Don’t go too much into the details here like completed graphics or fancy animations, use just key screens to walk them through your app.

Keep explanations short. Just bullets to grasp the idea

3. Competitors

Let’s be realists, when it comes to ideas, nothing in this world is truly unique. If you think there’s no alternative for your thing, we bet it shouldn’t even exist because no one really wants it. Sad but this is the way it works.

While doing research, put both direct and indirect competitors on your list.

For instance, if you’re starting a new CRM startup, your competitors aren’t just Salesforce.com and RightNow. The competition also includes people who prefer using Excel to track customers and prospects. Hell, even paper-style (customer inertia is your biggest challenge to overcome) should be included here.

It’s not enough to show you only compete in the same space. No one will give you a penny to see your startup swallowed by powerful guys. Instead, prove there’s a competitive advantage (enables you to compete in the long run) aka something you can do better.

Whatever the differentiation is, it should be truly beneficial for the end user.

Just like Apple designs we love. We love them not just because ‘it looks nice’. It’s more in terms of UI look

Do what Apple does. Their products have many bugs, prices are huge but the design makes us forget about that.

Remember that the way you speak about your competitors speaks a lot about you. Be careful when criticizing existing solutions and share just real weaknesses. To stand out from the competition (and save the reputation as well), just stay factual about what you’re doing:

‘What Competitor A is doing is ABC, we do the same PLUS we have a magic dose of XYZ…’

Btw, having a better understanding of who’s on offer in the market isn’t just a thing you do to impress investors. It’s more like a working way to stay objective and get to know your market. Figuring out what your targets love, what they don’t, whom they trust and how they choose between one or another.

4. Initial traction (most convincing one)

Investors want to perceive you’re building something people will pay for. We’re not talking here about tons of revenue. ANYTHING that says you’re progressing is all that is required (even if numbers are far from being impressive).

The choice of options that help you give confidence actually depends on how far you’ve gone with your MVP. Roll out your sleeves (it always requires hardworking) and see three ways to prove the evidence of traction:

- Customers who already use it (the better it will be to have signups not just from your mom and close friends).

- Beta list subscribers (in case your MVP is done but not so much done to start charging).

- User poll results (in case you have literally nothing tangible to show).

We didn’t put the ‘Already have a final version’ scenario here. For that guys, the best way to prove traction is by showing money in the bank from repeating customers (rarely happens to first-time founders).

Find out a way to prove that you’re progressing

Find out a way to prove that you’re progressing

5. Forecast

Simply because you cannot just ‘show up and be found’. Though predicting numbers when you just start out is a real challenge, having a roadmap in place lets you be a better strategist and keep track of what you’re doing.

Bare essentials here are:

A. A sales forecast

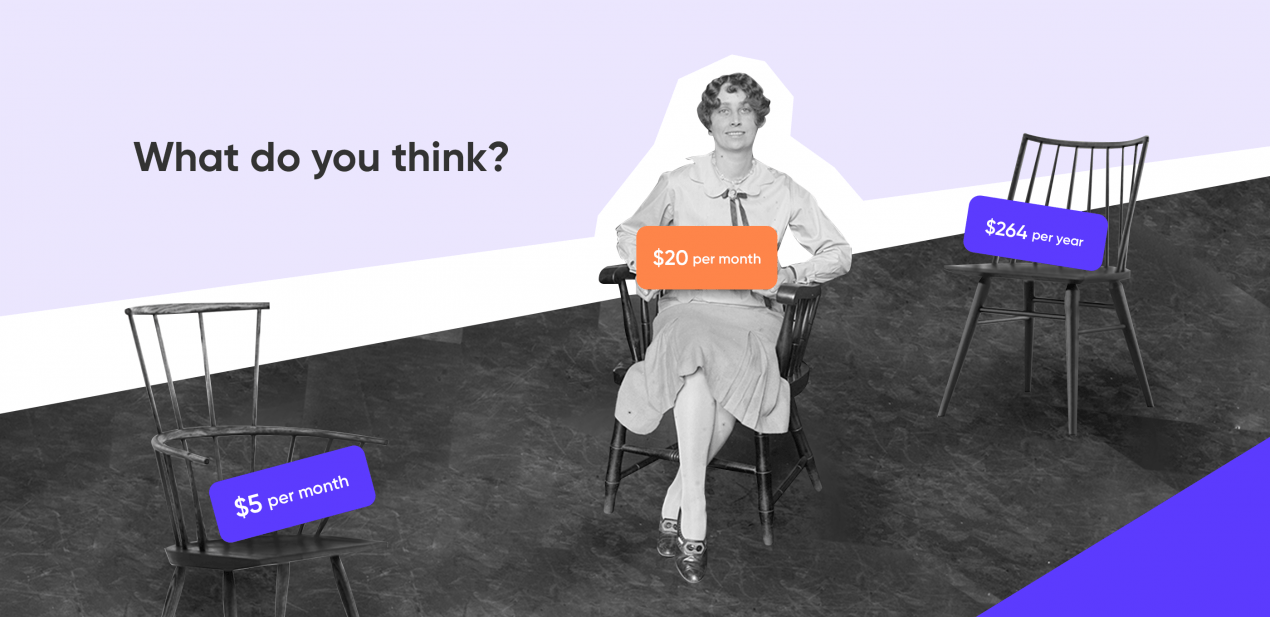

Plan your sales for the next three years. Think through monthly sales for the very first year, then quarterly (or monthly) plan the next two years. It’s quite possible even at the pre-revenue stage.

Prove you keep ‘How I gonna use the funds’ thing under control. Answer questions like:

- What’s the size of the market you’re targeting? How will you situate your startup within this market

- What drives revenue? (At least three metrics that influence revenue and growth — somethings like new customers, sales, new products or markets to grab).

- How many people (and who they are) are needed to start? (rely on staffing ratios here: if one person can support 50 customers, 4 will be needed to manage 200 customers. Simple but helpful math.

- How many customers do you plan to achieve?

- How long will it take you to have a positive cash flow? (when start making a profit)

- What will happen if you have to drop prices to retain existing customers (??)

- How will an investor get his money back if things go wrong? (take care of your exit strategy)

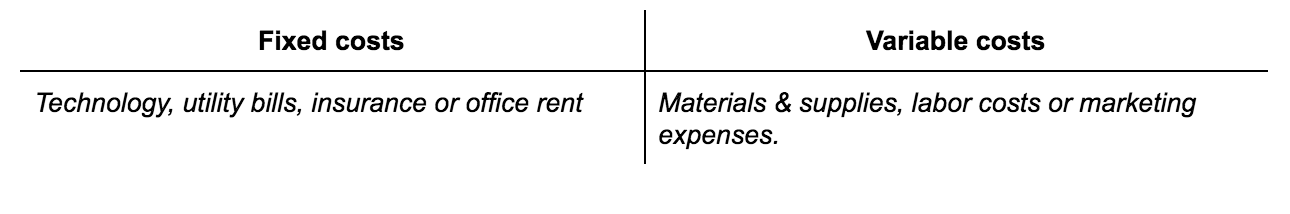

B. Expenses budget

To better understand how much it will cost you to make the planned sales. For that, include both fixed (stay the same regardless of how much you sell) and variable (depend on sales) cost in your plan.

A few examples are:

Avoid mentioning unnecessary details. No one expects you to know about every chair you plan to buy. You’d better think through general figures that drive value.

When you put together a plan, ensure everything on that list is reasonable and based on reality. Do not promise ‘the stars and the moon’ and care about what applies to your core mission. Just because the startup phase is far from being carried away with frivolous dreams about a plush office and catered meals.

Do not leave the ground while forecasting

Do not leave the ground while forecasting

Don’t solely rely on the audacious optimism. Be cautious and optimistic at the same time about all the projections you make.

6. Team

A key selling point for most (if not all) investors.

The worst scenario we could imagine here is when a key guy (not a solo founder) is the one who can talk. It’s something like:

Hi It’s me, XXX and YYY and this is our next big ZZZ.

Here’s a better approach to introducing people staying behind the product concept.

First, let your team speak. At least to deserve being called a team. Not a group of ‘smiling and nodding’ guys and their boss. Everybody should be involved to make things work.

Explain how you guys met each other. Have you already worked together or you just met a couple of months ago at a hackathon? Mention that in no more than 2 sentences.

Be very clear about your team competencies and roles fulfilled. Investors shouldn’t get confused about who is CEO or CTO, for instance. Deliver the info about key hires you’re missing as well — be it marketing expertise, financial management or manufacturing.

Be honest and let them know about what you can do better after getting funding. Expanding the team is no exception:

After raising a few hundred thousand we can hire two more devs needed for backend development.

Past accomplishments also matter. The more you had, the better. Do not hesitate to share what you’ve achieved, because all learnings you’ve taken from running a business are always better than having literally nothing (or hiding fuck ups to avoid being perceived badly).

I worked at a similar business for 6 years, then stroke out on my own.

Btw, it’s a smart strategy to show you’re hungry and passionate about working toward a common goal. Call it stereotyping or whatever, but this is damn attractive and always works.

You don’t need investors to build an MVP

Just because it’s always easier to take money from family members or a rich friend who strongly believes in your potential. Or simply get a business loan from a bank to get things done. Whatever option you choose, your best bet is to stay 100% dedicated to product and growth.

[wpim]