So, you’ve fleshed out your business idea, and now you want to meet investors to raise funds. What will happen if you begin your pitch deck without a valuation? Spoiler alert: it will be impossible to negotiate a deal.Without a valuation, you risk losing investment opportunities. And if it’s inaccurate you may incur financial losses later on. In this article, we’ll go over everything you need to know about startup valuation: key methods, factors, and advice to help you succeed.

Startup valuation shows how much money its assets are worth at a given time. It can also hint at expected future earnings, and it’s negotiated by founders and investors.

Founders argue for the highest valuation possible. The reasons are simple: they want to acquire a lot of capital to launch the startup and execute their vision. Also, high valuations allow them to keep their share of equity.

Investors try to inject the least amount of capital and mitigate as many risks as possible. At the same time, a lower valuation allows investors to buy out more equity. If the startup succeeds, they get to earn more money.

Simply put, it’s going to make your life as a founder easier. Let’s take a look at some of the reasons why it’s beneficial.

Startup valuation helps you figure out how high your tax liabilities should be.

If your startup is overvalued, you may have to pay more tax than needed. And if it’s valued too low, your company may not be contributing enough to the government’s budget.

In either case, you’ll be forced to pay fines and schedule unnecessary meetings with the tax authorities. And no one wants to get bogged down in a tax audit or investigation that can waste a lot of time.

Some of the valuation methods covered in this article include pre- and post-money assessments. Basically, you can figure out how much your company is worth before and after attracting investments. This has benefits for both investors and entrepreneurs.

For investors, they get to understand the value of your startup better. This makes it easier to decide if they want to go with your company or look for a different investment opportunity.

For entrepreneurs, you get an exact figure to use in negotiations later on. Once you start talking to investors, you’ll be able to state the investment terms you want, knowing your startup’s true value.

If your valuation is high enough, it becomes easier to hire top talent. Some specialists seek potentially successful companies to “get a piece of the pie.” Adding an impressive, high-value startup to their resumes is also an advantage.

You can see the list of America’s Best Startup Employers for proof. While employee satisfaction is important, many choose companies based on growth and reputation.

There’s always a chance that the startup doesn’t have as high of a valuation as hoped. In any case, you won’t know unless you try calculating the figure.

An accurate startup valuation makes acquisition smoother for everyone.

Founders find peace of mind by setting realistic expectations for buyers. They can also gauge the real worth of their startup, and an exact figure helps a lot with negotiations.

Investors can check to see if the acquisition aligns with their financial goals. They’re more inclined to take the deal if it provides a sufficient return on their capital.

If you’re planning to exit somewhere down the line — you need a strategy, and you can’t do that without an exit valuation. Once you know the figure you’re aiming for, you can better plan how to get it.

Your company’s potential isn’t the only thing that can impact its valuation. Both internal and external factors can combine to influence your startup’s worth. We’ve outlined the most important ones below:

Market size indicates growth potential. In the best-case scenario, your startup could attract the majority of consumers there. So, the bigger the market, the wider your reach becomes.

Investors also look at the industry you’re operating in. They’re more likely to invest in an industry with room for growth. That’s because the competition isn’t as cutthroat, and there are no limits to how many people can become your users.

Bigger market size → higher valuation.

The money you have and the stage of development you’re in contribute to startup valuation.

Generally, startups in the beginning stages tend to have lower valuations. That’s because it doesn’t have any MVPs or prototypes yet, so more risks are involved with development. There’s also little data regarding capital and market demand, which makes it harder to understand if the startup is valuable.

Startup is more mature → higher valuation

More experienced startup teams can boost a company’s valuation. Their expertise ensures smooth development, attractive user experience design that draws people in instead of pushing them away, and releases everything on time without bugs.

Teams with a proven track record are less likely to fail in their next venture. Investors appreciate stability, and a solid track record shows just that.

More experienced team → higher valuation

Development-wise, the stage of the startup matters, too. If the only thing you have is an idea, it won’t be easy to sway investors to invest capital. That’s because there’s no proof of concept or financial data on which to base projections. So, they’ll have better luck reading fortunes than calculating market demand.

Once you have at least a prototype, your valuation will rise exponentially. Because your product is already developed — there’s no risk of it getting delayed. Investors get to see a working product, so they’re more inclined to negotiate funding.

A developed product is always better than an idea without any proof.

In startup valuation, business models play a major role. Some business models can bring more money than others, they’re simple and can be easily scaled, no matter how many users you attract. Consider subscription-based business models and similar ones.

It’s also important to prove two things. First, that the revenue model you’ve decided on fits your startup. Second, your clients should be willing to pay the price you’re offering. Conducting a discovery phase can help a lot in this case.

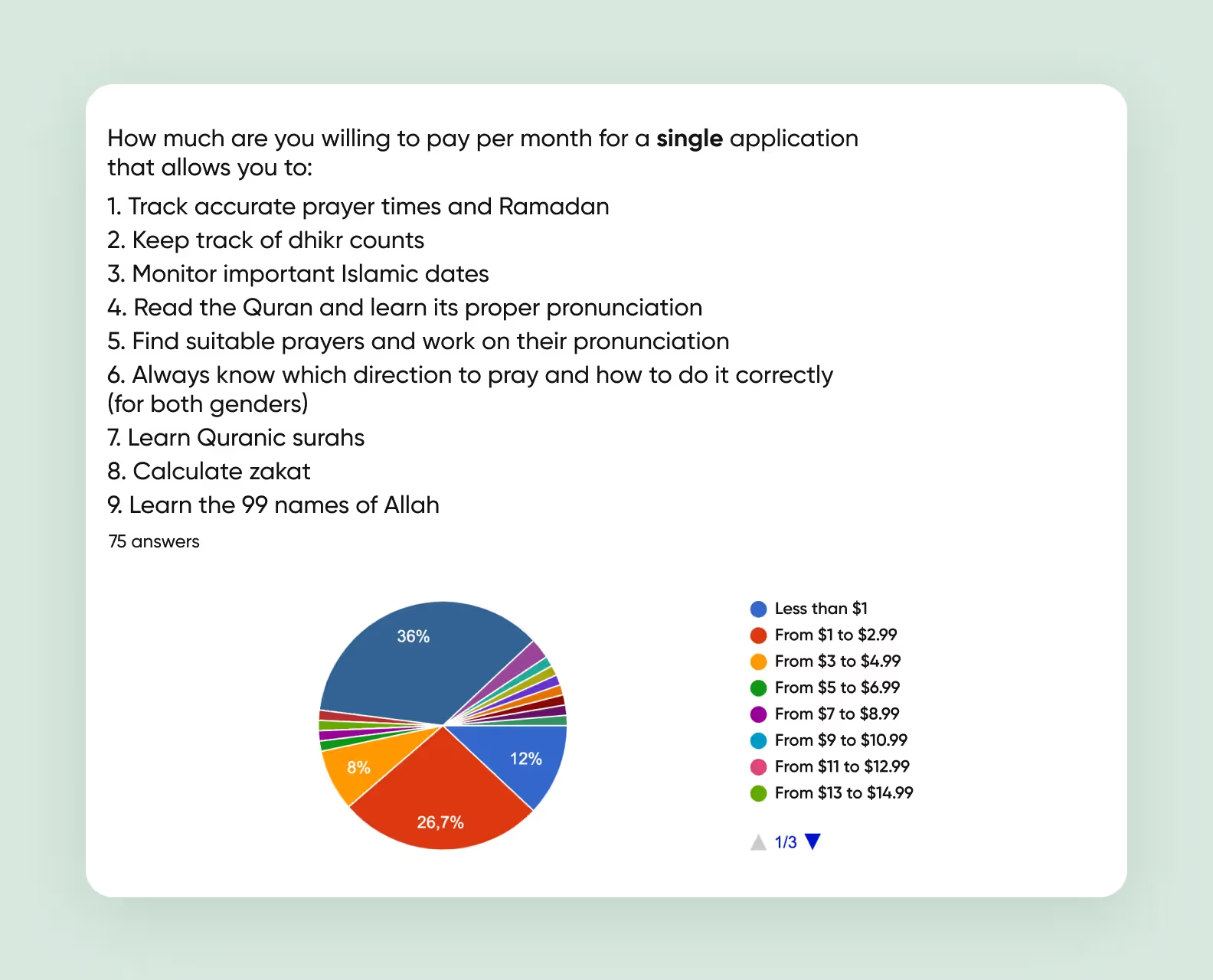

We did that when a client came to us with an idea for a Muslim super-app. Muslims actively use apps to keep their daily lives within Islamic rules. IT products remind users of prayer times, help find halal cafés and more.

Our client wanted to make one app that would answer all of their needs. Unfortunately, after calculating unit economics, we clearly saw that there’s not enough need for this kind of app and the app won’t be profitable.

The rule of thumb looks something like this:

The more predictable your income, the higher the valuation.

Key metrics that show the product is capable of growth impact startup valuation. These include metrics like monthly/daily active users, net promoter score, customer retention, and others.

This factor also ties into others — you can’t have traction without a functional product. A skilled team that knows what it’s doing is crucial for intuitive UX, and decent user retention rates. A solid track record means there’s less risk involved, so the valuation rises accordingly.

Metrics reduce perceived risks and lead to higher valuation.

Not all of these factors might seem important at first. Still, it’s important to keep them in mind when your startup develops. You might find yourself considering different factors to evaluate your startup as time goes on.

While it’s crucial to consider the factors responsible for startup valuation, some entrepreneurs can face difficulties applying them to their companies. That’s why we’ve listed 9 methods you can use to assess your startup worth. Choose the method that works best for your situation.

Entrepreneurs try to discern value by making revenue and profit projections. At this stage, however, the financial data is incomplete, if not nonexistent. So they ballpark it to something unattainable — statistics show that one in a thousand startups meet established projections. Adopting a different approach could yield more realistic valuations.

The Berkus valuation method is used to value pre-revenue startups. It doesn’t rely on financial projections, only faith that the startup can reach $20 million by the fifth year of business. Essentially, you take 5 key characteristics of a startup and allocate up to $500,000 each. For example:

Then, you add these values up and check to see if it could amount to $20 million in five years.

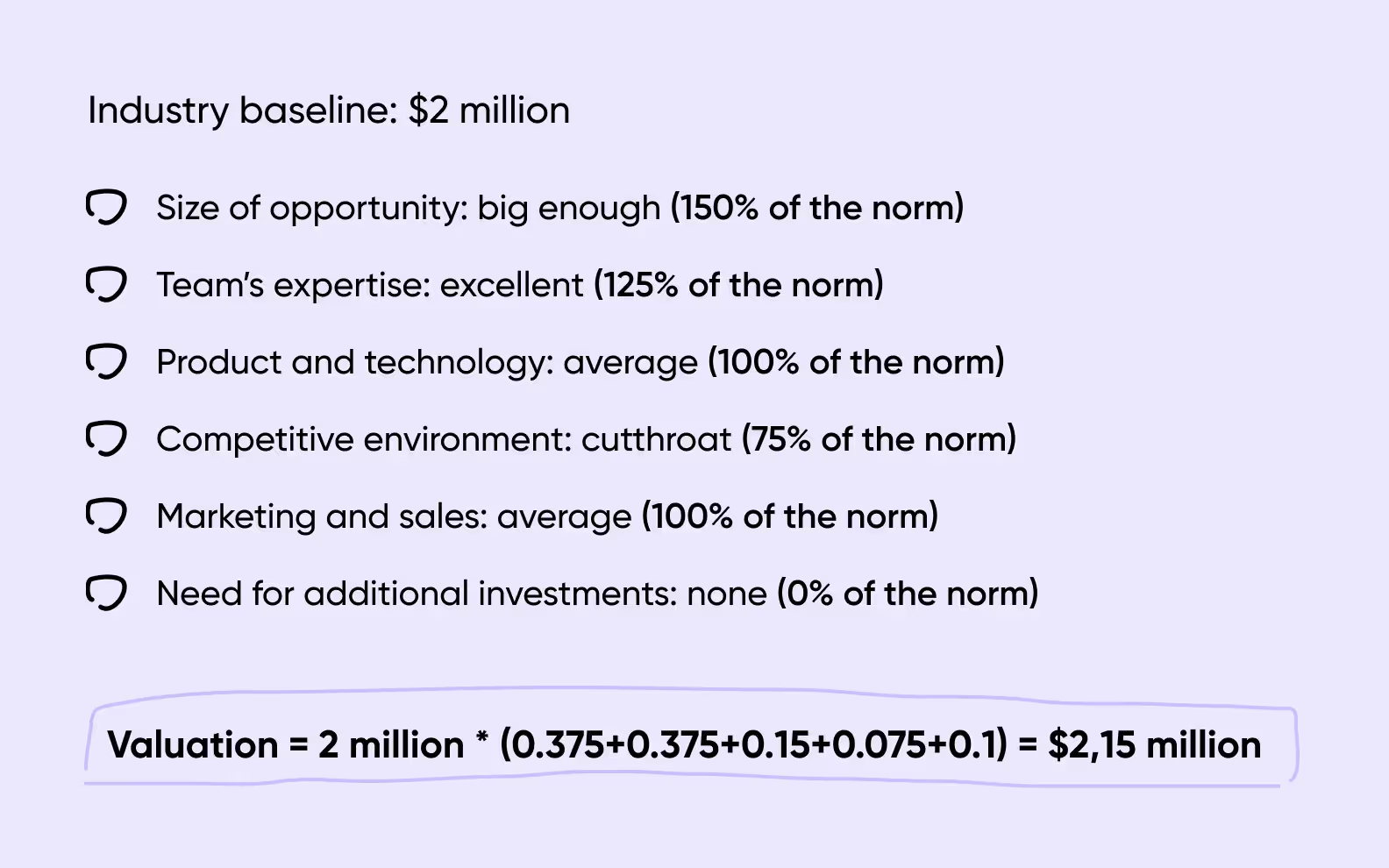

This method utilizes valuations of similar companies in the same region. It’s a promising starting point for startups that lack meaningful financial data.

You start by establishing a baseline value, which you can find by looking through services like Crunchbase, to get data about funding rounds and pre-money valuation ranges.

After that, you decompose your company into some factors, and assign a particular weight to each.

Add up these values and multiply them by the baseline to get a startup valuation.

Another method of evaluating pre-money startups. In this case, you’re not only adding factors but also subtracting them based on perceived risks.

The less risk you have, the higher the value of your startup.

Begin by singling out an average pre-revenue startup valuation. You can find it on external services or interview some founders to get a ballpark figure. Using a value you calculated via the Berkus or Scorecard method can work as well.

Take relevant risks and score them from -2 to +2. These include:

For each +1 score, add $250,000 to your valuation. Subtract the same sum each time you write down a -1 score.

It’s a decent tool to use once you have enough financial data to make projections. The majority of venture capital firms use it to calculate valuations.

You take the existing valuation before fundraising and estimate how much it changes after the company attracts capital.

Start off by taking an estimate of revenue for the current year. Here’s how to do that:

The Venture capital method is an effective method for startups looking to exit. It’ll come in handy if you ever want to sell your business or make your shares publicly available through an IPO.

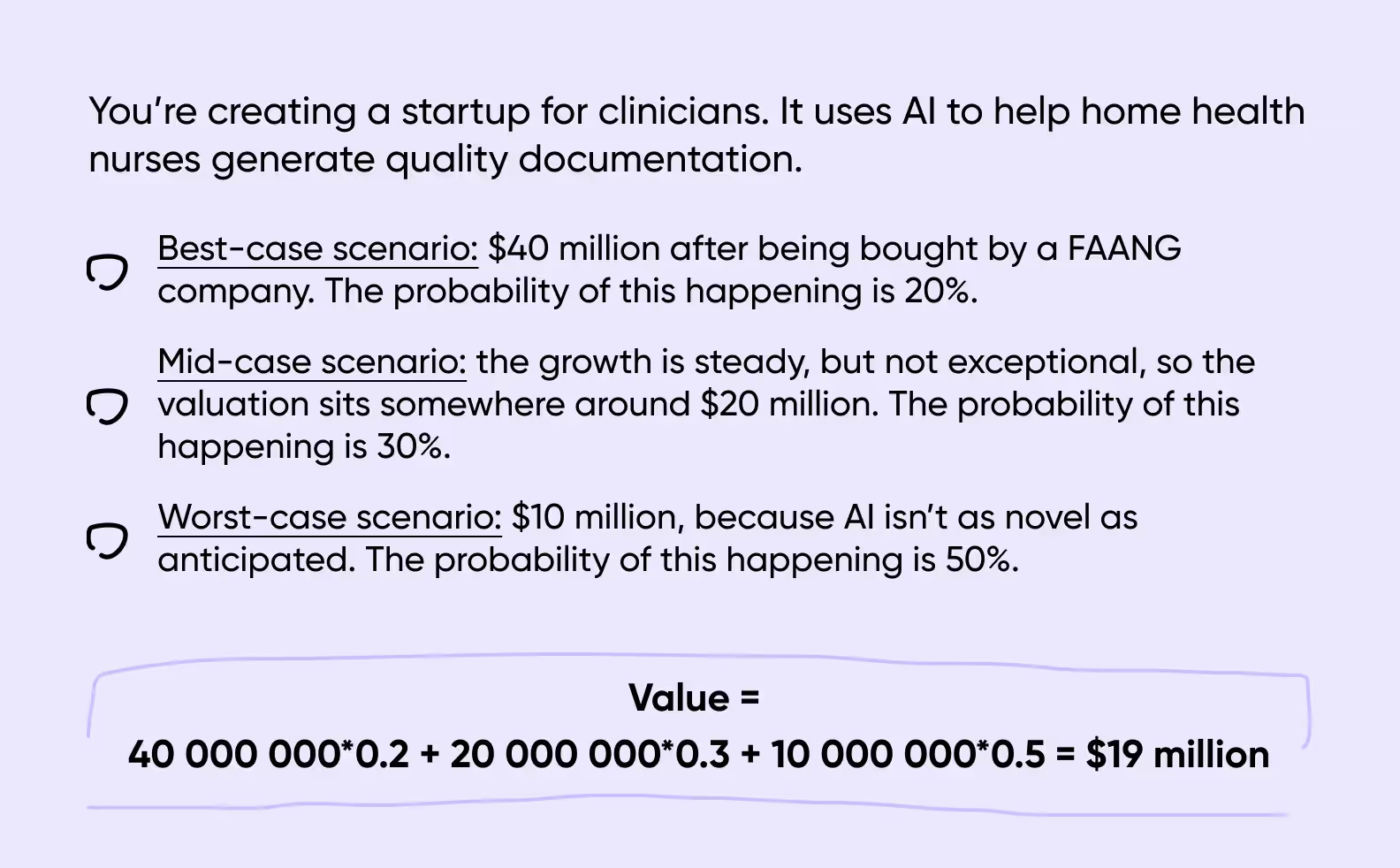

This is another method designed for startups with access to vital financial data, like cash flow. It revolves around making financial projections, considering the best- and worst-case scenarios a startup can go through.

Here are three steps you have to take to use this method.

Identify possible endgames for your startup. Ideally, you would end up with 3 scenarios: best-case, mid-case, and worst-case. For each of these cases, it’s crucial to create financial projections with expected revenue and exit-horizon.

The worst-case scenario usually entails bankruptcy or total loss of invested funds. A strong exit, on the other hand, indicates a best-case endgame.

Multiply the outcome of each scenario by its probability. If your best-case scenario is a $10 million evaluation, and the chances of achieving it are 30%, multiply 10,000,000 by 0.3.

Sum the values of every scenario together — and you’ll get a final valuation.

This method can help you evaluate how hard it is for a different company to create the same product you’re trying to, and how much it would cost. It takes all your tangible assets into account: recruitment, research, prototype development costs, rent, inventory, etc.

It’s a straightforward way to get a crude startup valuation.

To get the cost-to-duplicate, simply add up your R&D, technology development, research, and physical assets costs.

While handy, this method has its drawbacks, too. Although the valuation you get is somewhat applicable, it doesn’t show the full picture.

As the name suggests, you calculate startup value based on future cash flows. This method hinges on assumptions about the possible profitability of your business.

You take your projected cash flows and apply a discount rate to them. It’s the rate of return on investment: the riskier the startup, the higher the rate.

This method is one of the most convenient for startup valuation. Here, you won’t need to guesstimate future projections and calculate values based on financial data you don’t have access to. Instead, you can take publicly available information as a starting point.

Find a company that operates in a similar industry, decide on the parameters to compare, calculate ratios, and you’ll have a solid startup value estimate.

These parameters can include two things:

Price-to-sales ratio, i.e., comparison between stock prices and annual revenue.

Price-to-earnings ratio, i.e., the relationship between stock prices and annual profit.

If your earnings are evaluated at $2 million, and the price-to-earnings relationship of companies in your niche is 20, your startup value is $50 million.

Is your industry seeing startups acquired by major companies left to right? If your answer is “yes,” this method of startup valuation is for you.

Generally, you take the price paid for buying out startups in similar industries as a starting point.

For example, you’re selling an AI tool for teachers. Similar companies focused on college professors have already been bought for $10 million. You also know that they have roughly 500,000 active users. If your startup has around 100,000 users, your expected startup value is $2 million.

As a company develops, the relevance of valuation methods changes to match the growing availability of actual data and the investors’ evolving priorities. This shift from qualitative to quantitative approaches corresponds with the decrease in uncertainty.

An effort to apply a DCF for a pre-revenue startup, for example, may indicate a lack of expertise and turn off potential investors. This can happen if the chosen valuation technique isn’t appropriate for the type of investor or financing stage. Thus, a key element of a successful fundraising plan is matching investor expectations with the valuation methodology.

Now that you know the most common startup valuation methods, we’d like to give you three best tips on how to use them. They’ll make calculating your startup’s value easier and faster.

The tools you use should depend on the development stage of your startup. For instance:

Begin with the Berkus method for pre-valuation. It’ll let you know what areas of your startup can be improved: from the business idea to strategic relationships.

Continue with the risk factor summation method to uncover potential blind spots.

Use precedent transactions to get a figure that’s rooted in reality.

This is just an example because each of these methods can offer unique insights for your startup — show its current situation or reveal room for growth. There’s no one-size-fits-all approach, so combine them to get the best possible results.

To get an accurate startup valuation, it’s important to conduct market research. You can find that half of your work has already been done for you.

Calculate market demand and assess your competitors. Check their backgrounds and mergers or acquisitions revolving around similar companies. There’s a chance they already have valuations you can use as a starting point. It’s better to use realistic figures than make it up yourself, even if it comes from a different company.

It’s a good idea if you’re facing a tight deadline to prepare a pitch deck.

We suggest contacting agencies with a proven track record in startup valuations. At Purrweb, we’ve helped hundreds of startups with valuation and provided figures that can be used for presentations and data analysis.

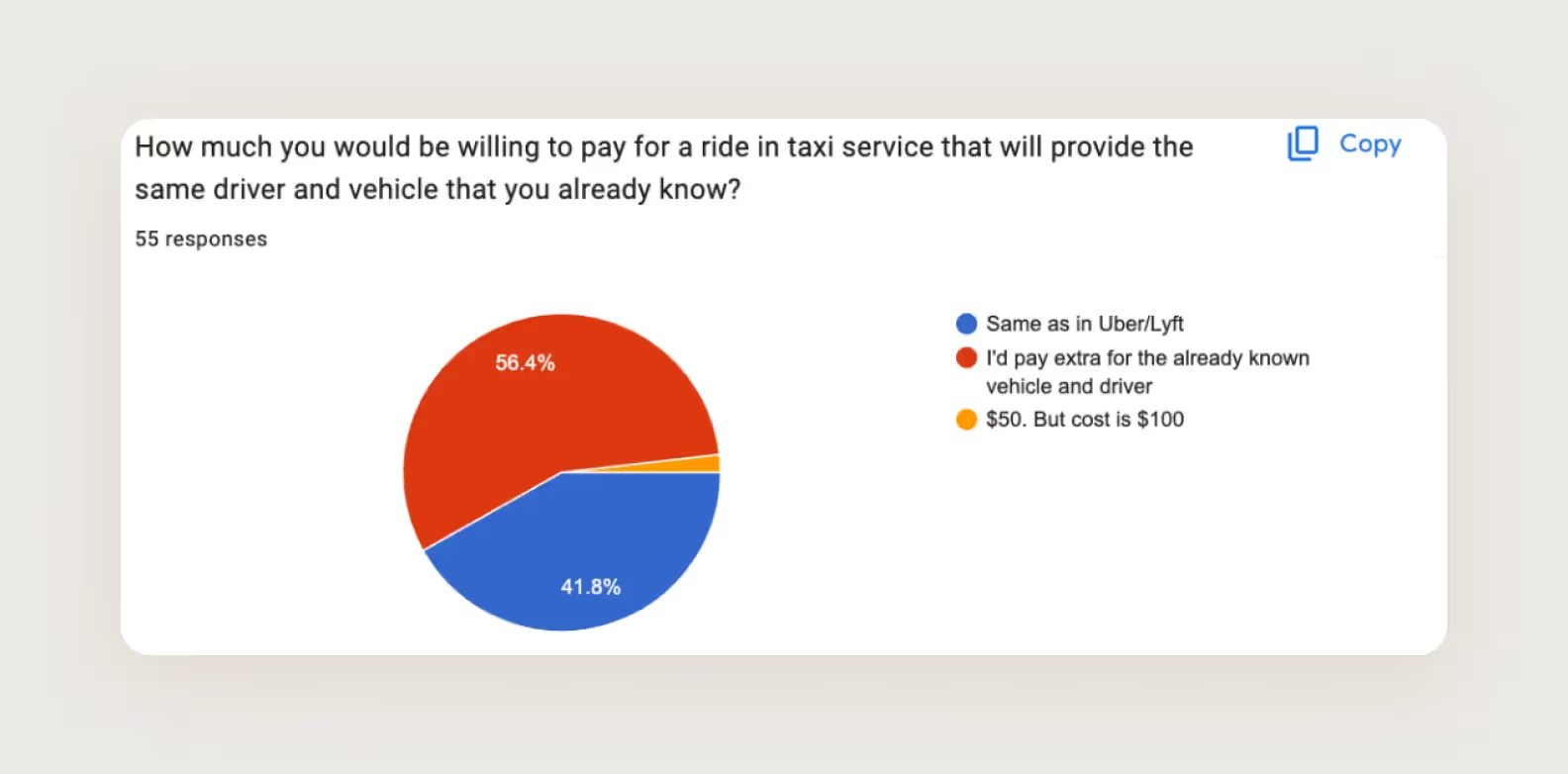

For example, we helped a taxi aggregator startup in the US calculate unit economics. Here’s what our respondents said about how much they’re willing to pay for the service:

As it turns out, it could earn $7,900 in the first month, which is a solid estimate and a strong case for attracting investments.

But that’s not the only thing we have expertise in. Our developers can help you release an MVP, a tangible product that’s guaranteed to raise your startup valuation.

At Purrweb, we’ve dealt with many pre-revenue startups. We had to make valuations from scratch to either convince entrepreneurs to abandon their ideas or help them sway investors to get in on the deal.

We believe that a discovery phase is an essential part of startup valuation. Let’s look at two cases where we did that.

Our client had a simple idea: they wanted to create a super-app where Muslims could read the Quran, get notified when to pray, and monitor fasting.

Before startup valuations, we wanted to see if there was any real market demand, so we set to work. We conducted surveys using qualitative and quantitative research and calculated unit economics.

In the end, only 18–40% of the segment needed a super app. So we discouraged the entrepreneur from following through on their idea. Overall, we saved them $150,000 on design and development.

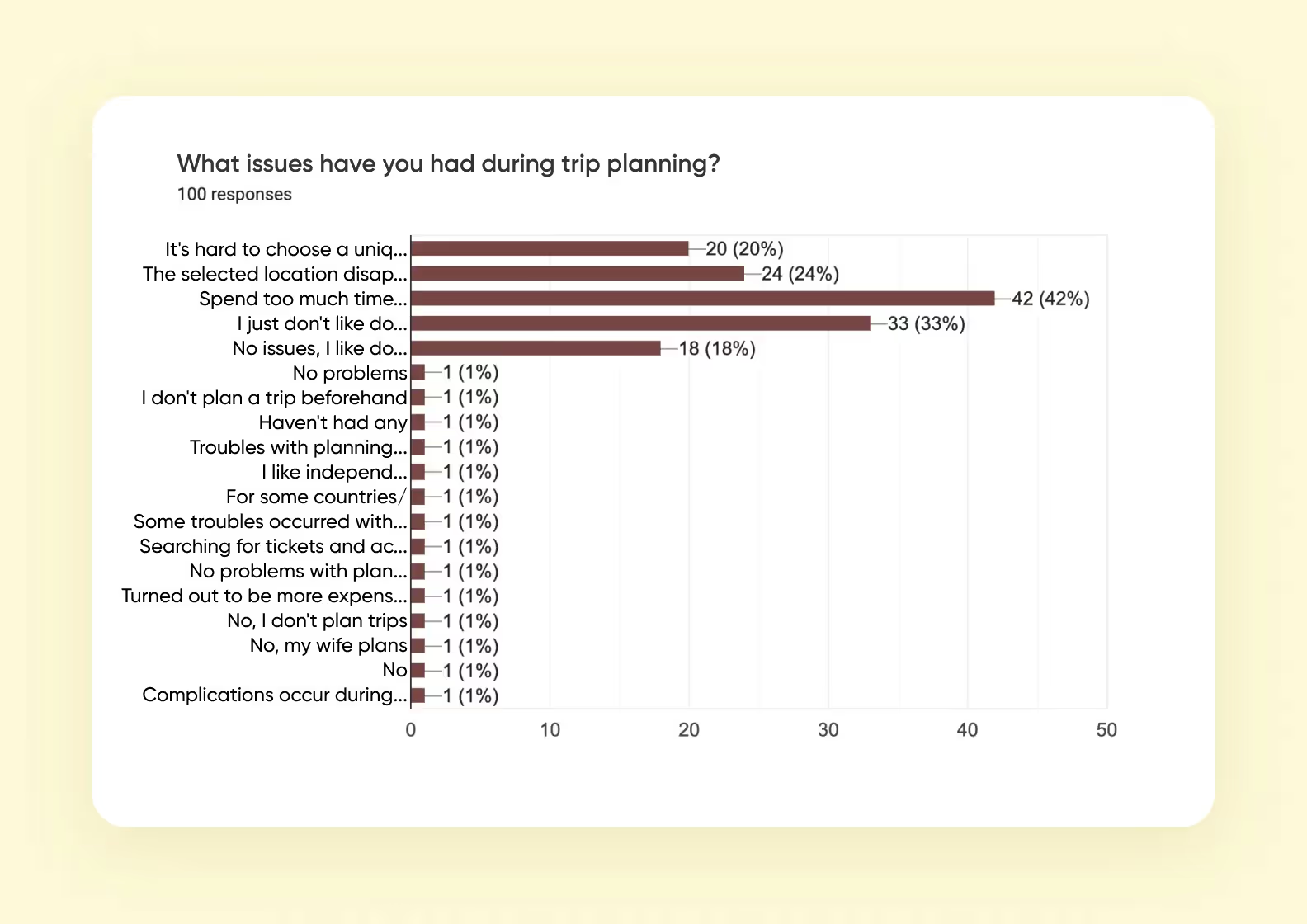

The client wanted to develop a travel app with unique routes and destinations, a travel journal, and a sharing feature.

The market is oversaturated with travel apps, so the startup valuation could be very low. Still, before creating an MVP, the client wanted to conduct market research. It showed that there are users out there ready to pay for our product, so we set out to create an MVP.

➡️ If you don’t have time to do a startup valuation yourself — <a class="blog-modal_opener">contact us using the form</a>. We’ll provide you with an accurate figure that you can use during a pitch deck. And if you want to create an MVP to increase your startup valuation, we can help with that too.