When you have a cool idea and enthusiasm takes over, you often hear phrases like: "It'll definitely take off!" or "Well, yeah, it didn't work out for them, but it will for us!" In this situation, it's tempting to go all in, develop an app, and hope for the best. But it's a trap.Without an accurate budget estimation and strict adherence to the plan, the chance of success is minimal. An IT startup should understand how much it can raise and how to effectively distribute it from the very beginning. Only then there will be a chance to release the application and get the desired result.

Before launch, a startup budget is an essential tool to determine how much money you'll need for the first few months. After launch, it becomes an analytical tool to see how resources are actually allocated.

Knowing where your money is going and planning accordingly can make the difference between a thriving startup and one that fizzles out.

Before you can begin managing startup costs, you’ll need to find the money. Personal savings is the most straightforward option. Using your own money means you won’t owe anyone else, but it’s risky if things don’t go as planned.

The good news is that financial organizations, investment funds, wealthy business angels, and the government are all happy to support innovation.

If it’s not safe to risk your personal finances, you can turn to other investment sources. We’ve gathered them in the table below.

No matter what your source of funding is, you should distribute the money as wisely as possible. It has to cover all your key business needs and keep you out of debt or unexpected cash shortfalls.

You’ve probably heard inspiring stories of micro-businesses launching on shoestring budgets of $3,000–$5,000. While these stories paint a pretty picture, the reality is that business startup costs vary greatly based on the business type. In practice, initial investments can range from a few thousand dollars to six-figure sums.

For example, it doesn’t cost much to launch a basic MVP for a small nearby coffee shop, while implementing a large-scale solution for a medical business can cost tens of thousands of dollars.

Starting a tech startup comes with a variety of costs, let’s look at the overall list without breaking them down by industry.

Researching your field, looking for an app development company, and then creating and testing your product, will eat up a sizable part of your startup budget. This stage also includes prototyping, designing and developing software, supporting your product, etc.

Silicon Valley Bank states that salaries are the biggest startup expense. You’ll be paying your team of developers, designers, marketers, and tech support staff. It’s expensive, especially when the business is just gaining momentum, and you haven’t seen any profits yet.

The hourly rates vary by region, so consider outsourcing to those developers who both have enough industry experience and fit your budget.

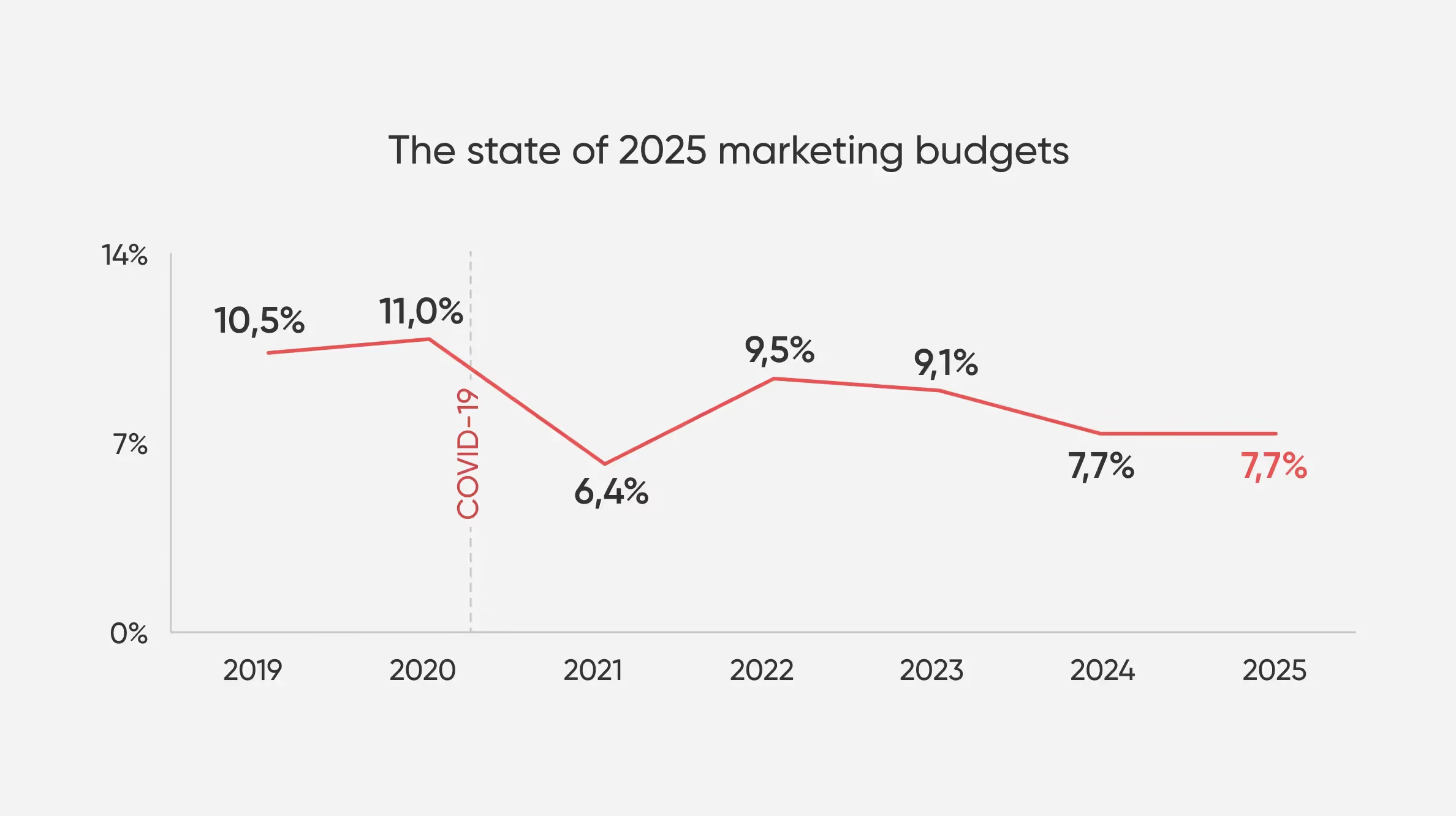

This is when you get the word out about your startup through various channels like social media, ads, and PR. On average, 7-12% of total revenue is spent on marketing across all organizations. To gain traction, however, startups and growing companies may need to invest 20-30%.

Compared to a couple of decades ago, the list of necessary tools for a tech startup may seem overwhelming. You’ll need computers, servers, software licenses, teamwork and collaboration platforms, CRM systems, SEO instruments, and other things for operations in a particular industry.

It’s not going to end with computers alone. Renting an office or co-working space if you’re not working remotely is another big item on the list of business expenses. You’ll have to pay for electricity, internet, and other utilities.

It’s necessary to set up a proper business structure and ensure compliance with laws. Generally, it’s more expensive to incorporate a business startup as an LLC or corporation than a partnership or sole proprietorship. However, these types of businesses may offer benefits such as personal liability protection and tax advantages that outweigh the additional costs.

Another considerable expense is protecting your business from risks. Use various types of insurance, like liability and property insurance. Keep in mind that the number of employees, company size, industry, jurisdiction, and provider also affect the price of insurance.

Now, we’ve figured out why you need a budget, but, before you start the calculation process, there's one more important preparatory step — a business plan. A solid business plan helps you clarify your vision and set realistic goals. It also provides a foundation for future pitch decks, lays the groundwork for calculating your budget, and enables you to approach investors in search of funding.

For example, Tony's confident in his idea and has prepared a presentation where he talks about the product he wants to make. It’s an advanced algorithm for student course selection at a local university.

At the meeting, he goes on and on about how cool his startup is, and how it would change the world. Then, Tony asks for $50,000. Would you invest in Tony’s idea after that pitch? Well, maybe, but most investors wouldn’t.

Here’s a reverse example. Jack, who had a similar idea to Tony’s, conducted market research and found out the main problems that students face when choosing courses. After that, Jack found out that 90% of respondents have this problem, and they rate the inconvenience 9 out of 10. And, according to forecasts, there are 1.5 million such people in Russia alone.

Then, Jack created a step-by-step business plan and used tables to show how much money was needed for development, support, and promotion. Would an investor sponsor this project? That’s much more likely.

More specifically, your business plan should include:

And if you already have an app idea, and it’s time to write a business plan, check out our guide.

Startups fail. It’s quite common that only a few businesses survive, and these are the initiatives that have a sound plan to execute and a specified budget. It’s as basic for a business as training and proper nutrition for an athlete.

R&D provides insights into the market, user preferences, equipment costs, development costs, standard monetization models, etc. You can use these factors when planning your budget. Keep in mind that it also requires financial resources, but the discovery phase can be handed over to an external team, to save some money.

The rule you should follow during the R&D — be conservative in your assumptions and projections. It’s better to overestimate possible spending than to spend more than planned.

So, to make sure that your business won’t immediately start running out of money, you’ll need to calculate your startup budget precisely. Founders typically follow these five steps.

Be ready to start paying for essential startup costs before the launch. If you're a tech startup, and you are developing an app from scratch, start with a minimum viable product (MVP).

As a fresh startup, you only need the core features to test your idea in real market conditions and determine the demand for it. You can add some nice-to-have features such as AR, advanced videos, and loyalty programs later.

When you make a table with expenses, try to avoid general statements. Don’t just write “development,” use it as a category in which you’ll list all the major features and the cost of developing them. Also, don’t forget that every new feature will be tested both during and after development.

<div class="post_divider"></div>

⭐Our experience

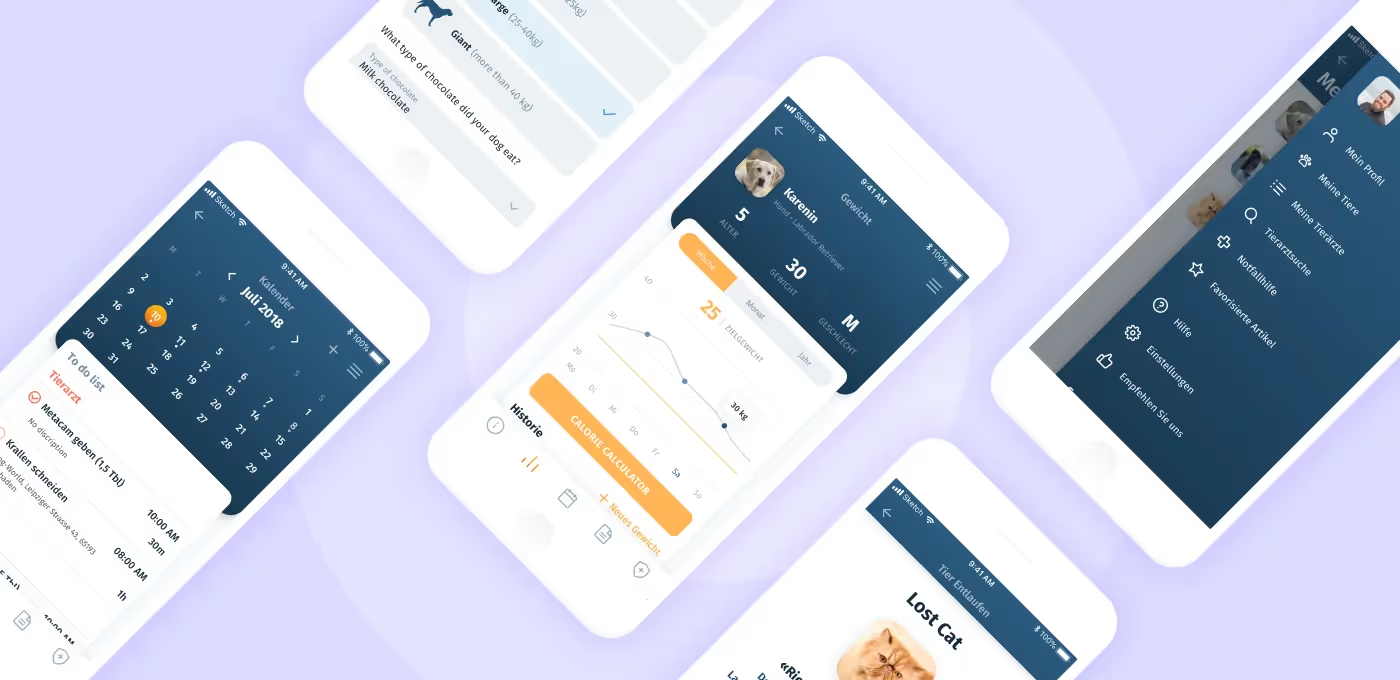

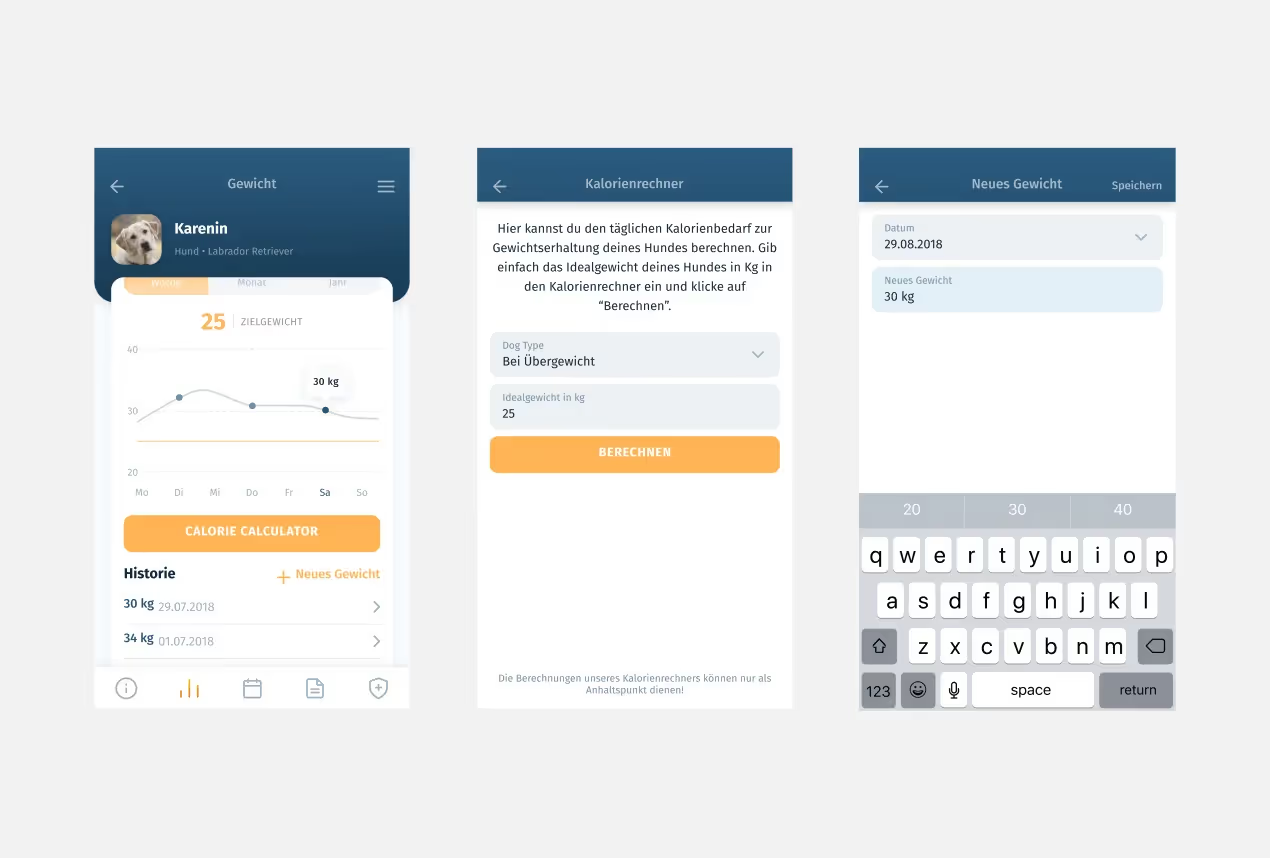

A German veterinarian came to us with the Petbuddy mobile app concept. Her goal was to provide pet owners with an easy-to-use tool that would help them care for their pets. The primary objectives were ambitious: to assist users in monitoring the health of their pets, promote follow-up visits to the vet, and eventually increase the lifetime value.

We focused on creating an MVP — the essential features that were required for the first version of the app and offered benefits to users. As a result, we could test the hypothesis with minimal risk and complete the project in 3 months for $30,000.

We included a simple yet useful set of functionality, such as:

With an average rating of 4.5 stars on the App Store and 4 stars on Google Play, Petbuddy has achieved success in the market. More than 5,000 people have downloaded the app, and it’s received positive reviews.

<div class="post_divider"></div>

You can group expenses in several ways. The most common one — dividing them into logical units. For example, it’s not always a good idea to list everything related to equipment, development, then marketing. This kind of grouping makes sense only at the first stage, and later on you'll need to introduce a few more categories. Among them:

Determine how much money you'll actually spend.

List specific items in precise quantities with their costs for at least 12 months.

Do research to get accurate figures. You can get quotes from suppliers, look up average salaries in your area, or check rental prices for office spaces. Look for places where you can get a good deal on equipment and ads.

A good rule of thumb is to add about 15% of your total budget for unforeseen costs. This cushion will save you a lot of stress down the line and ensure you have the resources to handle any surprises.

For example, Jack received money for his project and the business started to generate profits. Since he had drawn up a well-thought-out budget for the startup, everything was going well until he hit a rough patch.

First, he had unexpected medical bills. Then, his car broke down. A week later, his cloud provider had an outage. Fixing the hardware stopped all work, and a month’s worth of business revenue was lost.

Jack was able to recover with minimal losses only because he had set aside 15% of his budget in advance.

Of course, you probably won’t get into Jack’s exact situation, but by proactively budgeting for unforeseen startup costs, you can have financial stability and peace of mind.

Monthly review and optimize your startup budget to take care of any changes in the expected costs. If you went over budget right after the start and resorted to emergency funds — try to replenish them as soon as possible.

Remember that the startup has to grow so the spending will increase. Include your income in your future planning, and don’t forget about taxes. Estimate monthly revenues, including money that comes from sales, investments, loans, and startup bank savings accounts. Then, plan your new budget accordingly.

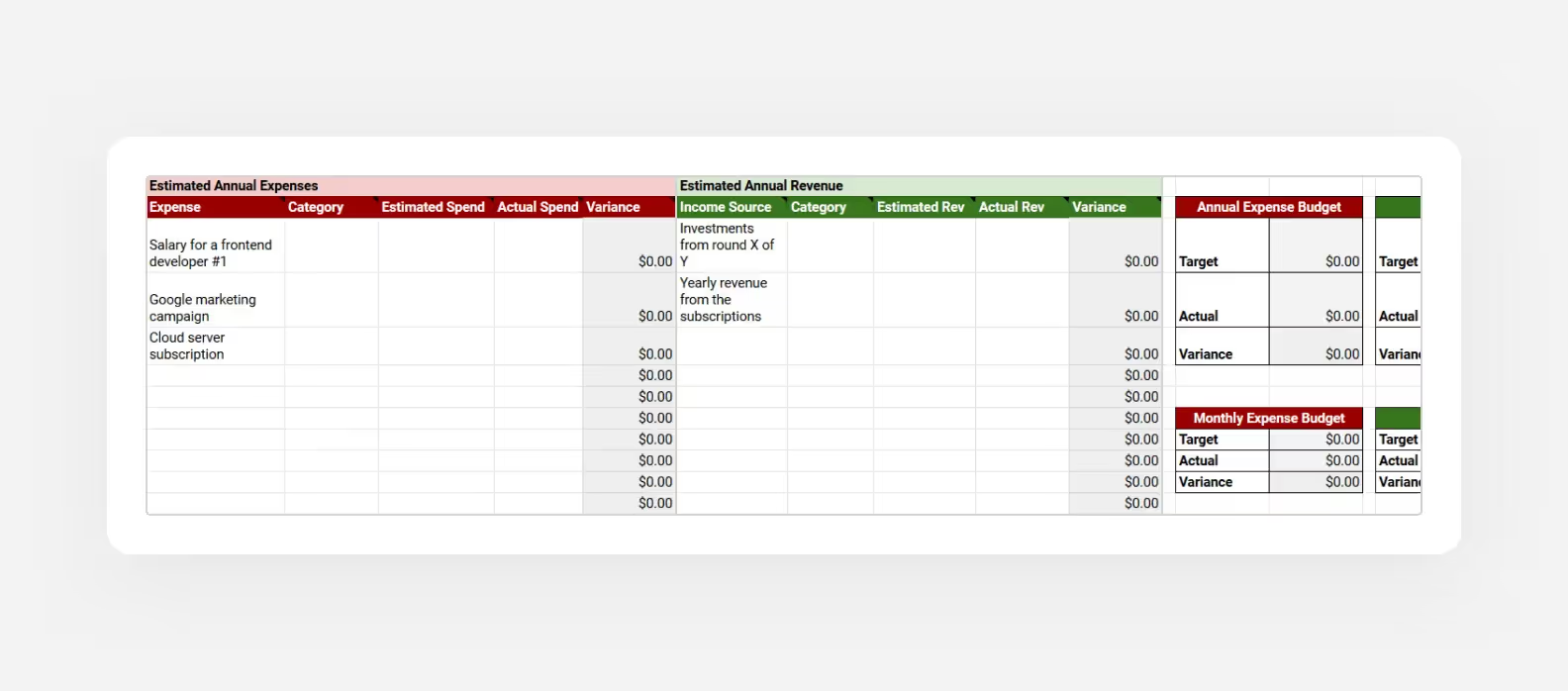

A startup budget template is a structured tool that helps new businesses plan, track, and effectively manage their financial resources. It commonly includes predefined categories for various expenses, allowing startups to insert their data to assess needs and track financial health over time.

You can use our table or choose any of the other templates available on the internet. We’ve also made a handy Google Sheets spreadsheet, so you can copy it to your Drive and start planning your budget.

Since 2014, Purrweb has helped startups launch hundreds of times and we want to share a couple more tips for managing startup costs.

Don’t get blinded by enthusiasm. It’s almost impossible to succeed in business by just going with your gut. Therefore, everything that concerns money must be thoroughly calculated. The more carefully you plan everything at the start, the higher the chance of success.

Negotiate with vendors. Don’t be afraid to negotiate with vendors and suppliers. You might be able to get discounts or better terms. When possible, take advantage of free tools and resources. For example, many companies offer trial versions of their software.

Outsource when possible. Consider outsourcing non-core activities to freelancers or contractors. If you’re not well versed in a particular area, whether it’s the legal aspects of starting a business in a certain country or developing the server-side logic of an app — ask the experts for help. This will save you money and some nerve cells.

Monitor cash flow. Keep a close eye on your cash flow. Make sure you have enough funds on hand to cover your startup expenses.

Monitor the burn rate. It’s the amount of money your startup spends per month. Here’s a formula to learn how fast you’re spending money. Subtract your ending cash balance from the starting cash balance and divide the results by the number of months. It’s important because a rising burn rate may signal scope creep, operational inefficiencies, or other issues that need to be addressed.

Remember that you're not alone on this journey. Reach out to people, ask for advice from experienced entrepreneurs, and stay focused on your startup’s mission. With a well-thought-out budget, a flexible mindset, and strong support, you can overcome any challenges.

Managing startup costs is necessary for launching a business. Start by searching for funding from different sources and determining the total startup costs you need to launch. Use a detailed business plan to guide your decisions and attract investors.

Calculate your startup budget. Start by listing and categorizing expenses, and don’t forget about a contingency fund. Use a template to keep everything organized, and then regularly review and adjust the budget.

➡️ Consider outsourcing if you need expertise in a particular area. At Purrweb, we’ve launched over 550 projects for tech startups, so we can help you develop an MVP in under 4 months and include the most valuable features that your clients will love. Describe your idea <a class="blog-modal_opener">in the form</a> and get a free evaluation from our experts in 48 hours.