‘It was just last week that I got my paycheck, but the money is already gone. Why?’ That’s the question billions of people cry out desperately every day at seeing an almost empty wallet.

We spend money daily on shopping, car charging, taxi, or going out. And it’s easy to forget where those 50 dollars vanished. But if you have a convenient budget application, striking your personal money balance gets a lot easier. If you want to learn more about how to create a personal finance app that will assist people with tracking expenses, keep reading, and you are going to find the answers you need.

Well, getting to the point of it is not hard. A personal finance application, also known as a budget application, is an app for managing your money. You shouldn’t confuse such software with a banking app, as the latter uses cards and accounts of a particular bank. Whereas a finance management app provides a detailed review of how you control the purse in general.

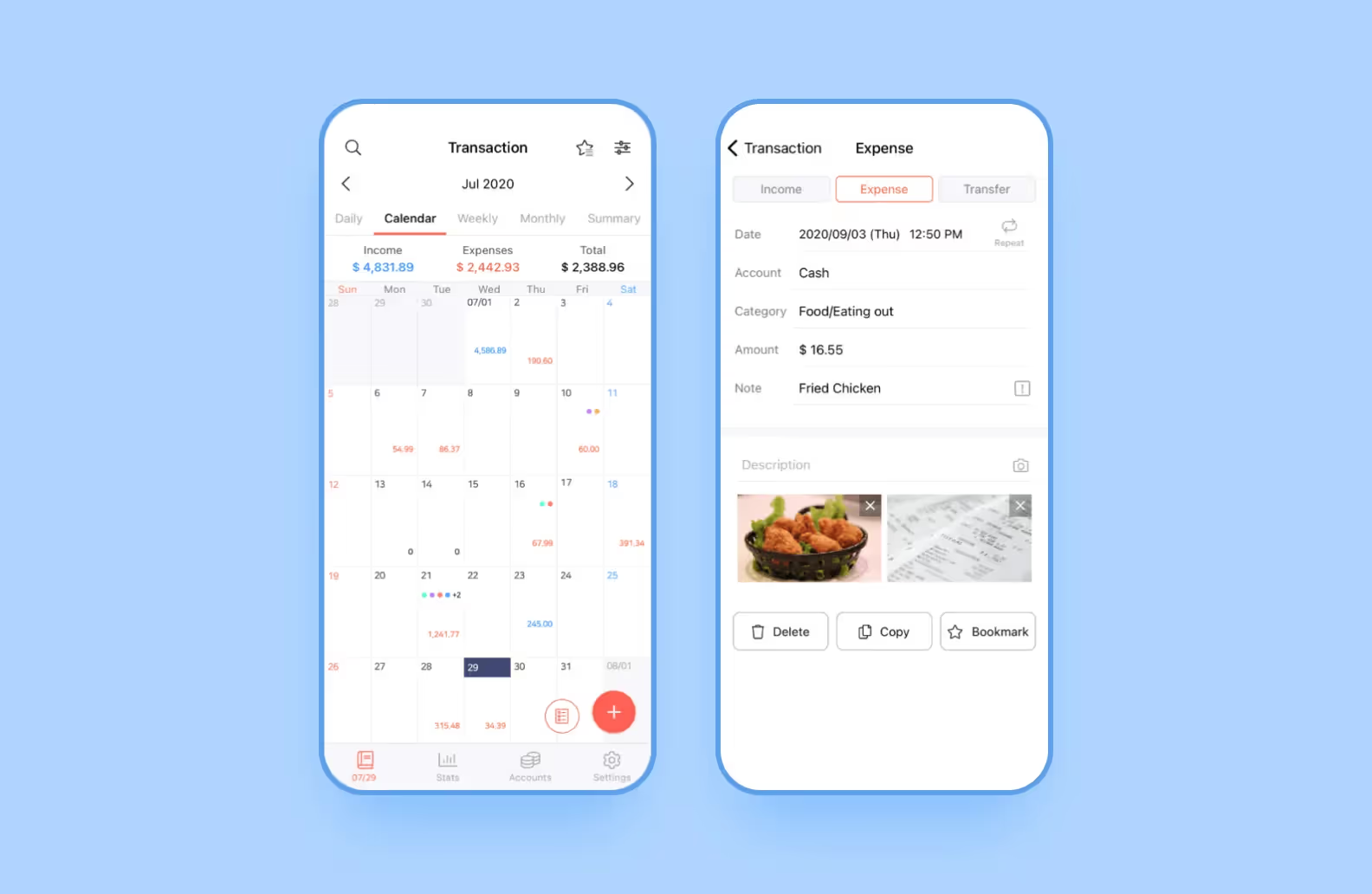

You can’t really say how many applications of that sort are available in the App Store or Google Play, but the number is definitely going to be huge. As all the developers strive to release a unique product, apps’ features differ in many respects. However, a standard set of capabilities for a money management app usually includes:

Before getting down to any product building, you need to gain an insight into the target audience. In terms of personal finance app development, it’s essential to study what drives users to start managing money and what objectives they pursue. The point of tracking expenses is clear and lies on the surface, but usually, there are plenty of other needs hidden behind the money management process. Here are the most common reasons:

For such people, a budget app is a useful tool that helps them become more financially literate, discover weak points in their personal finance management, and speed up savings.

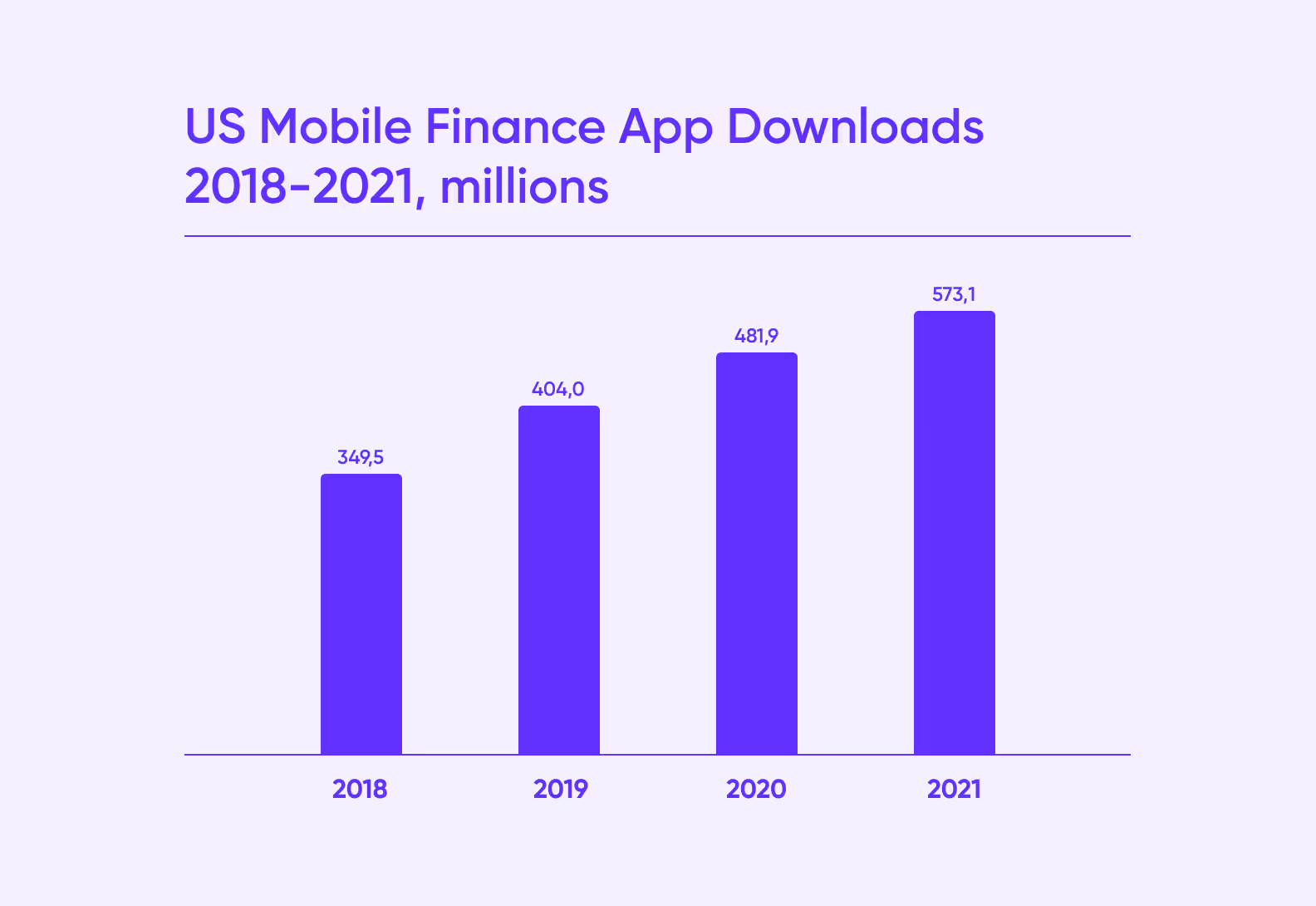

The personal finance app market is rather promising for startups, as the number of finance software users has continued to increase over the last 4 years. Statistics show that in 2024, personal finance mobile app market is expected to reach $2.9 billion in the US. That’s a 19% increase compared with previous years.

In global reports, the finance app market has the biggest share among the entire app development sector. All these numbers make it a promising niche, appealing to developers. As a consequence, we have a highly competitive environment. So, to make a worthy adversary, you have to learn more about the best of the best in the personal finance app market.

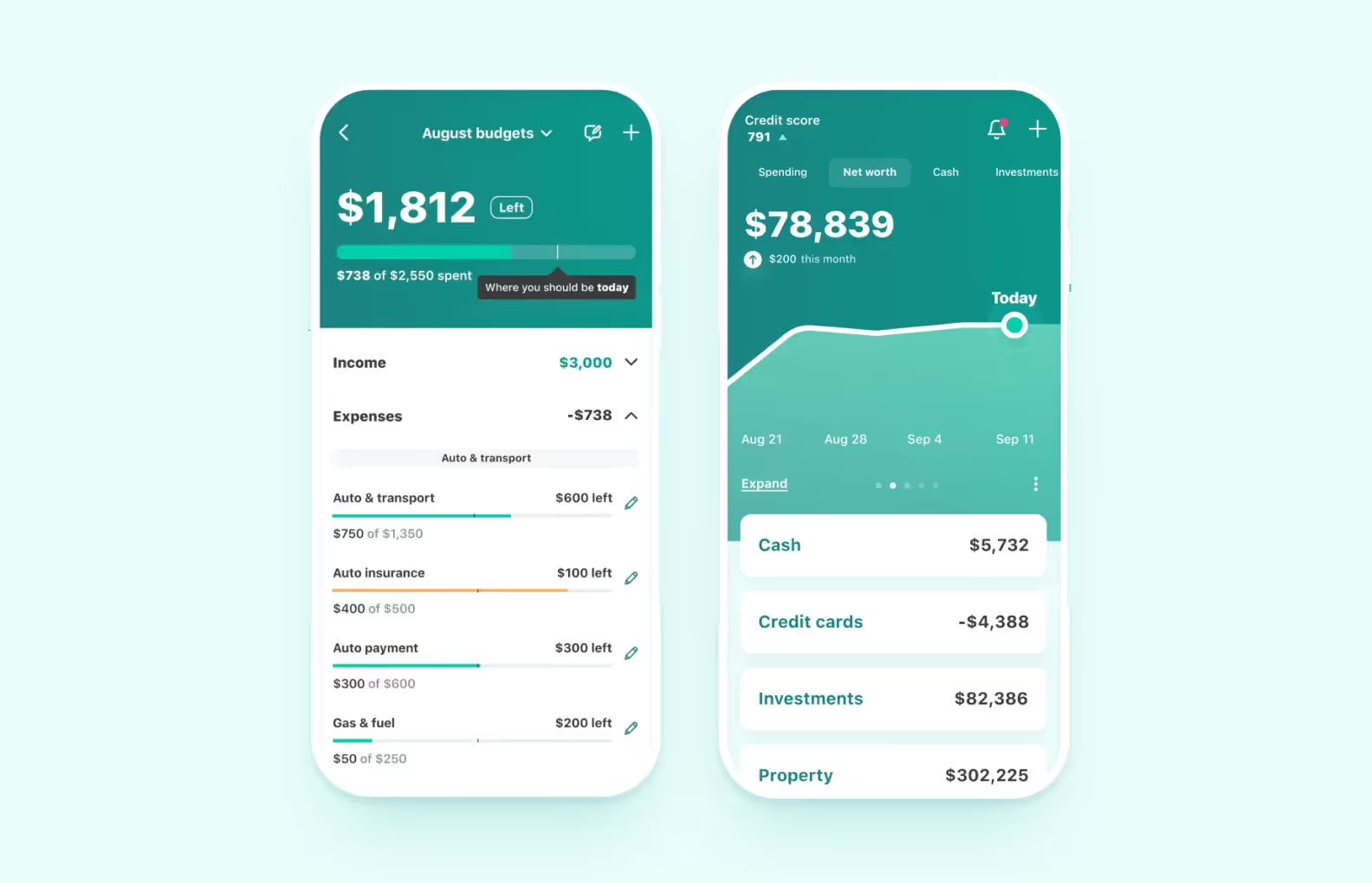

Any list of the most popular finance tools out there would include a money management app called Mint. This application syncs bank accounts, credit cards, and retirement accounts to give an overall review of your income and expenses, suggests goals and budget plans based on the statistics, and categorizes expenses. Users value its simple and intuitive interface, high security, real-time updates on money transfers and useful tips. Anyway, there is a fly in any ointment — Mint is unavailable outside the US and Canada and can’t distinguish income from budget.

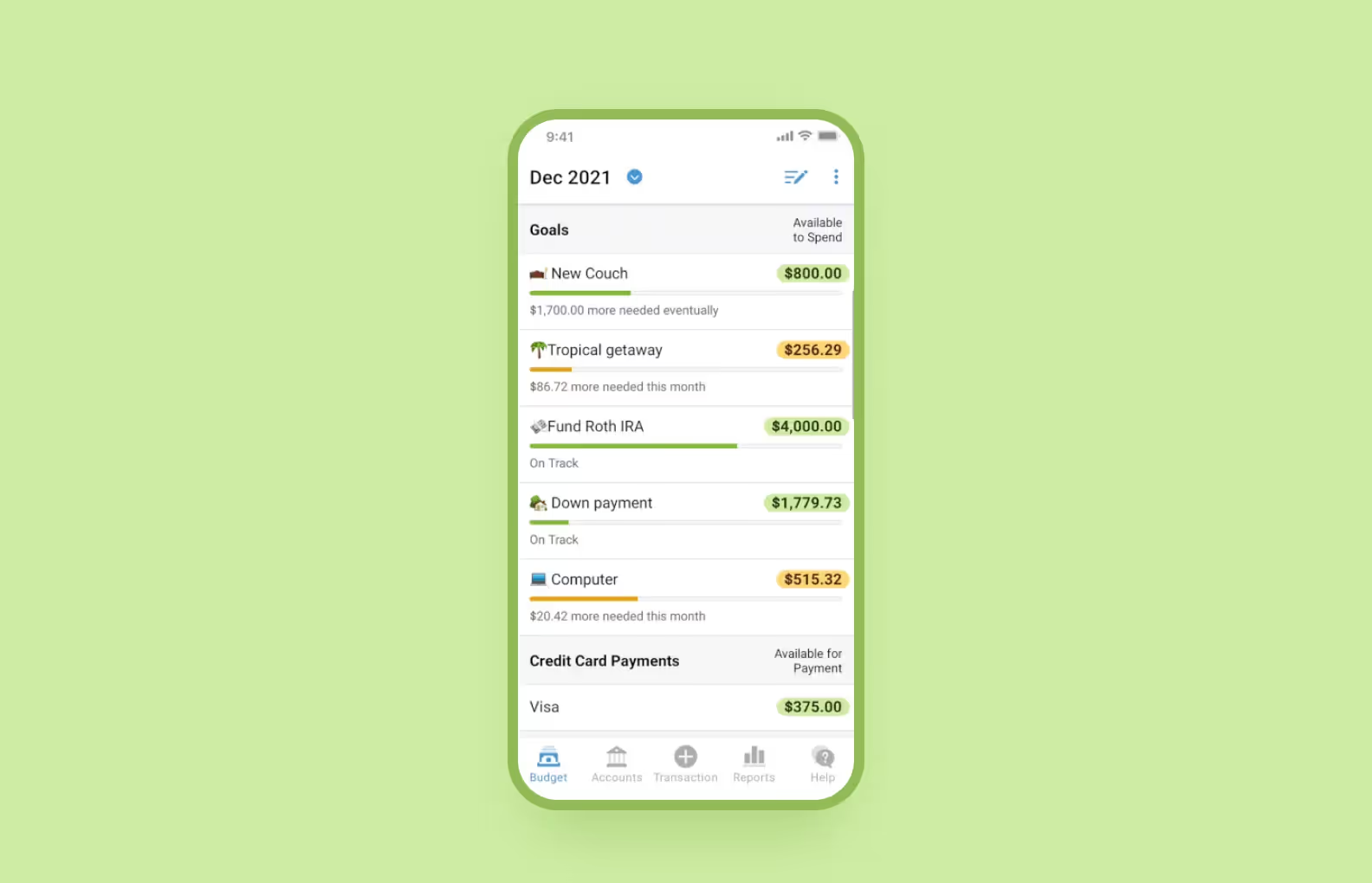

The second place on our finance app market list occupies a software called You Need a Budget or simply YNAB. It might be helpful for people who want to take charge of their money, save, and plan financial decisions with care. Developers claim that, in general, new users save over $600 in the first two months of using YNAB and $6,000 in the first year alone. This application is mostly about building a prosperous tomorrow, which is going to need a lot of discipline in your day.

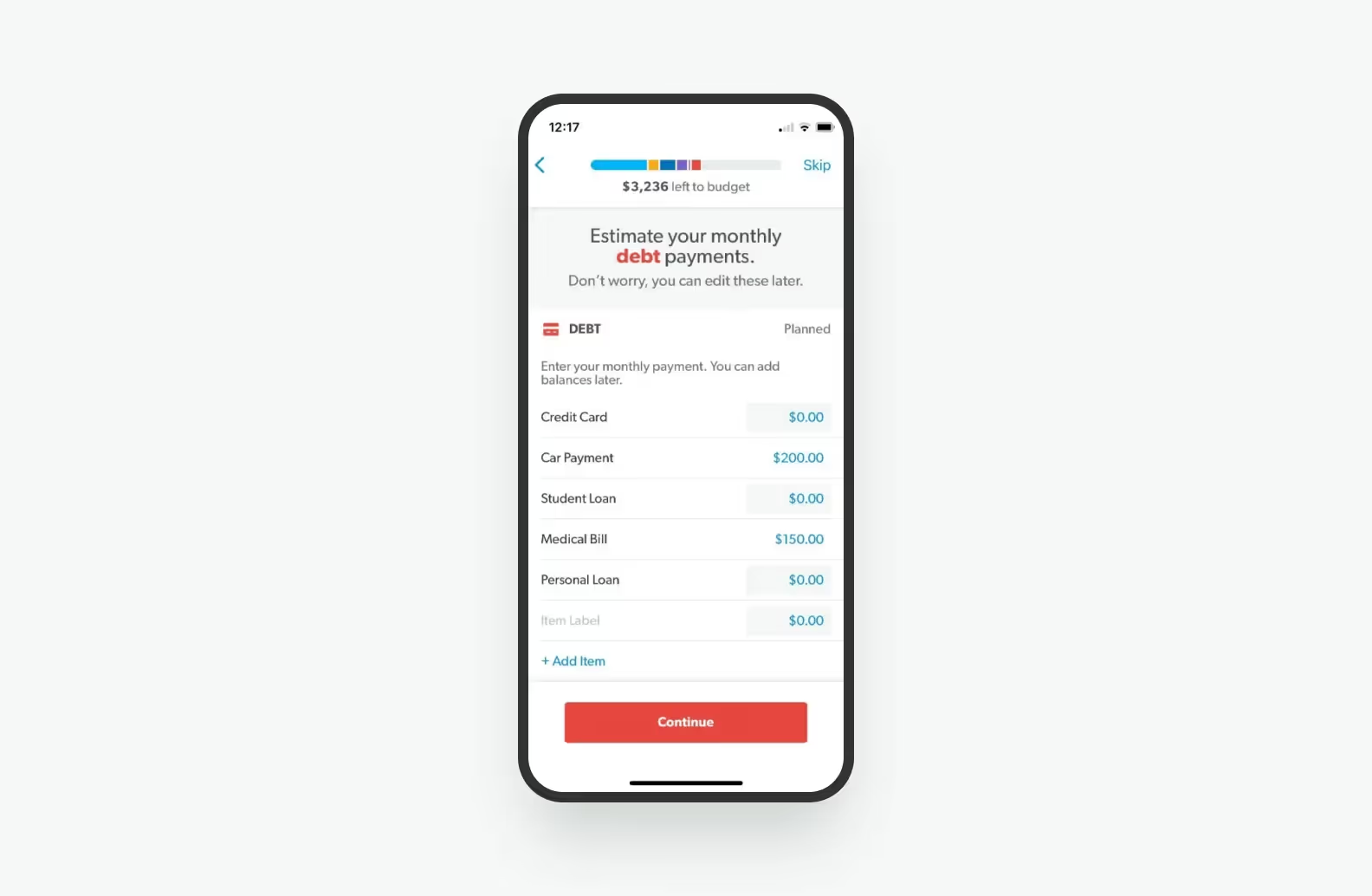

Everydollar is a classical financial planning app created by American personal finance advisor Dave Ramsey. It’s efficient if you aim to bring order and become savvy at managing your purse: building a budget based on income, categorizing expenses, and tracking spending habits. Everydollar can also assist you with debt payoff using the Debt Snowball Method. In a nutshell, it means paying off the smallest amount you owe as soon as possible.

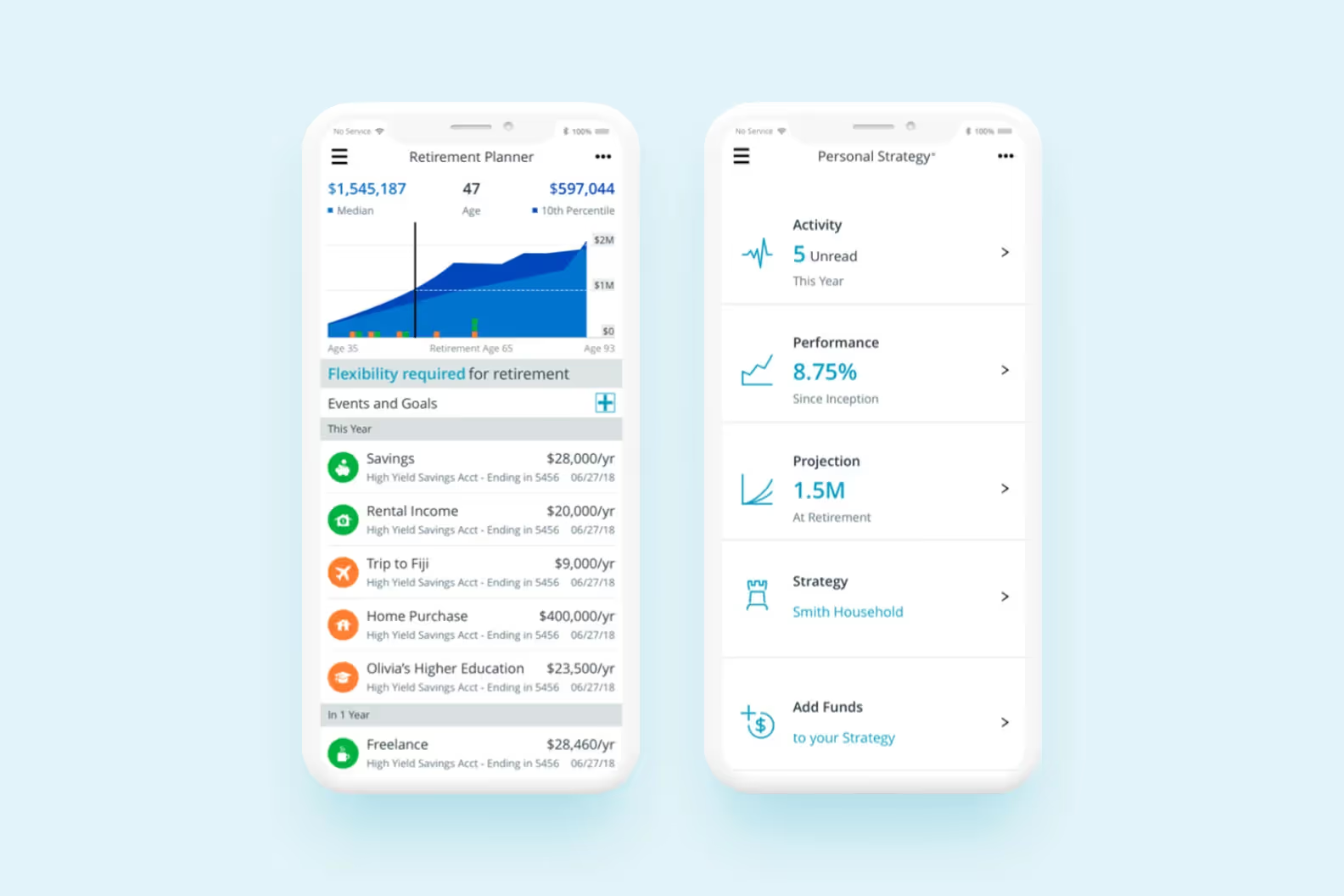

Personal Capital, which is the next on our list, is slightly different from all the above-mentioned options. This is a platform offering investment services and wealth management in the first place, enriched by free financial tools, money management accounts, budgeting, and personal portfolio analysis. Personal Capital’s audience consists mainly of high net-worth users who need to monitor bank, credit card, and investment accounts all in one place. However, the app can’t be described as cross-functional, as it doesn’t have an option of adding a debit card or cash transactions.

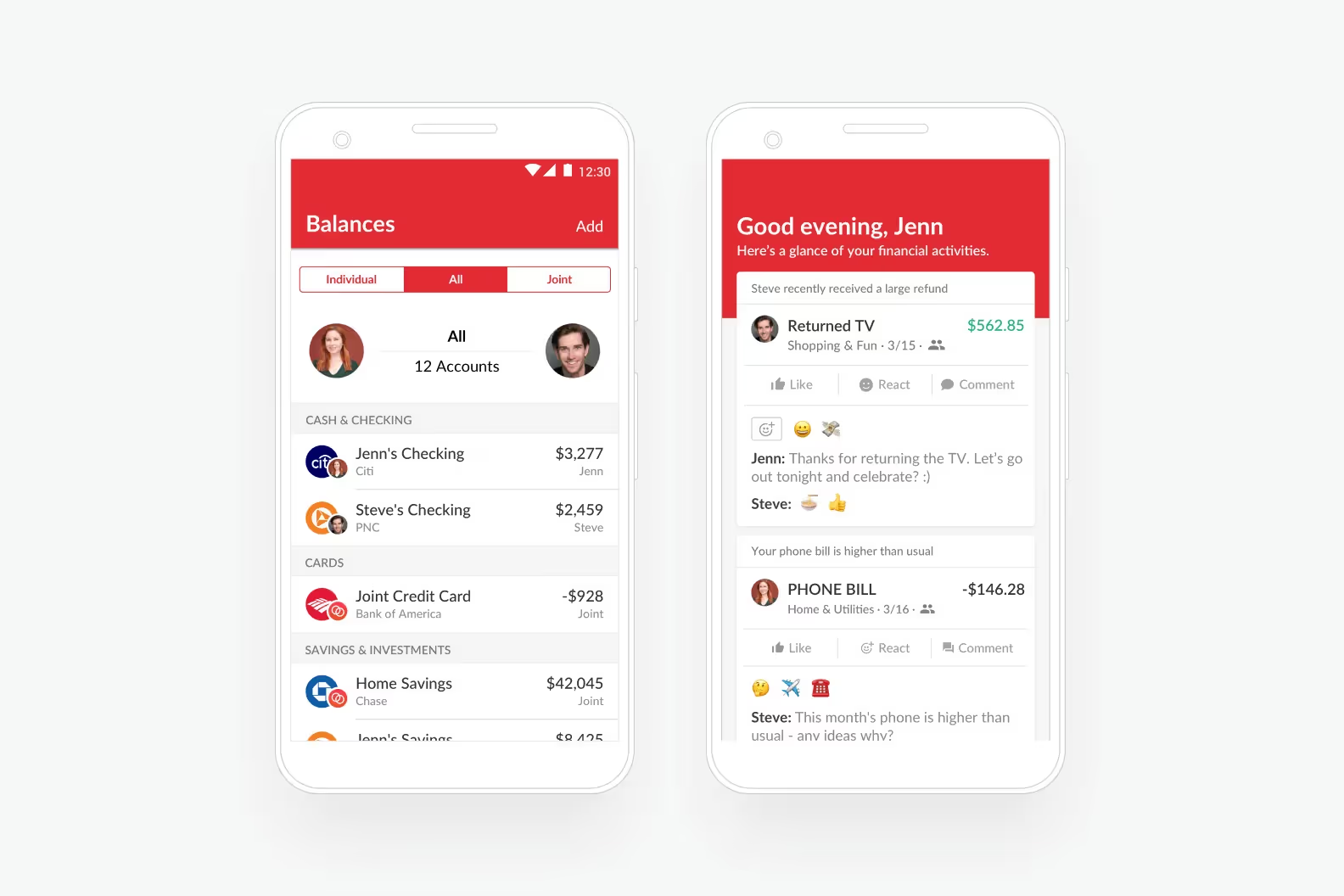

If you have a family or partner living with you, it’s not just about sole budget optimization anymore. The best tool for partner finance management is Honeydue, where users can check balances, track each other’s expenses, set common financial goals, and set spending limits for their accounts. Moreover, this personal finance app has a chat, so if one sees that the other has made a mysterious purchase, they may inquire about it right away. Users can also set transparency settings themselves and choose if they want to share transactions and balances with their partners or not.

As we may judge from the market review, companies turn to personal finance app development for various purposes. They combine features and build solutions according to the audience’s needs, so sorting out apps based on their area of focus in terms of mobile app development makes just a little sense.

First and foremost, if you want to build a personal finance app, you have to choose whether it’s going to be a simple or a complex app.

Simple software requires manual data entry. That means that users have to fill out all the information about income and expenses on their own. Let’s say you had your paycheck just now, you open the app and write the number you got. Then, you buy some groceries, open the app again, and write the total cost. Sounds psychologically effective, as committing reports may help grow self-awareness, but the whole idea may seem too time and effort-consuming.

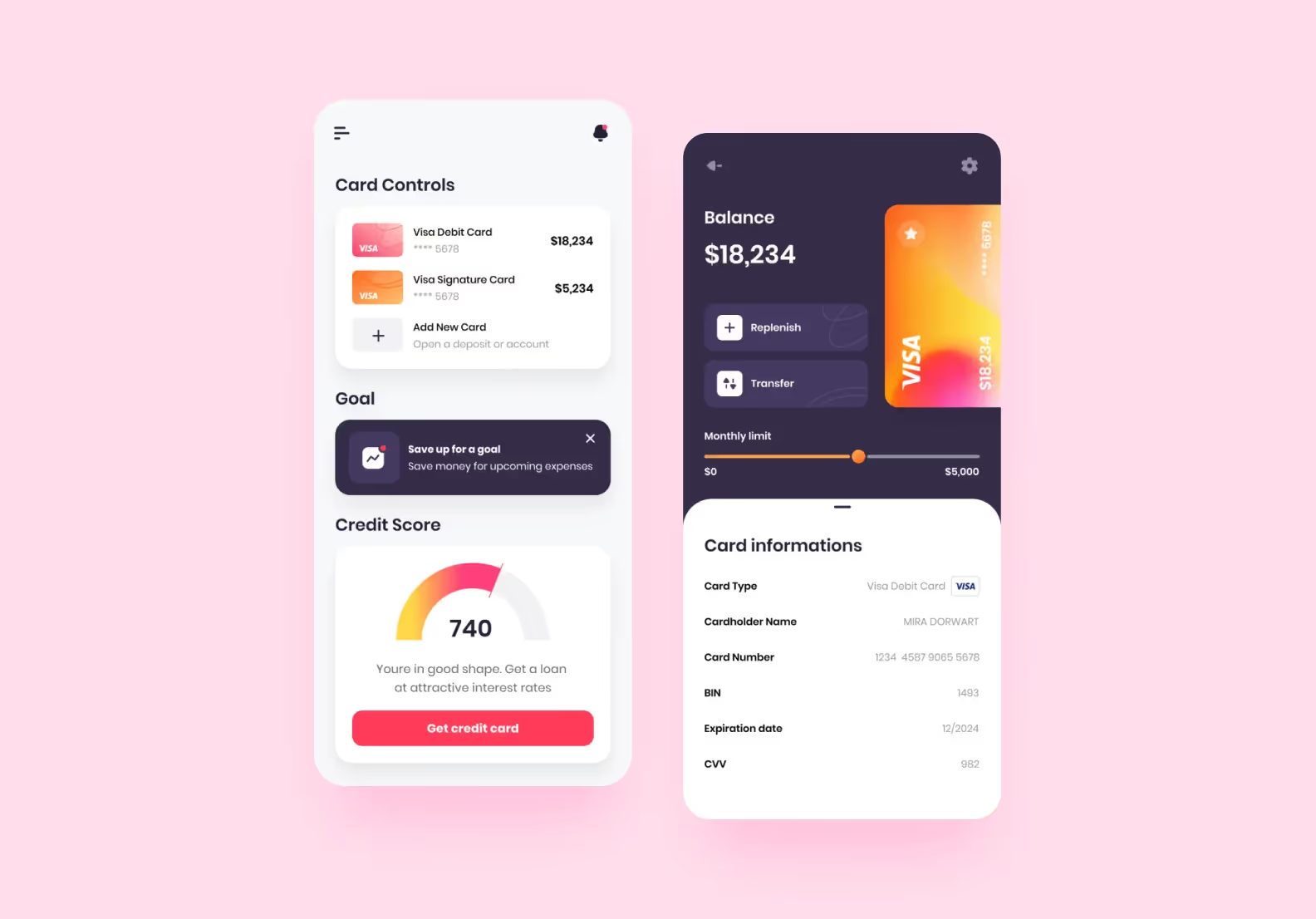

That’s why, eventually, a complex personal finance app was invented. Complex solutions ensure automatic data entry, as you can connect them with bank accounts or credit cards. Let’s say you got the money transferred; the app recognizes this and adds it to the budget. Then again, you buy groceries, and the app commits the transaction before you can say knife. Owing to precise real-time data tracking, there is no chance to forget or miss something. However, make sure the application has strong security.

You might be wondering why developers keep on building simple applications when we have these cool complex things. That’s not hard to guess, as the first ones are cheaper and faster to create.

When you know what forces people into finance management, it’s essential to dwell on their needs and expectations. The two stages combined give you the full picture of features recommended to implement in personal finance app development.

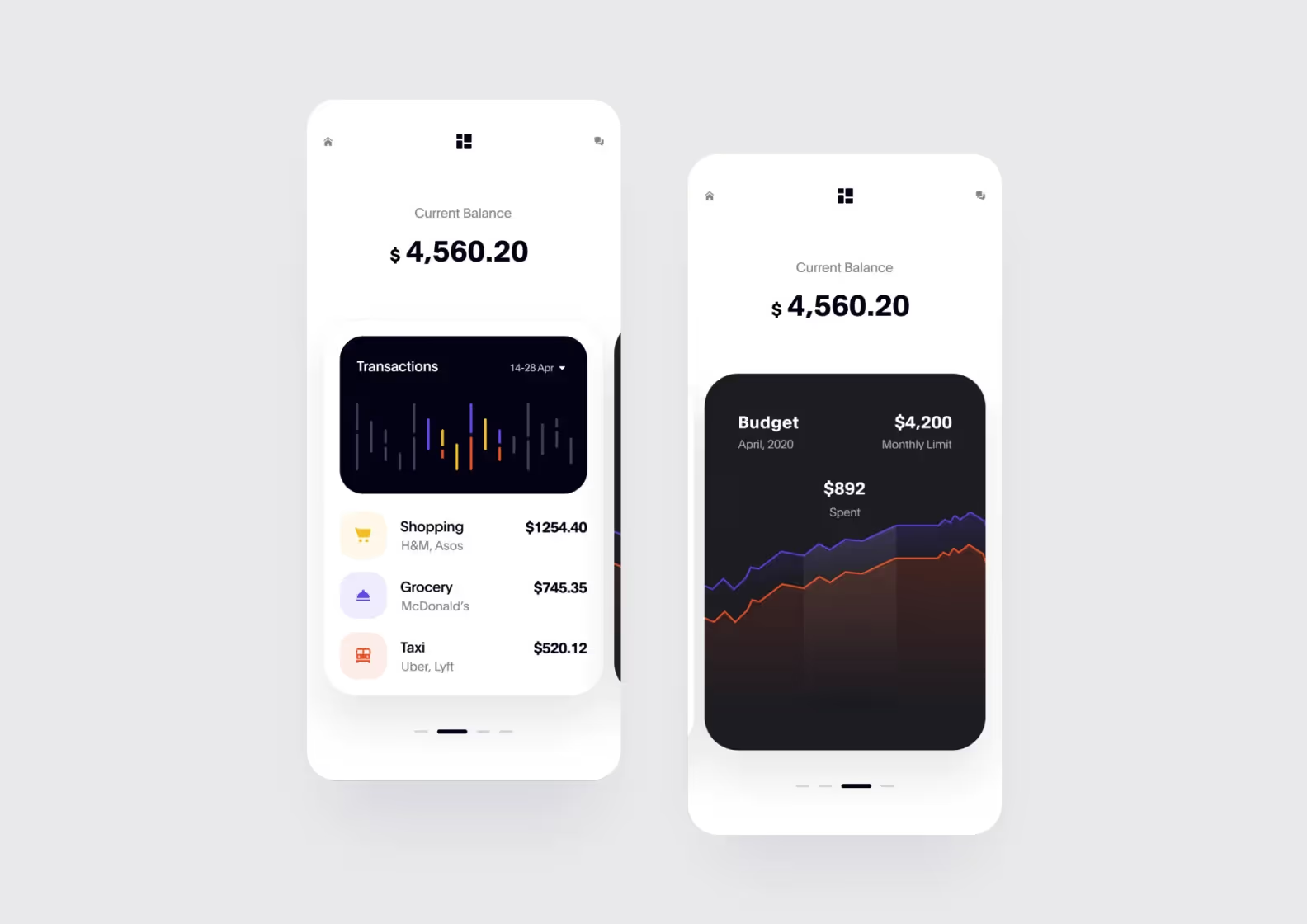

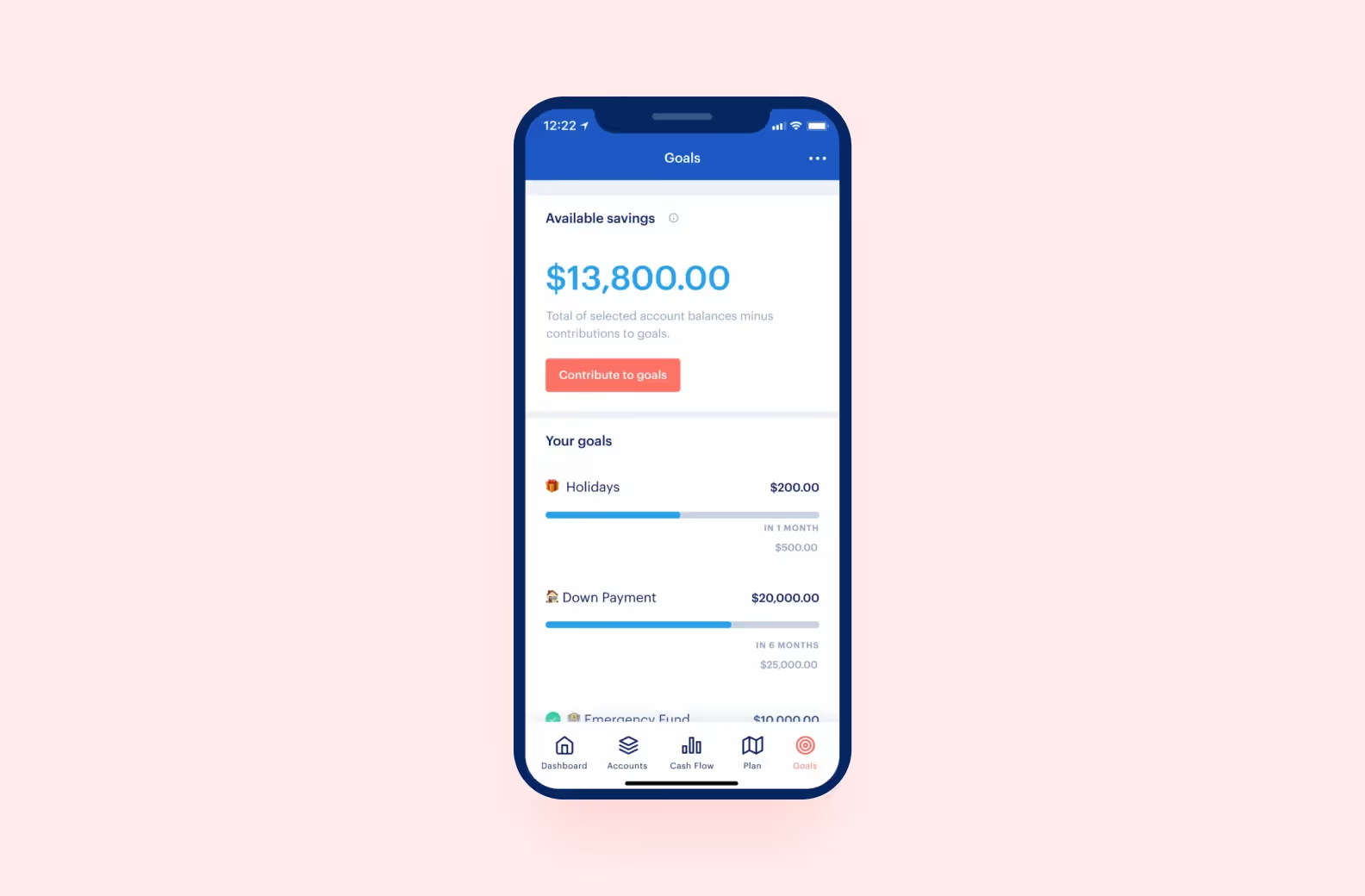

What people want from a personal finance app is a comprehensible and objective record. And there should be a reason for them to install an app instead of writing down each penny they spend and get in a spreadsheet. So, insightful, clear, and visually compelling reports really matter.

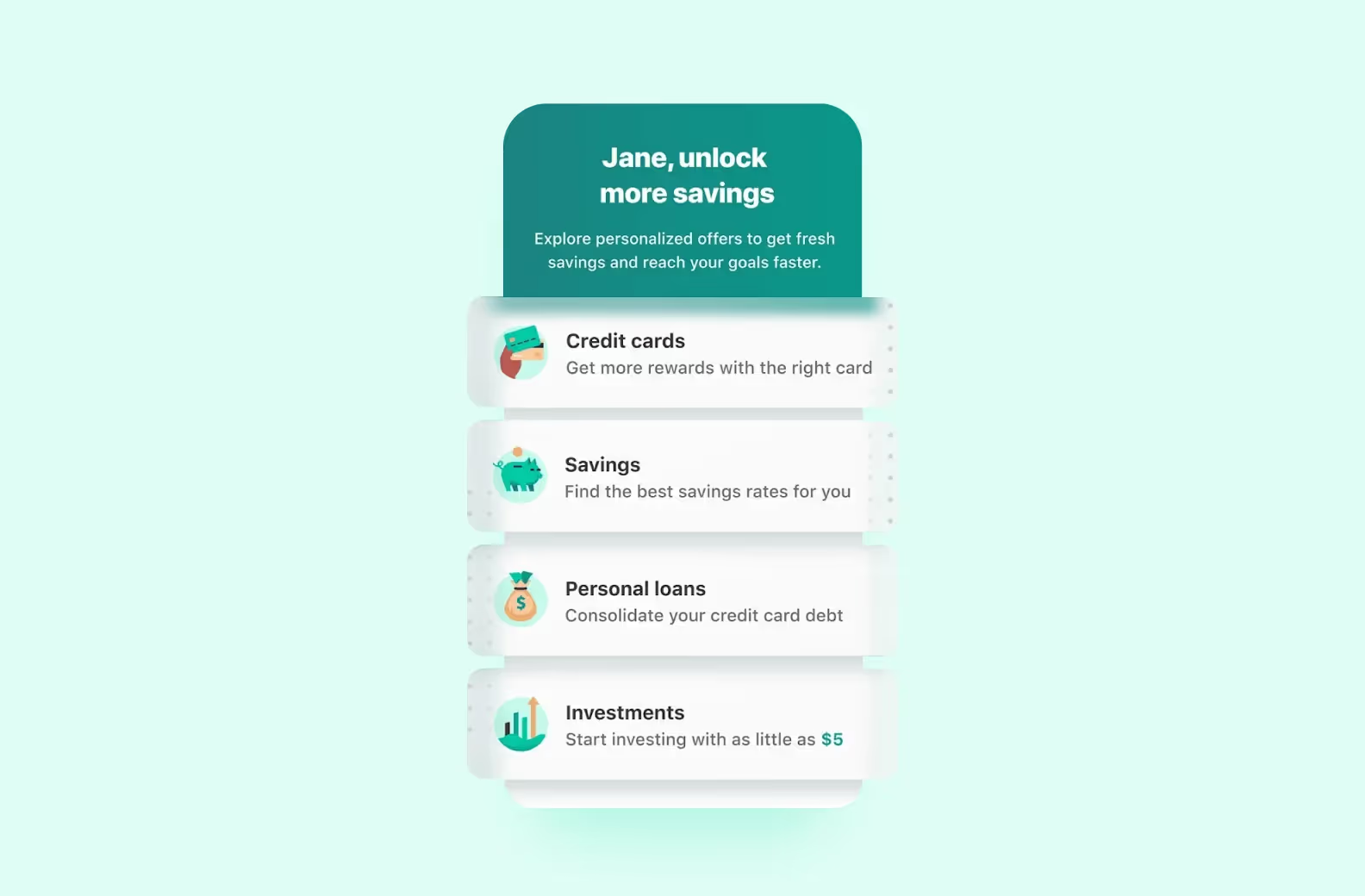

Seeing your stats is good, but receiving it along with individual saving plans, recommendations, and categorization of your expenses is way better. We use financial planning apps to know more about ourselves and expect developers to understand this.

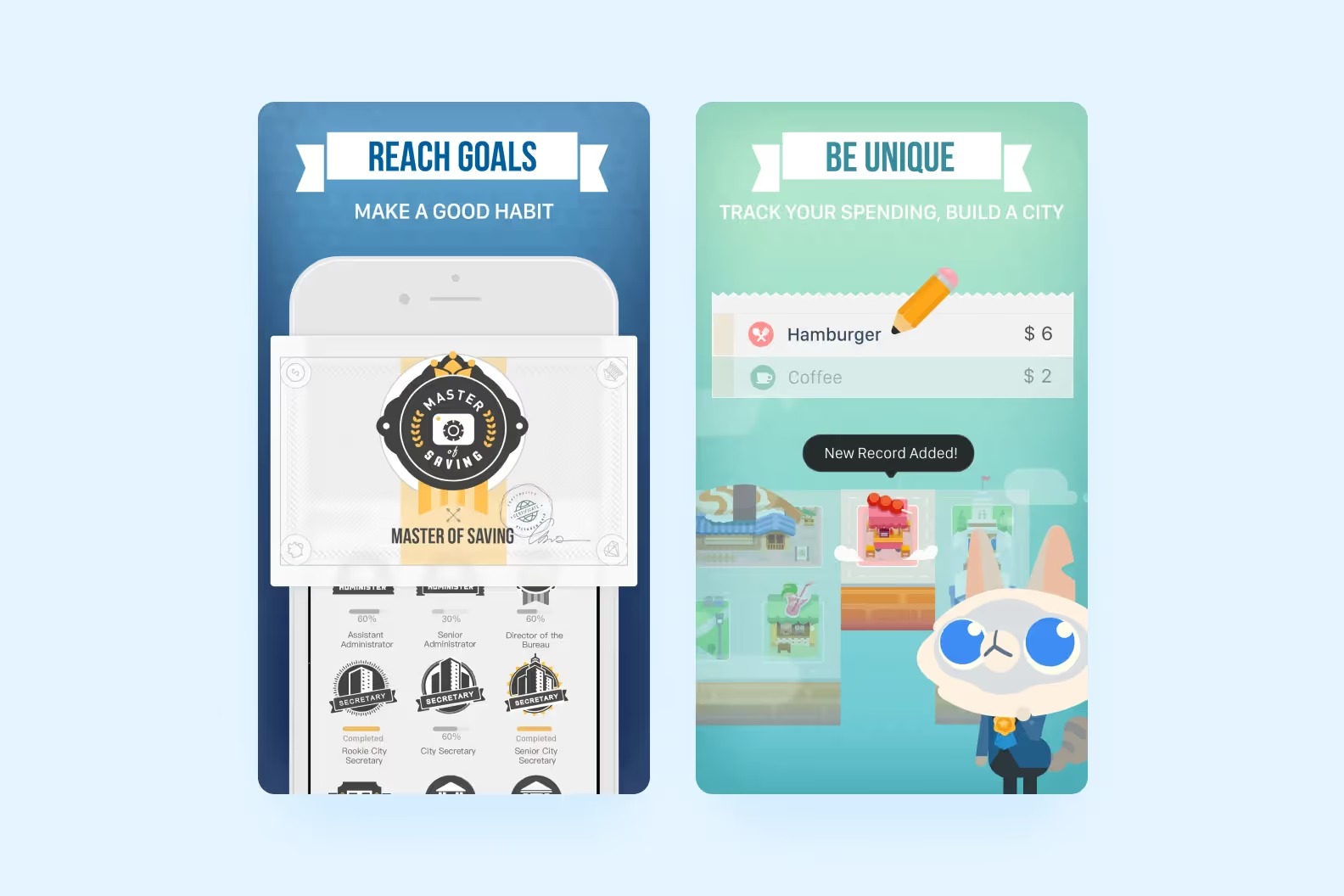

In the end, this is all about sensibly carrying the bag, so don’t ignore the psychological aspect. It’s essential for users to see if they have reached the goal of savviness or not. Besides, a money management app is a frequent assistant in savings allocation. Users will appreciate it if the software can help with reaching such goals.

Now that we studied users’ drivers and examined their expectations, it’s time to move forward with the features. There are certain functions that are vital for personal finance management, and you’d better start the development process by defining those. And then, advance to some additional ones.

Before discussing the actual process of creating a personal finance app, you have to think over some technology matters. Now, startups have dozens of tech opportunities for software development, and making the right choice is hard.

The options here will be

If you intend to release a personal finance app for Android and iOS simultaneously, you may choose either a cross-platform approach or PWA. However, one cannot upload progressive web apps to the App Store, so we recommend choosing the first option. Cross-platform development reduces time and costs, as you hire just one team that uses the same codebase for various platforms. Besides, you can create a unified design for all these platforms.

One of the most popular cross-platform frameworks is an open-source React Native framework created in JavaScript by Facebook. This solution enables startups to create software with truly native performance and user experience flexibility.

When you release a new solution, the best approach is to avoid the “go big or go home” concept. MVP or Minimum Viable Product approach has proved effective hundreds of times that’s why we strongly advise you to stick to it.

Without further ado, let’s find out how to create a personal finance app in just five steps with the MVP approach.

At this stage, your task would be to do the research. Start with collecting data about the target audience using the prompts mentioned above, studying the market, and defining the Must-, Should-, Could- and Won’t-haves for your product.

The discovery phase, or business analysis, is the foundation of your project, so we recommend that you do not neglect it. The discovery phase not only allows you to learn more about your target audience and market niche, but also test your idea and avoid unnecessary costs during the personal finance app development phase. It usually includes:

You can read more about project discovery in the article we wrote together with our team of business analysts.

As soon as the idea is crystalized, it is time to move forward to the UI/UX design. At this stage, design teams create wireframes for the future User Interface and develop its style, including visuals, color scheme, typography, etc. In terms of User Experience, it’s crucial to map out user flow and invest efforts in working out user journeys. MVP success depends much on UX and user-friendliness, so make sure you do your best at building it.

Tip! Keep it simple to create the feeling of trust and safety, which are crucial for financial apps. Though the temptation to use as many trending design details as possible is high, bear in mind that nothing should distract users from getting to their goal. Otherwise, they wouldn’t value your product.

That’s the phase at which the finance app development team starts writing the codebase. You will need to hire a frontend and a backend developer. Besides, there is an option of hiring just one full-stack coder who can do both, but in this case, the development is going to extend. This process is tightly bound to quality assurance. QA checking helps eliminate bugs and make sure the financial management software works properly on any device.

With the app released starts the most dramatic and stressful stage — idea validation. Beware that you haven’t confused MVP with the “that can do” version. The minimum viable product has to meet users’ needs anyway. You observe how people perceive the product, what they do or don’t like, and what’s lacking. Then, collect feedback and find the areas for future growth.

With user reviews up the sleeve, it’s time that you mapped out updates and further development for your personal finance app. Release just got it on the road, starting the product life cycle. You will have to maintain the software to ensure a bug-free experience for the users, proper app functioning, or increase app safety afterward.

It’s crucial to continue monitoring feedback not only in the early days after the release, but also in the future as the app evolves. People may ask you to enhance the app functionality with personal recommendations, shopping reviews, and so on. Chalk up, and users are going to appreciate it.

This is an estimation of finance app development costs with Purrweb, where we evaluated an MVP release with the core features and approach described in this article. However, before starting each project, our team discusses the idea and estimates expenses individually and free of charge.

Let’s cover the most valuable insights once more.

Inquire for finance app development costs individually, as it all depends. Anyway, we strongly recommend starting with MVP, as this way product release expenditures are going to be much lower. If you are nursing a personal finance app idea right now, feel free to contact us and share it. Purrweb will help you create a reliable and elegant application.