Any business is risky, but the pandemic and the subsequent economic crisis have affected even the most resilient of all. It would seem that there is no moment less suitable for risky investments than now. However, venture investment — a.k.a. investment in innovative startups — is breaking records, and the prospect of becoming a part of this trend is extremely tempting.

We’d like to help you figure out how to find investors, what drives them, and what a startup can do to increase its chance of being funded.

What encourages venture investment? The reasons are as follows:

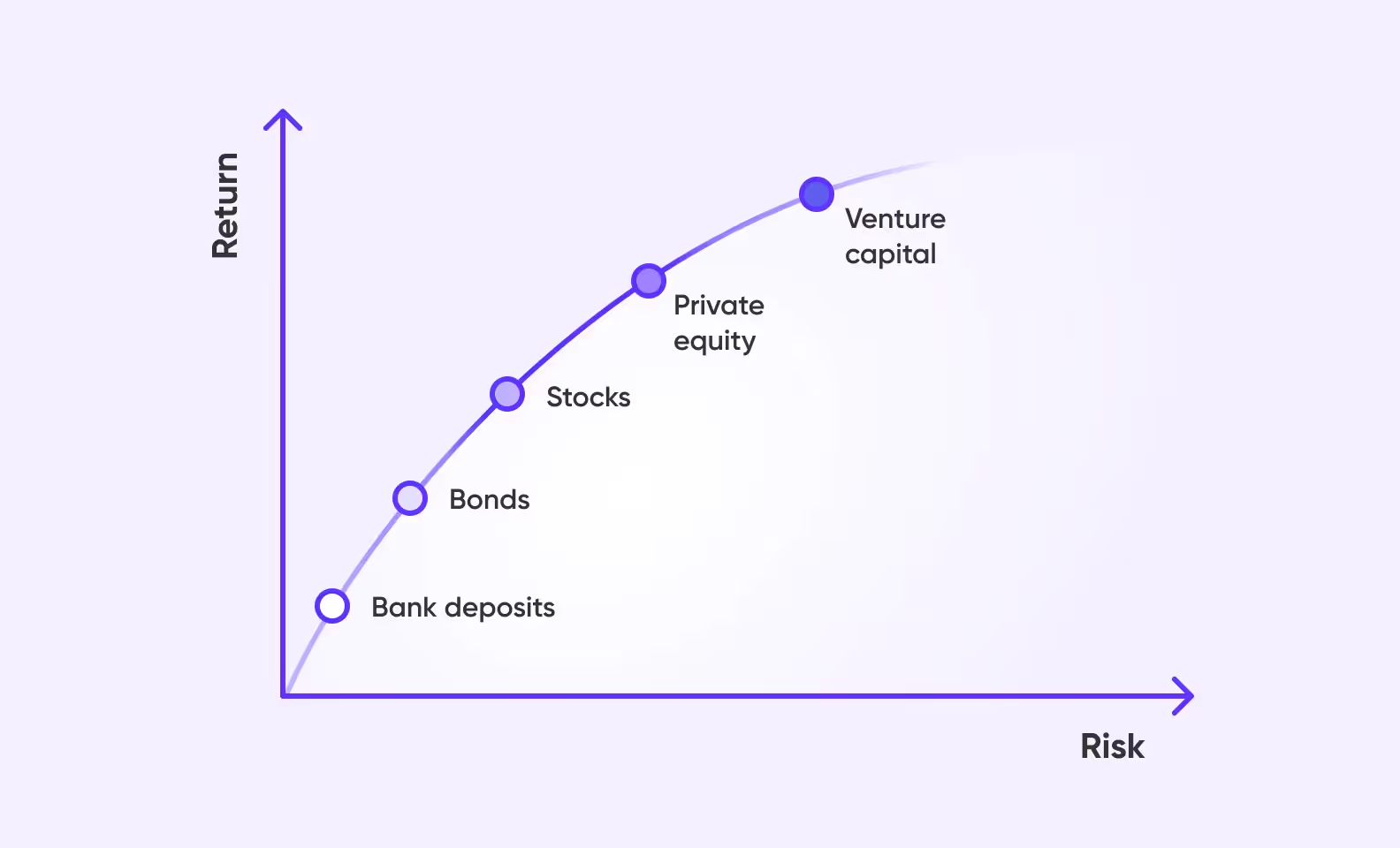

Unlike traditional instruments, investing in a startup business carries additional risks, but also promises extra profits.

Investors can put their money into an early-stage small business and profitably sell their shares after a few years of growth.

Despite the nice numbers, startups struggle to attract funding. Investing in a startup is a risky business because according to various estimates, 50% to 90% of all new companies fail. And only 1% will be lucky enough to become the next Tinder or Airbnb.

Investors usually pay attention to the following risks:

Also, most startups cannot show any tangible results at the earliest stage: an idea is all they have, and it can be too vague for investors to understand. This is another reason why it’s so difficult to get funding. Not everyone would agree to buy a “pig in a poke” from a hardly known small business.

Before we move on to how to find investors, let’s see why you’d want to find them. In theory, you can build a startup without any external funding. But is it worth it? After all, a lack of capital is one of the most common reasons small businesses fail. On the other hand, investment opens important doors to startups.

There are four essential benefits from external investments:

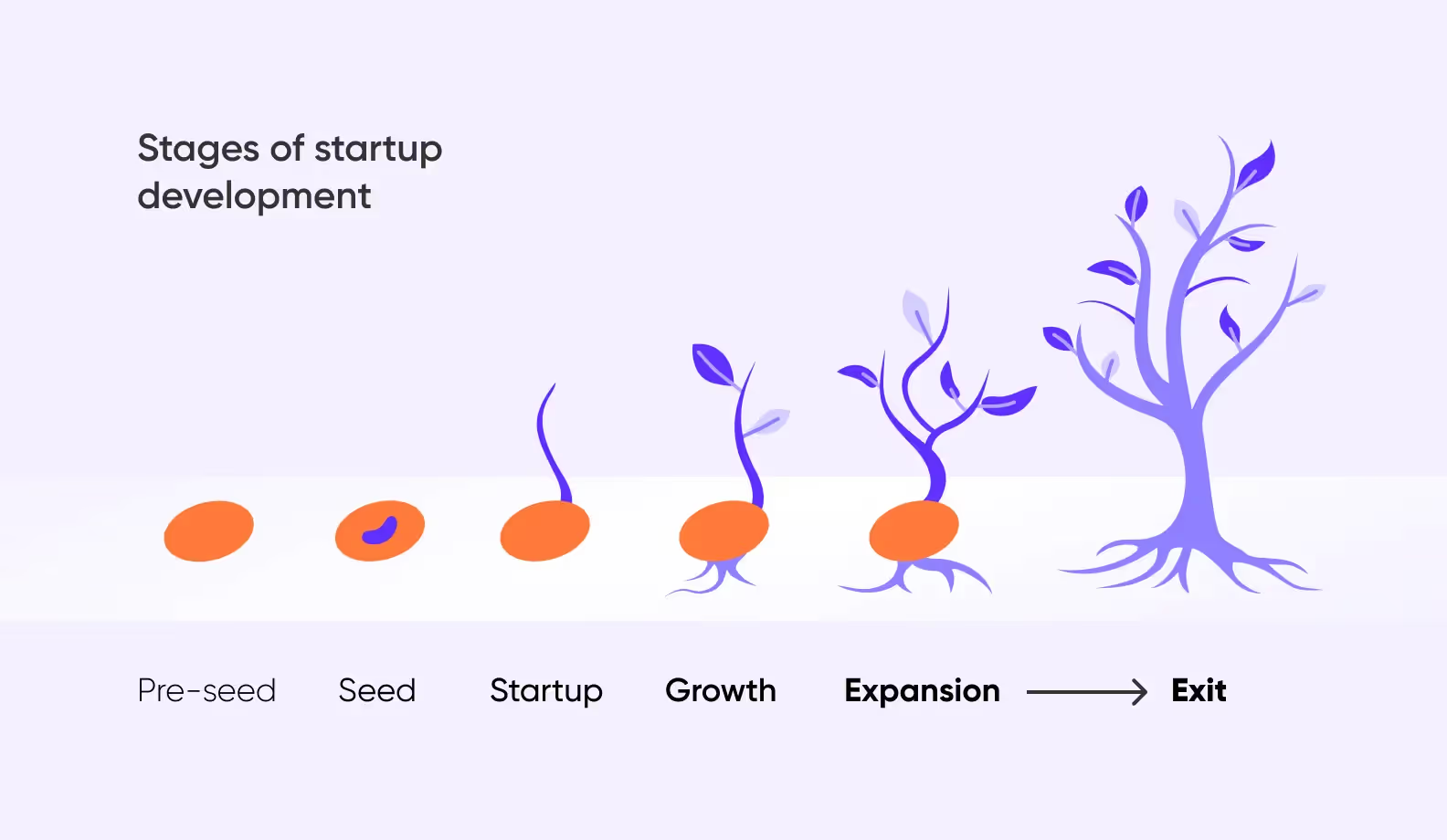

A startup can get investments at any stage. But it helps to know where you are: this way, you’ll understand your own needs, associated risks, and what type of investor might be interested in your business.

There are six stages of startup development:

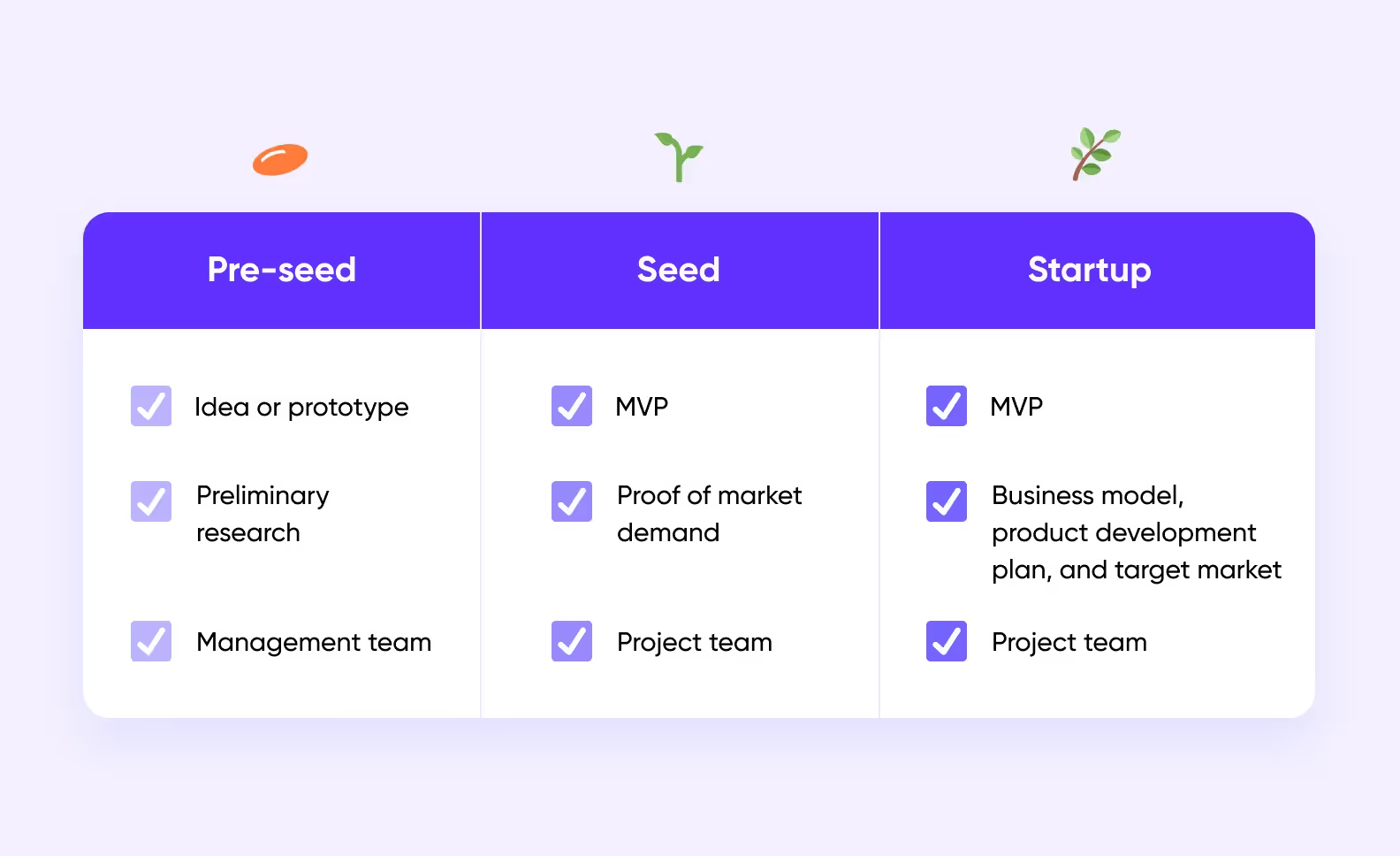

Pre-seed is where the founders have nothing but an idea. The first profit appears at the startup stage, and the exit stage owes its name to investors who take profits by selling their shares in the company.

We will focus on these first three stages: it is here that most new businesses cease to exist, but the potential return on investment is higher.

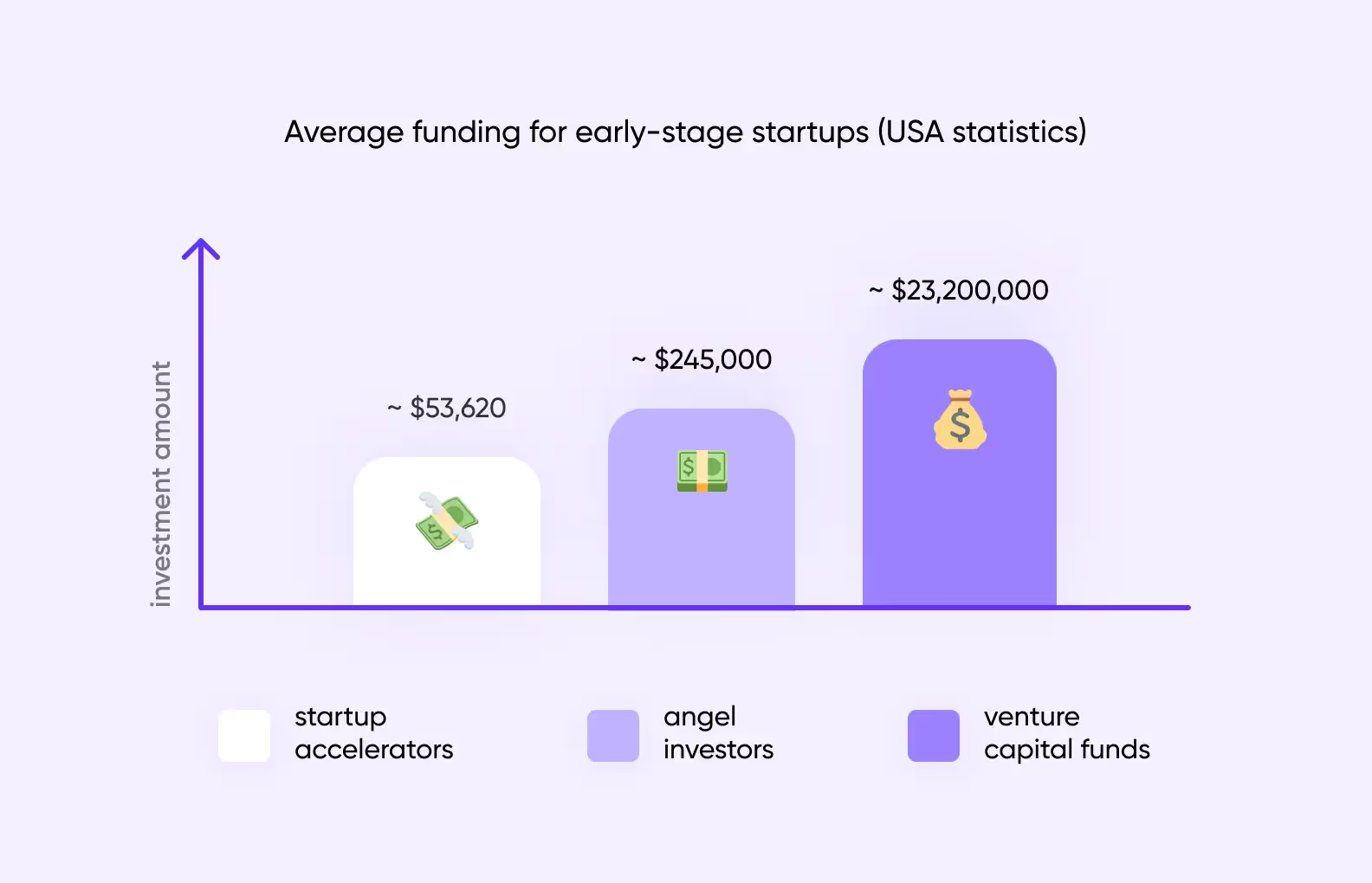

It makes sense that the longer a startup exists and the more founders develop the idea, the higher the chances of attracting private investors. At the pre-seed stage, this is unlikely but possible. The chances increase at the seed stage. Once MVP is ready, the founders can now turn to startup accelerators and angel investors. In the third stage, venture funds come into play.

<div class="post_divider"></div>

In 2017, two students contacted us. They had an idea and a limited budget of $1,500. Although this money was not enough to develop an MVP, we decided to get to know the client better.

They wanted to develop a medical app. There, people could write their symptoms, and a chatbot would ask questions and suggest reasons for feeling unwell. The app would also recommend what tests to take and what a doctor to see.

Our clients wanted to get investment to develop their startup, so we offered to make them a clickable prototype. The prototype shows the design and reflects the basic principles of the app. This is enough to convince investors.

Our clients were targeting the US healthcare market. They showed the prototype to investors and were able to get $400,000 in investment, which helped them develop the project further.

<div class="post_divider"></div>

Beyond capital, investors can often provide additional support. We'll briefly describe the major types of support you might receive:

So-called super angels are similar to venture capitalists: even though they're private individuals, they invest third-party capital.

There’s also a special type of fund — a seed venture fund. As the name implies, such funds focus on the seed stage.

As you can see, you can get funding for your startup even at the early stages. However, the competition there is huge. If you want to succeed, you need to prove to the investors that you're aware of the existing risks and have ways to minimize them.

Startups can help themselves and their potential investors to evaluate and mitigate some associated risks.

You should start with developing a minimum viable product (MVP) or a design prototype. A startup with an MVP is no longer just an idea in someone’s head. With a visual representation of the product, you're more likely to convince the investor. You can read more about MVP benefits in our article.

Along with MVP, you should choose your monetization model. It will allow you to start making money sooner.

<div class="post_divider"></div>

Our client wanted to develop a P2P payment app for the Kuwaiti market. There was a demand for this type of application, so they decided to start with MVP development and then pitch the project to investors.

The app has all the features you need to manage your money effectively: balance, card list, transfers, and transfer history.

The Kuwait Investment Fund and other international companies saw the potential of the project and invested $1 million in the first funding phase.

The application now has more than 100,000 users. The clients are planning to enter the Saudi Arabian market and launch a neobank.

<div class="post_divider"></div>

The best way to work around market risks is to conduct market research. There are two options, and we recommend using both if possible:

We already have an article on the importance of preliminary research. Click the link below to read about its main stages and the most common tools.

It is important to show investors that you have a strong and reliable management team, for instance, CEO, CTO, and COO. It would be nice if they had entrepreneurial and industry experience.

Also, it won’t hurt to have a clear business model, established internal regulations, and corporate procedures in place.

Closer to the startup phase, ensure some media coverage of your project. If people are talking about your company, it's a good sign for investors. This means that potential users already care about you, and there's a high chance that they'll buy your product in the future.

The equity share for an investor depends on many factors: the market valuation, your track record, the stage they enter the startup at, the projected return on their investment, time to return, estimated cash flow, and others. Be prepared to give up anywhere from 5% to 25% per round.

Here is how different factors can impact the amount of equity you'll give up:

You may find investors for your startup through word of mouth, direct emailing, or intermediaries. But investors don’t just sit and wait — they are looking for potential startups themselves. So, it only makes sense to try and get under the spotlight.

Various online and offline events are held around the world every month: conferences, hackathons, meetups, and forums. This is a great opportunity to meet potential clients, partners, and investors, find some support, and receive an expert review of your idea.

When preparing for a professional event, make sure your pitch is ready, too. You’ll be surrounded by talented entrepreneurs and you must make your project stand out. We recommend keeping your pitch concise and memorable. Explain your unique solution and target market, and add personality — what makes you believe in your idea and drives you to get out of bed every morning?

🤔 Advice: Don’t try to boil the ocean and participate in all the events at once — sharpen your focus, pick opportunities that relate to your niche the most, and get your pitch rehearsed before attending.

This is a special event where startups and investors come together. Entrepreneurs take turns presenting their projects, and investors contact some of them later. Quite a lot of pitching sessions take place every year — both local and global.

You can start your research on pitching sessions from:

Pitching sessions can be daunting since you will have about 20 seconds to catch investors’ attention and distinguish yourself. The key is to explain the impact from the start and don’t be afraid to repeat the main points.

A startup accelerator is not only a source of funding, but also a whole mentor-based program where you can learn from experienced founders, network, and get the support you need to hit the ground running.

Most accelerators hold only 1-2 programs annually, but that gives you plenty of time to get ready.

❗️Tip from us: When you choose an accelerator, pay close attention to programs with experience and expertise in your field. They'll have more niche-specific connections and advice. Also, consider the accelerator’s track record and success stories: have they successfully helped similar projects in the past?

Angel investors are rich people, former entrepreneurs, executives, and CEOs who are looking to get their hands on the big thing and get some return on investment. When you’re just getting your startup off the ground, their funds and business expertise can be crucial for getting those early-stage resources.

How do you find angel investors? Here are a few tips:

Once your startup is taking off and you’re ready for the next stage, it might be time to get some of those venture capitalists on the line. These firms have massive pools of capital specifically for backing startups they think can be total unicorns. In short, they provide cash injections, and we mean BIG money.

If collaborating with angel investors and venture capitalists is not for you — try crowdfunding. It lets you go straight to your potential customers and get funding from people who will actually use it.

Here's the hook: to make your crowdfunding campaign successful, you need to sell people your vision and come up with exclusive rewards for backing you. You don’t have to give up equity, but you must promise something captivating and interesting enough for people to invest and wait. Here's where you can start:

Sometimes, the best investor connections come from conversations with fellow startup owners. People who've been through the same turmoil can provide the best advice and introduce you to investors who will change the project direction.

Don’t be afraid to put yourself out there, not just at investor meet-ups and conferences but also at entrepreneur gatherings. Even if it’s a couple of founders grabbing beers together, picking their brains, and finding out as many details about who’s important in your industry. The right connection could lead you straight to that untapped angel investor, VC, or even their pockets if they see the potential and have resources.

Finding investors for your startup is a lot of work. Of course, each of them may have its unique requirements. But we'll highlight a few baseline criteria your business should meet to qualify for investment at one stage or another.

We hope that our checklist will help you while preparing for investor meetings.

➡️ If you need help raising funds for your startup, we’ll package your product, put together a pitch deck, and connect you with business angels and VC funds from our network. <a class="blog-modal_opener">Fill out the form</a>and we’ll get back to you!