People always want easier ways to handle money: from gold coins kept in chests, we came to paper money and investment portfolios. Today, FinTech is taking us to a completely new level. A mobile app for remote application for insurance and loans, investment in the stock market online, tax management, and currency exchange — all of this is part of FinTech. We strive to make it easier to manage finances, so products helping us in this are always in demand.

Let's see which FinTech applications are already on the market, what features they have, and how much it costs to build a FinTech app.

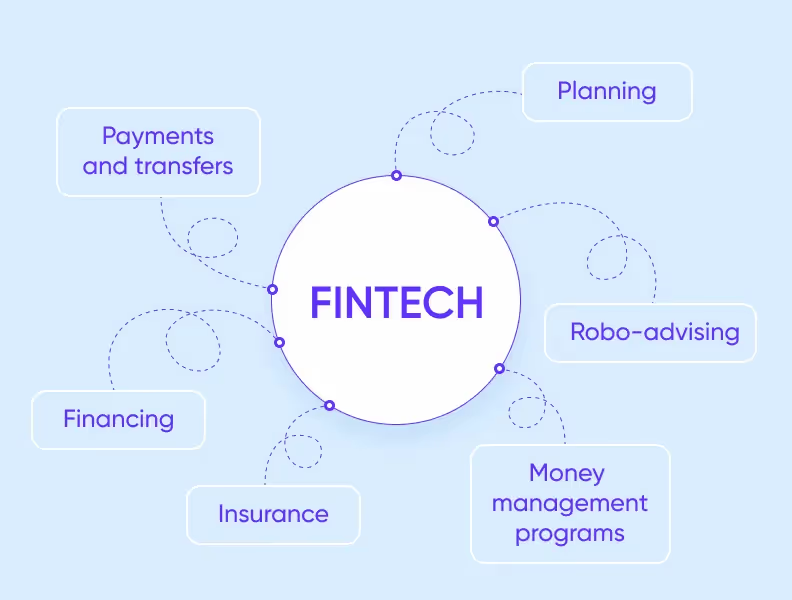

FinTech is short for financial technology — a product that provides and enhances financial services. It includes a wide range of innovations to improve and streamline different aspects of the financial industry.

The FinTech industry uses modern technologies to compete with traditional financial institutions. This includes online payments and transfers, financing, money management programs, financial planning applications, insurance, and much more. Financial technologies improve financial data processing and increase customer security with additional layers of fraud protection.

According to Forbes, FinTech investments in 2021 hit $91.5 billion, almost doubling the 2020 total. The global FinTech market size is booming across the globe. It is estimated that the volume of financial assets will reach $16,652.68 billion by 2028, which is 2.5 times larger than today. In contrast to that, the size of the financial sector was $6,588.78 trillion in 2021 at a Compound Annual Growth Rate (CAGR) of 13.9%. According to Statista, in 2021, round two thirds of Americans used online banking, and this figure is forecasted to grow.

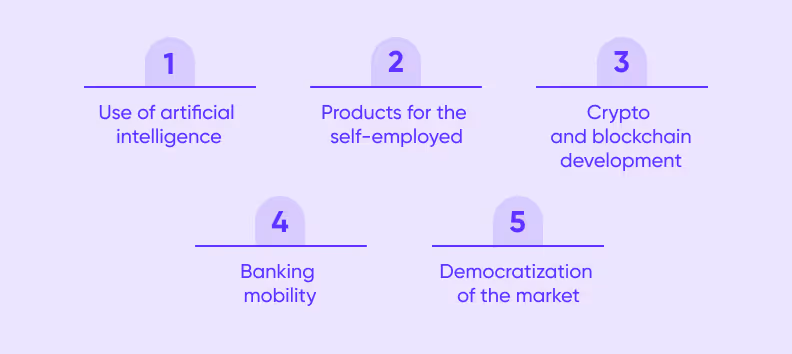

We’ve analyzed the Fintech market and outlined five key market trends.

Banking has shifted from large financial institutions with brick-and-mortar locations to smartphone apps. The pandemic has accelerated the growth of digital banking. To ensure safety, many traditional banks started using FinTech solutions to provide customer services online, eliminating the need for physical interaction.

Artificial intelligence is a catalyst for the growth of the FinTech sector and the adaptation of FinTech applications to the users’ needs thanks to automated financial data analytics. FinTech mobile apps use AI interfaces, chatbots for customer service, and personalized dashboards and offers.

The market sees an ongoing exploration of crypto, and blockchain ecosystems, for more efficient regulation and management. According to analysts, blockchain technology is considered the most promising, as it develops at a fast pace and has undeniable benefits.

The market is becoming more transparent and businesses, retail investors, and ordinary users get more new opportunities. There are various marketplaces, tools for money management, and new business models of financing, including digital assets, available for all.

Self-employed and freelancers with increasing opportunities for remote work are drivers for the FinTech sector, as many require a fintech application for monitoring taxes, creating invoices and receipts, and accounting for finances. FinTech can also offer tools for risk management and financial stability.

From the point of view of app owners, there are convenient models for the monetization of FinTech apps, which means that you can make money on this. They include:

You can offer a free trial period and then charge a fee if the user wants to continue using it. Subscriptions are paid at a fixed rate, recurring at regular intervals, monthly or annually, in exchange for access to a product or extra features. Your income will be directly determined by the number of users.

If your financial application offers a virtual card or account, then you can add a commission for transferring funds to other financial organizations. Transaction fees are the most profitable way of monetization since financial applications not only allow users to transfer funds but also convert currencies and pay for third-party services.

If you think about a constant income from the application, advertising is a great option. Despite the users’ criticism, advertising banners or small videos are used almost everywhere. To avoid dissatisfaction, you can place banners in the application so they do not interfere. In any case, the advertiser pays for placement and views.

If you want to develop a FinTech app and are looking for a new idea, you will have plenty to choose from. Let’s look at the main types of existing financial applications.

Digital banking apps and lending apps allow users to manage their bank accounts and use other financial services without visiting a physical branch. The category includes both mobile and online banking.

The banking and lending app services cover everything a person can get in a physical bank: opening bank accounts, checking & managing the balance, transferring funds, making mobile payments, getting a loan, etc. The main benefit is that digital banking apps, especially lending apps, ensure transparency and convenient 24/7 access to money.

<div class="post_divider"></div>

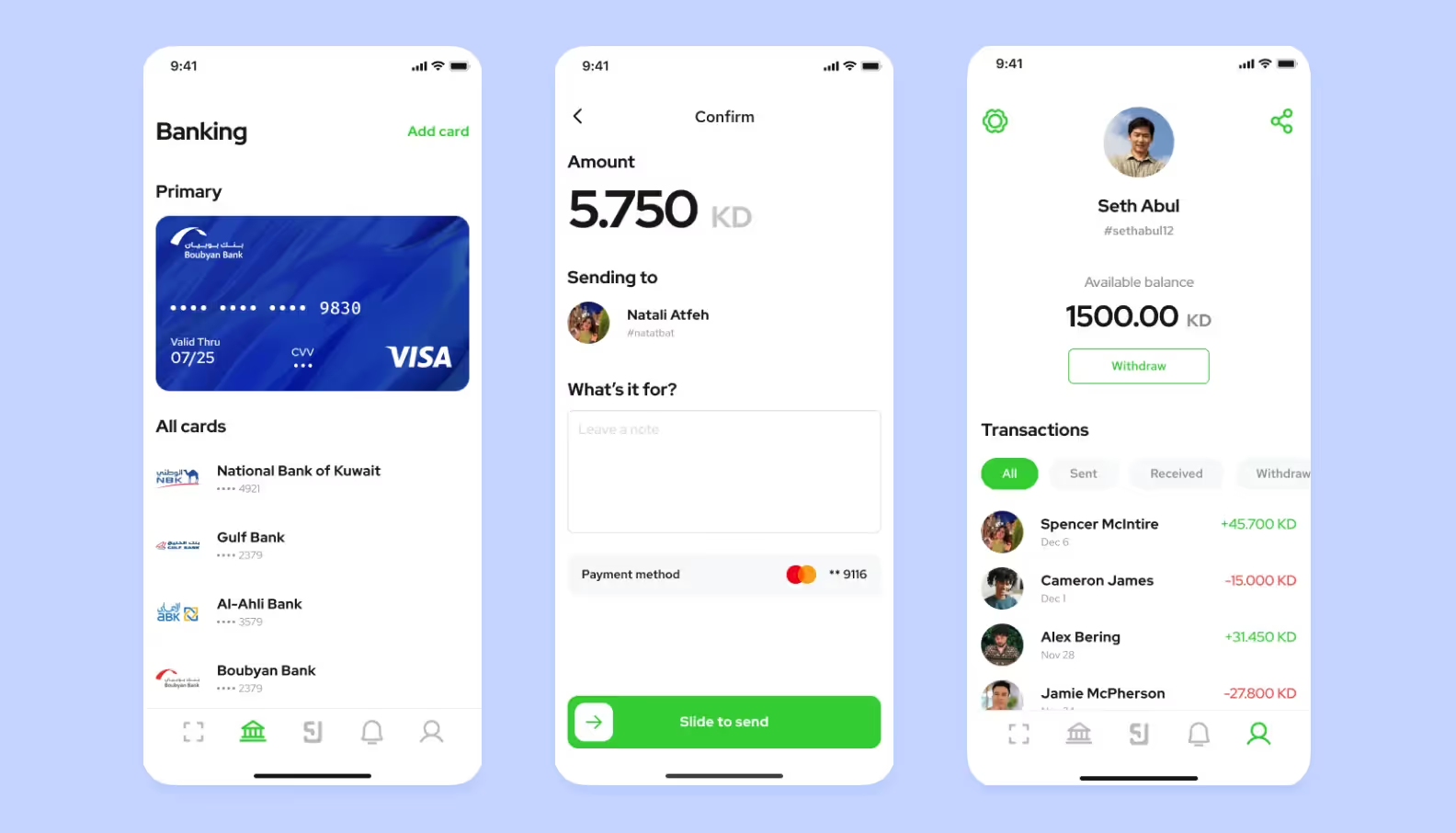

We were once approached by a client who wanted to develop a money transfer app for Kuwaitis. Although not everyone in the country used online banking services, there was a demand for this type of app. Therefore, the client wanted to offer Kuwaitis their own convenient and intuitive P2P payment app.

We developed an MVP that included all the necessary features for money management: balance, card list, transfers to friends, and transfer history.

We met the deadline, and the client showed the app to investors. They were able to raise $1 million in the first round. Now, the app has more than 100,000 users and is actively developing.

<div class="post_divider"></div>

Payment processing applications process all transactions on behalf of the fintech app development company. They take on the role of an intermediary that connects payment service providers with the customer’s payment information to enable web and mobile payments.

Payment processing fits perfectly into a typical e-commerce ecosystem and enhances customer convenience. These applications open up the possibility to offering even small businesses debit and credit card transactions and other online payment methods.

InsurTech applications help to improve the financial industry by adding more accurate ways to assess risks. It provides users with faster ways to apply for insurance coverage and process claims.

There are many implementations of InsurTech applications for property, cars, pets, and even life insurance. They help not only manage claims but also help insurance agents conduct on-site risk assessments and make better deals.

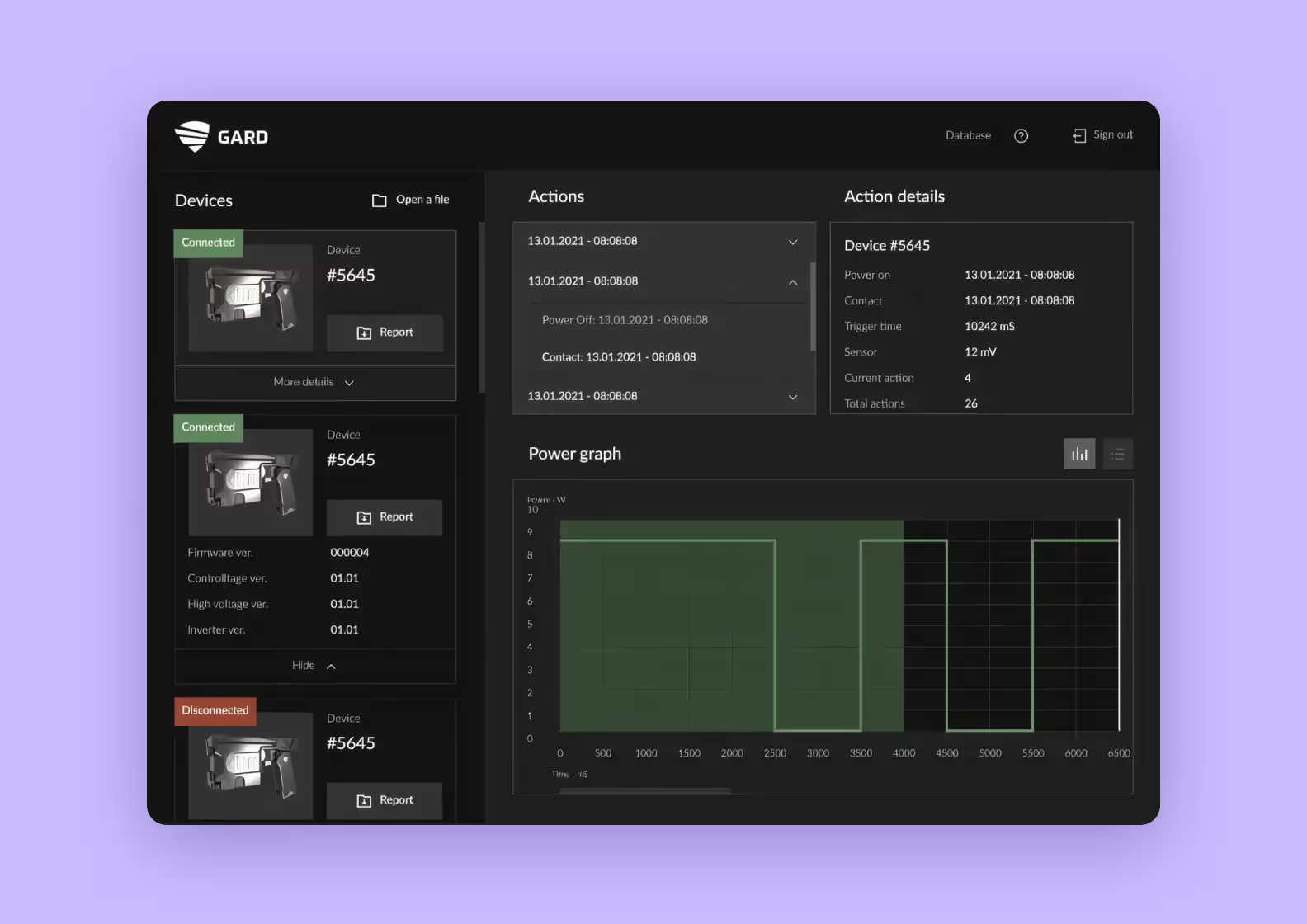

The scope of InsurTech goes beyond simple applications. It uses the Internet of Things devices, smart wearables, and AI to better assess a person’s lifestyle and risk profile. Even though InsurTech is a relatively new niche, it is rapidly developing. Its market size was estimated at $2.72 billion in 2020.

Investment apps are the leading platforms engaged in democratizing investing by making it accessible to everyone, not just the wealthy. An investment app eliminates intermediaries, lowers commissions, and makes it easy to trade and make bids and purchases.

Robo-advisors take this idea one step further by they providing an automated broker to manage the user’s portfolio and make trades. They use AI and machine learning to assess a client’s financial situation and risks.

<div class="post_divider"></div>

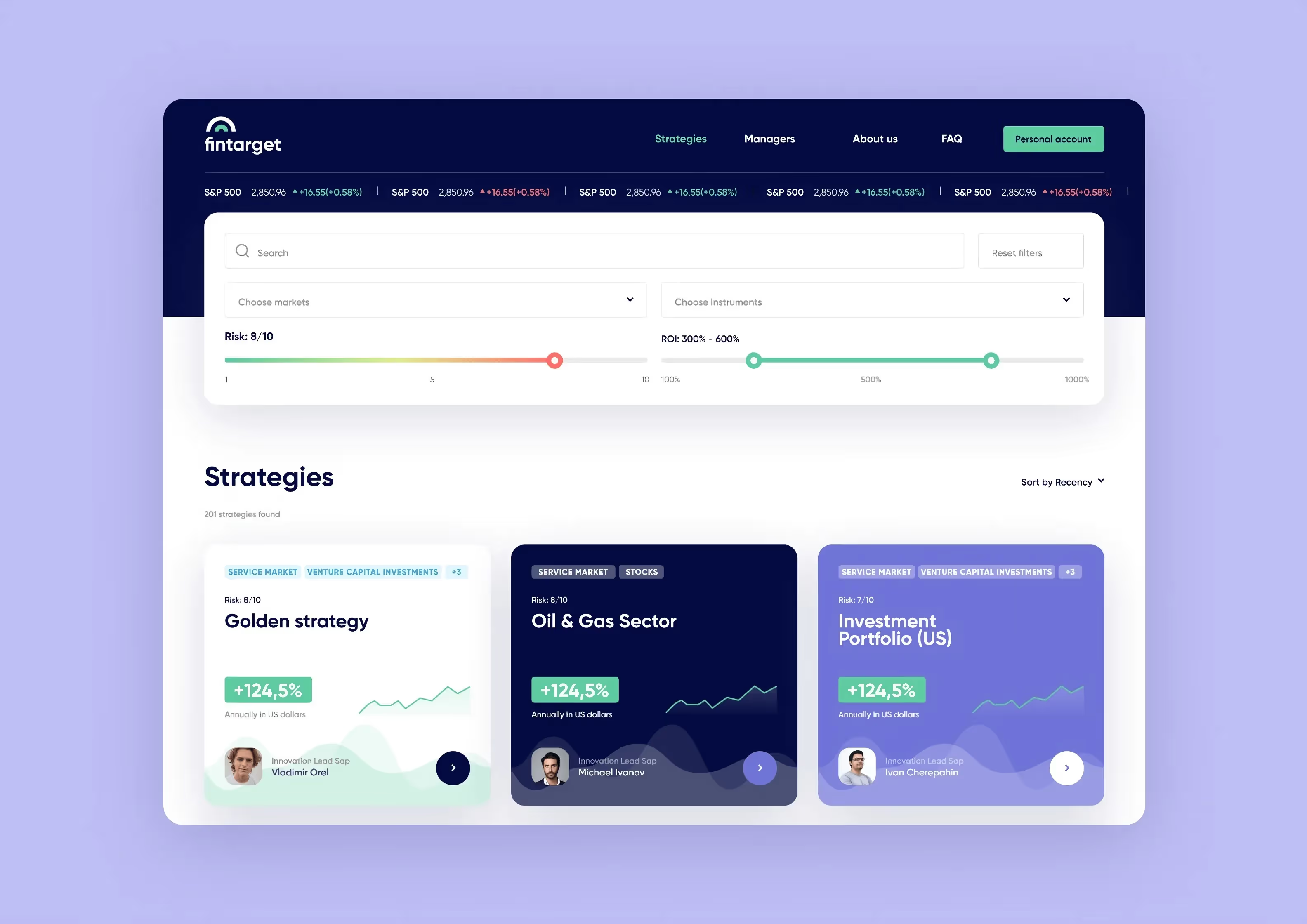

A large company in the investment market asked us to design new pages for their investment platform Fintarget. The platform was mainly used by experienced investors, but the client also wanted to attract beginners.

To motivate beginners to register, the client decided to show that investing is easy, even if you have no experience. To test this hypothesis, they wanted to create an MVP. Normally, we work on projects from the ground up. However, since the client had their own development team, we only did the design.

With the help of search filters, users can find a suitable strategy and invest money

We designed a separate page for the existing robo-advisor service and also created a personal account. Our teams managed to establish communication from the very beginning, and the project was successfully completed.

<div class="post_divider"></div>

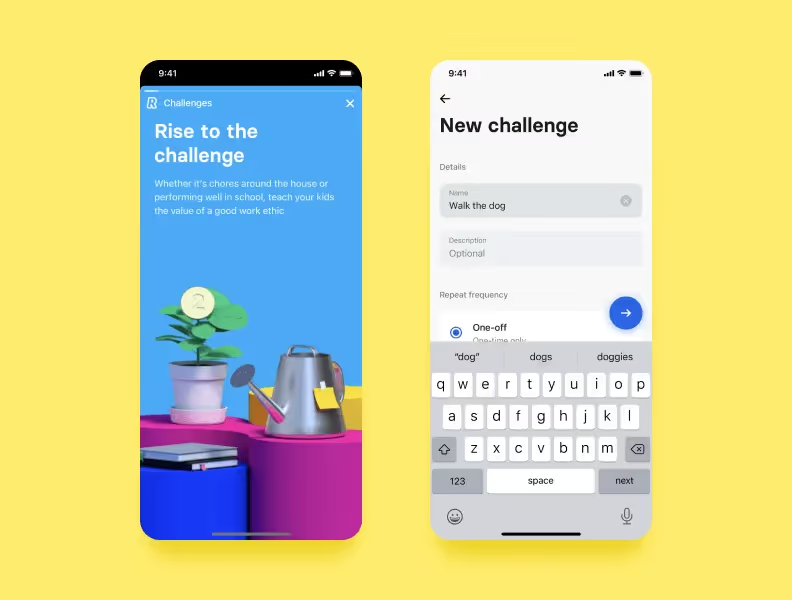

Helping people manage their finances — tracking income and expenses — is one of the most important functions of FinTech, and personal finance apps help this a ton. This includes budgeting apps. In personal finance management applications, interaction with the users is always intuitive: they can choose a goal, link a bank card or account, and monitor the cash flow. Centralizing the data in one place simplifies financial management and helps with tracking spending habits.

Taxes are often the most difficult aspect of finance. The rules and fine print are challenging to understand, which increases the likelihood of error. Different income tax rates for individuals and organizations, tax benefits, and changes in legislation can be confusing.

The complexity of the tax systems worldwide is the reason why tax management software for filing and managing taxes is so valuable. FinTech companies create applications to simplify the process of preparing, submitting, and controlling documents. There is no need to hire an accountant or have any experience since almost everything is automated.

These are online systems that help to exchange currencies on the internet. Various financial companies deal with electronic money, so they need platforms where users can make money transfers or buy desired currencies.

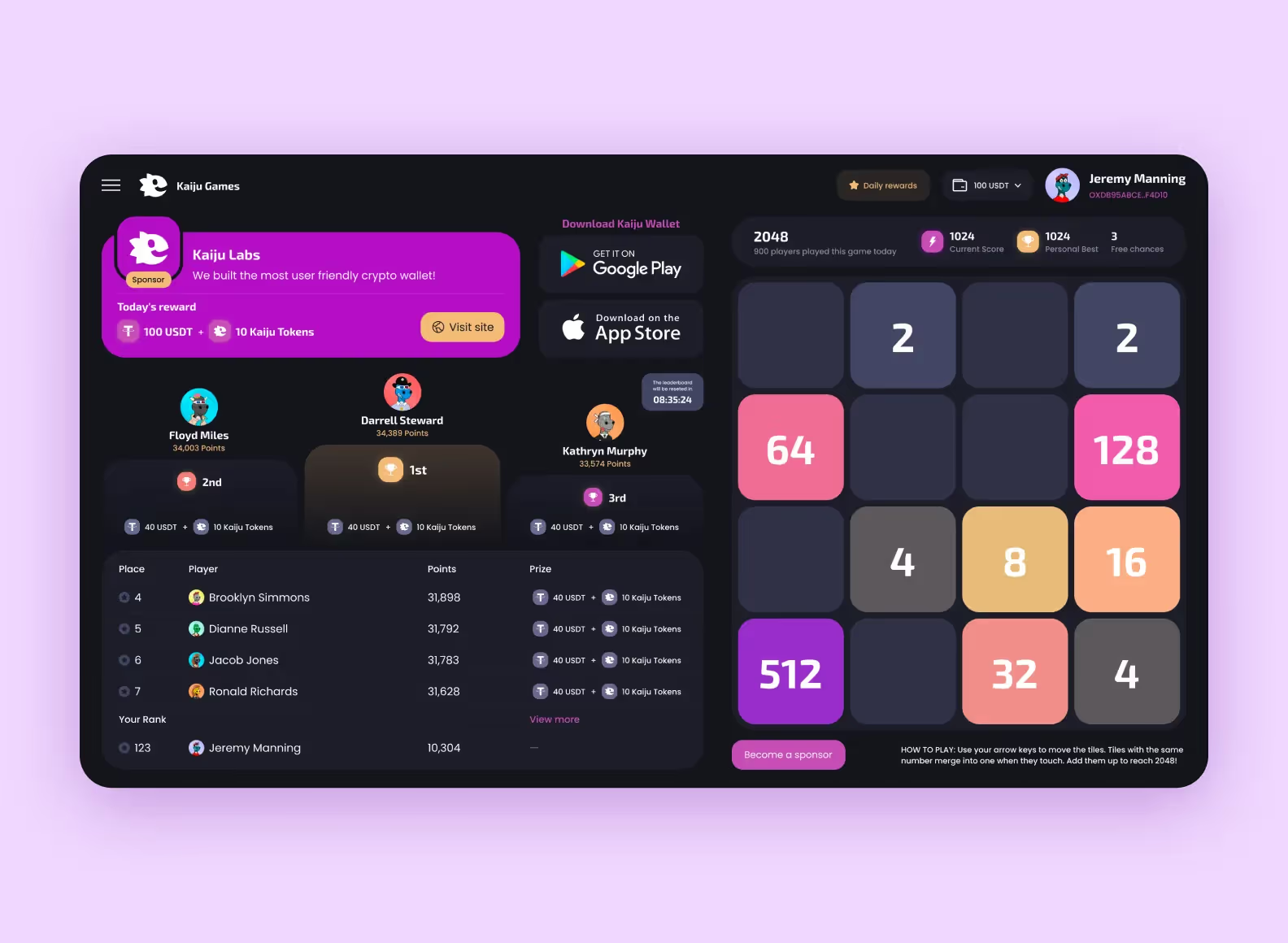

Speaking of the booming sector related to blockchain technologies, a cryptocurrency exchange is an online trading platform where users buy, sell, and exchange cryptocurrencies. They work similarly to an online broker since users can deposit fiat currency and purchase crypto. Some exchanges allow users to receive interest from the cryptocurrency stored in the account.

Let’s see how financial applications are implemented in practice. We have compiled a selection of top applications for various previously mentioned types and fields of application.

This FinTech app is the most popular in the online banking sector. It has over 20 million users and provides services for 950k businesses. Revolut covers 200+ countries across the globe and offers various services that help users manage, invest, borrow, and protect their money. The app provides businesses with additional tools to accept payments, manage accounts, and minimize costs.

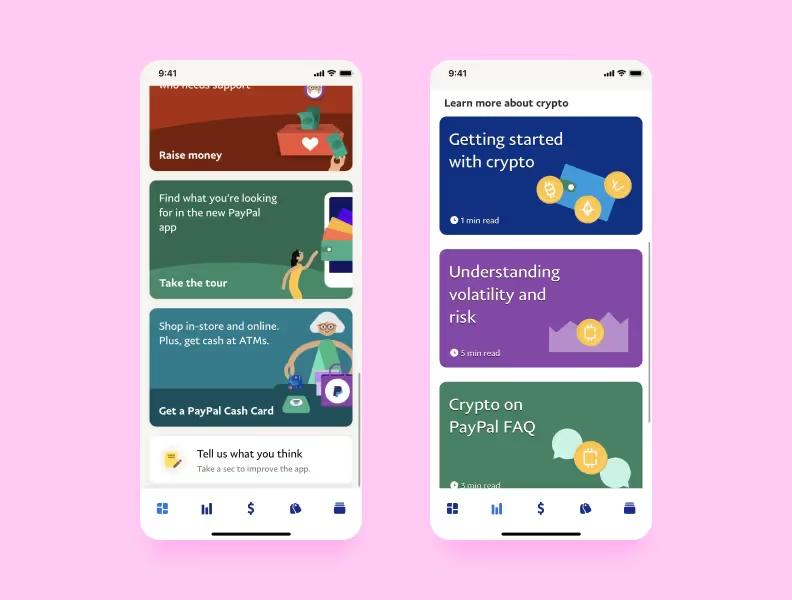

PayPal is the payment system that allows you to conduct and accept mobile payments on PayPal wallets without commission. Users can make purchases with PayPal in online stores around the world. All information is protected, and the service needs only an email address and password in PayPal to make payments. The payment system offers fast, flexible, and inexpensive solutions. Funds are withdrawn directly from linked to an account’s bank card, which makes shopping convenient.

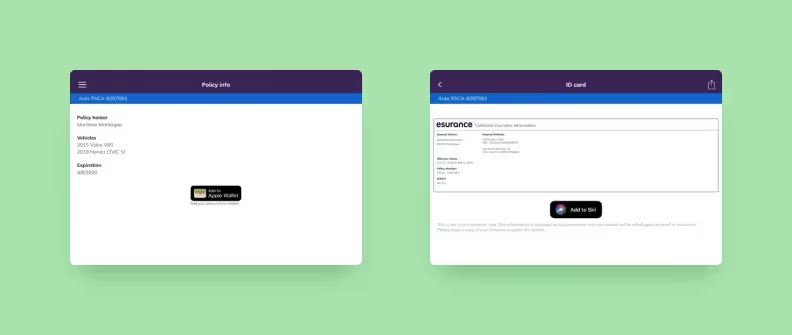

Regardless of whether you want to insure your home, car, pet, or even your life, Esurance offers the appropriate coverage. With several types of insurance to choose from, users can select the policy they need or combine coverage to save money. Esurance was chosen as the best insurtech app by Investopedia. It has a user-friendly interface and is available all across the US.

This financial application is used to exchange currencies and automate investments. Wealthfront was launched in 2011. The app offers retirement savings in traditional IRA, Roth IRA, rollovers, college savings accounts, trusts, and investments. The Wealthfront robo-consultant uses the Modern Portfolio Theory algorithm to manage money and invest.

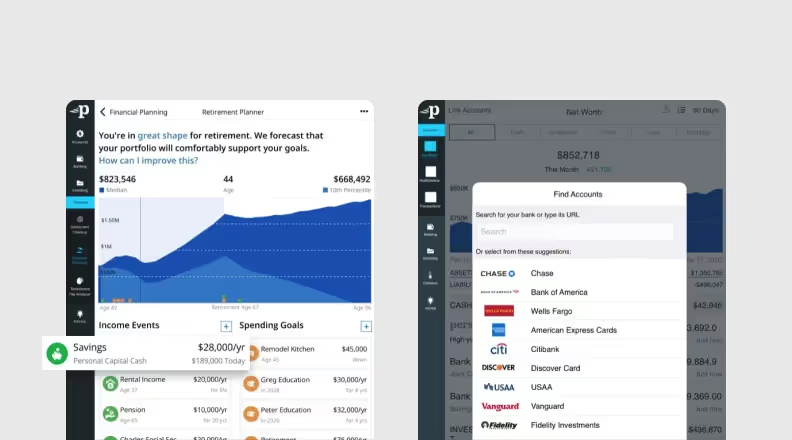

This is one of the budgeting apps — an application offering financial management tools and additional services to control personal assets. This is a great tool for budget planning. Personal Capital tracks your net worth across all your accounts, assets, and liabilities.

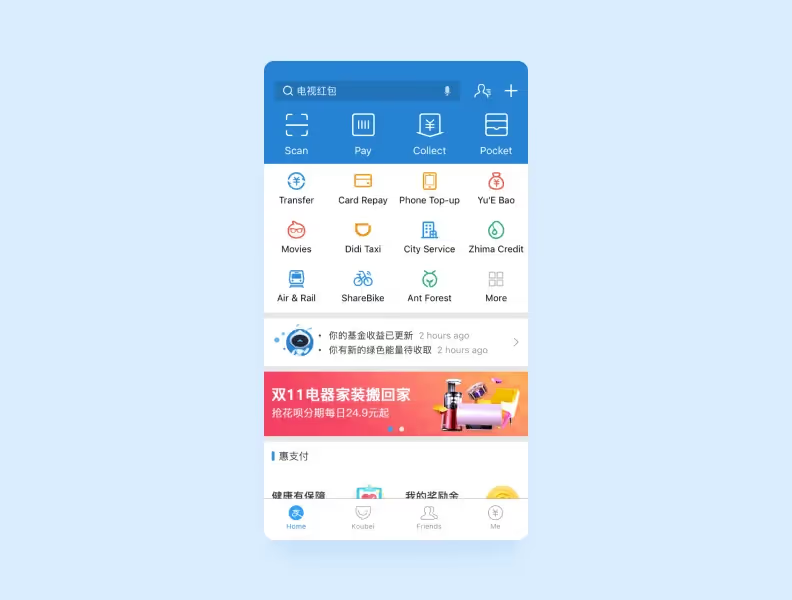

The Alipay application can be called a super app, as it is a combination of mini-applications that meet all customer needs. The main Alipay page only has basic functions for financial management, such as QR-code scanning for payment and receipt of money. All other services are divided into six categories: daily services, transfers, shopping and entertainment, funds management, education and public welfare, and services from different companies.

A financial application should have a set of functions distinguishing it from any other app. Let’s look at what a developer needs to create a FinTech app.

Linking a card is a must-have for any application. This can include the integration of the payment gateway and linking and managing bank cards.

Security is the most important aspect to focus on in a financial application. Users’ money must be securely protected with a password or PIN code, and transactions must be confirmed with one-time SMS codes or two-factor authentication. You need to have a security protocol, advanced data encryption, and a simple but safe login process.

Basic financial transactions. You should allow users to make payments and manage their funds. You can add convenience for users’ distribution of funds between different cards, accounts, and virtual wallets.

Custom notifications. You need to inform the user via push notifications about debiting or crediting funds and messages from banks and tech support about their news and offers.

Every FinTech app must comply with accepted standards. As a rule, financial data flows are carefully controlled. This is not a feature, but it is crucial to know all the subtleties of the banking and FinTech industry because they are strictly regulated.

Laws regulating the FinTech industry include:

Depending on the application, you should consult a business analyst on what laws and standards apply specifically in the service area.

Additional functions and services, added during the app development process, will increase users’ engagement, enhance their experience, and distinguish your app from competitors.

Personalization and use of AI algorithms. These are the features commonly used in bank applications: the ability to transfer money by a frequently used number, put regularly used services on the main page, view up-to-date spending analytics, and more. Here, you can add Big Data to predict customer behavior and create targeted offers.

Automation of online financial processes, for example, such as payment of utility bills, loan repayments, and others. You can allow users to make regular payments automatically by setting a schedule, automating internal business tasks, and controlling the status of all cards and accounts.

Blockchain fintech solutions will help your application reliably store data, securely track and manage digital identification information, and minimize the risk of personal data leakage.

QR-code payment is one of the fastest payment methods. The buyer can pay for the purchase using the mobile banking app by clicking on the QR code or by clicking on the button in the interface.

Dashboards and information boards. Make sure that everything your user might need is available on the dashboard without any unnecessary features.

Additional services. You can add non-traditional financial services to your financial app, such as ordering food, buying tickets, or donating money to charity. It’s possible to integrate microservices, so the application will be structured as a set of interconnected services like Alipay.

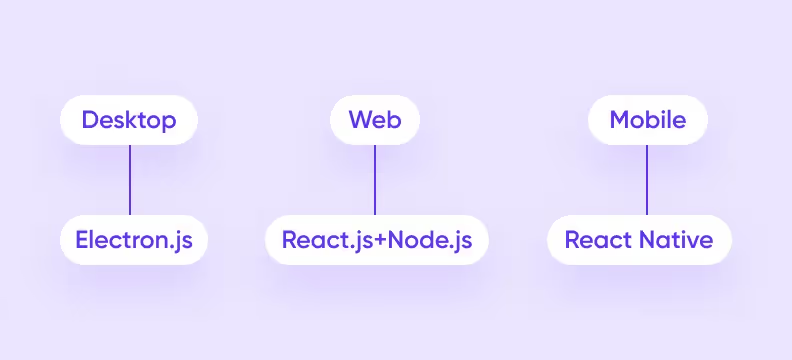

First of all, when developing a FinTech app, you need to choose a desktop, a web, or a mobile app. Let’s learn about the most advanced technologies used for different app types.

Desktop apps with Electron.js. A well-known open-source framework Electron.js is used to create native cross-platform applications for desktops. Electron uses JavaScript, HTML, CSS programming languages, Chromium, and Node.js frameworks. Electron.js helps to build apps compatible with Mac, Windows, and Linux.

Web apps with React.js and Node.js. They are JavaScript libraries for creating web apps. React is an open-source library for the front end. Node.js is a JavaScript environment that is used for back-end app development. These tools allow web apps to be flexible and benefit from high performance.

Mobile apps with React Native. React Native is used to create cross-platform mobile applications for IOS and Android. Using a single-code base during fintech app development, this framework helps develop applications for both operating systems. From a user’s perspective, these apps cannot be distinguished from native ones written for a specific platform.

Meanwhile, you’ll need only one fintech apps development team, which is cheaper than finding professionals to create two applications.

At Purrweb, we agree with professionals that these instruments and frameworks are the most efficient for FinTech app development, so we create desktop apps with Electron.js, web apps with React.js and Node.js, and use React Native when developing mobile apps for FinTech.

Creating an application is not a matter of one day, as it requires time and investments. Therefore, the first thing a startup should think about is an idea and a niche. Each development goes through several more stages. You can create a mobile banking app in just five steps:

We’ve outlined some features which are important to include in any app. Include things like card linking and basic security. At the same time, think of a feature that will separate you from the competition. Use that as leverage when getting new clients. If they can’t find an alternative to your product, it’s likely they’ll stay with you and pay you money.

It is necessary to conduct market research and determine the type of future application and monetization model. Pay attention to the project evaluation, then define the budget and deadlines.

It’s also the step when you have to analyze the target audience of your app. Pick an audience group you’re going to hone in on. This could be investors new to the cryptocurrency market, or people looking to track their finances and see where their money is going.

You can also pick some members of your target audience and conduct a short interview. This way, you’ll get insight that’ll make your app even better.

Applications should be user-friendly. Clients value simplicity, transparency, and aesthetic beauty. A good user interface and UX are the second most important steps when it comes to FinTech apps. Find references, define your personal preferences and develop a design with the UI/UX team.

For the design process itself, after references we start with wireframes. We suggest you do the same. These are simplified screens of the app. They’re black and white, and they don’t have any flourishes or special design elements yet. The goal with this step is to understand the logic of the app, and if it’s easy to understand what the user can do on any given screen.

Flesh out the wireframes and turn them into finished screens. One thing we like to recommend after the design is over is creating a UI-kit. It’s a file with every design element you have in your project: buttons, icons, fonts, etc. A UI-kit simplifies development and makes designing new screens easier. You don’t need to create them from scratch, just build one from the components you already have.

Define a project vision and the features of your FinTech app. Outline what problems it solves for users and how they would interact with the app. Discuss all your ideas with the fintech app development team and create your application.

If you are thinking of building a fintech app, you can make a minimum viable product (MVP) — a basic version of the application that includes its main components. It’s a great way to actually test your idea in the real world. If in the end an app turns out to be unprofitable, an entrepreneur can abandon it or modify it at no greater cost. And if it’s actually popular with its target audience, you can scale it with ease. You’ll get more clients and revenue without exerting much effort.

Be sure to check and test the fintech application. A test run will allow you to check all aspects of the work of the application and avoid bugs in its future operation.

An important thing to check is that the app works at different resolutions. If you’re planning to release an app to both iOS and Android users, it’s vital that the FinTech app works properly on all mobile devices. Try to fix it if smaller screens compress the content too much and the screen looks overcrowded. This ensures you’ll get a successful fintech app.

Launch the application and get feedback from the first users. Get your app released on the App Store and Google Play Market.

If you’d like to release an app on all mobile devices and save time, we recommend going for cross-platform development. In this case, you develop both apps using a single codebase. This reduces time and resources you have to spend.

Getting feedback from real users will reveal flaws and add ideas about which features should be added, removed, or changed.

This is the time to scale if you’ve got a successful fintech app. Pick out the best features from the ones your audience outlined and integrate them into updates. You can also remove bugs that went through the QA testing unnoticed. This way, your app will be the best version it could be.

In case you want to create an app and you think you lack skills, it is easier and reasonable to seek help from professionals. If you are a startup or you have a great idea or plan to grow and you need technical assistance, the Purrweb fintech app development company will be useful to you.

We know how to build a FinTech app from scratch. The Purrweb team has successfully launched countless applications, including a crypto wallet, a content marketplace, and a smart design for the FinTech app for investments. Check out our financial app cases to learn more.

At Purrweb, we estimate the cost of a project based on a basic set of functions. If you are going to create your own FinTech app, you should know a lot about what stages of development you will need to go through and how long each of them will take. Our estimate does not show the average value for the market since the complexity of FinTech software development projects and the level of specialty of the teams vary significantly.

We want to share the potential costs and timeframes of a personal finance management application development:

Overall, the development of a FinTech app will cost you $59,000.

We are always ready to answer your questions, so for more detailed information on how to build a FinTech app or to get an individual offer, please contact us.

We hope the article was useful, now that you know all about building a FinTech app.

Application development for FinTech is in demand, and it will only grow. Traditional banks are outdated and to compete with IT companies and digital banks, they need modern and complex FinTech solutions. We see that even the world’s leading banks are investing in FinTech, changing internal business processes, as they are looking for new ways to interact with customers.

Should you have any questions about FinTech app development, don’t hesitate to <a class="blog-modal_opener">contact us.</a>