Do you think you could win a game, if you didn’t know the rules? You could try, but the odds would be stacked against you.

For startups, game rules equal market research. It’s an efficient preparation stage to secure your project’s bright future. It informs you and supports you in deciding what direction your project should take. If you’re ready to embark on a startup journey, don’t underestimate the market research.

And if you wonder how to do market research for startups or what benefits it brings, here’s our explanation.

Market research is a manner of pre-emptively exploring and evaluating the market your startup is planning to join. Sufficient market research brings a clear idea of your project’s perspectives, strong suits, and weaknesses. Supporting your decisions with market research is essential to a successful investor pitch and subsequent launch.

Startups conducting market research use data to:

It’s also necessary that market research precedes a mobile app business plan.

Market research serves a dual purpose. It allows you to avoid mistakes while ensuring a successful outset of your project.

Market research is a critical business instrument. As such it has several benefits. To begin with, it will preserve your time and money. Market research streamlines the process of finding the product-market fit and ensures that a business idea is feasible. Amongst the most frequent reasons why startups fail is a lack of demand. Gathering data in advance will stop you from pursuing a shaky idea.

Market research attracts investors as well. Supporting your startup project with data will work in your favor. Market research will demonstrate that your business idea has potential, and it indicates that your entire approach is thorough.

Market research can show that strategic changes are necessary. It means your findings may suggest your startup needs to pivot. Let’s say your concept is a groceries delivery startup. But before exploring this concept in full, you commit to surveying your audience. Maybe the market research shows that your future consumers are satisfied with what already exists, but their problem is that they want a better delivery method for the product itself. Taking the information into account, you can decide to scrap the initial project and pivot to a discovered direction. That’s how market research for a startup prevents judgment errors and dead-ends.

Finally, market research affects the promotion approach. Understanding your target market and clients well enough, you’re able to adjust the marketing strategy. Maybe you’ll discover that your potential buyers are predominantly car drivers. Market research showed they also live in large cities with busy traffic. Combining these two factors, your marketing team may opt for billboards.

Typically, you can do two types of market research for a startup, depending on how you gather data. If the information comes directly from your audience and you collect it on your own — it’s considered primary market research. This includes surveys and expert interviews. If you analyze already available data provided in reports or elsewhere, it’s considered secondary market research. One example of this is public databases.

Let’s explore primary and secondary research in detail.

Primary research is also referred to as ‘field research’, since you speak to someone directly. You should find industry experts and regular users, prepare questionnaires, then interpret and parse data afterwards. And even with professionals’ service, primary research requires time.

Primary research methods belong to one of the two groups: qualitative research and quantitative research. Methods from the former answer how and why people do something, the latter show how much, how often, and who does it.

This method delivers an understanding about your target audience straight from themselves. Market research is a way to learn more about competitors as well. Imagine your startup project is a booking service, so Airbnb and Booking.com appear to be your primary competitors. But after several interviews, you can learn that your target audience resorts to banking apps for hotel reservations. That kind of revelation can drastically change your team’s mindset and influence marketing strategy. There may not be sufficient reports about super-apps usage, but interviewing potential clients can provide the necessary information.

In addition, primary research can become deeper or more shallow when needed: the available data has no limits.

Secondary research’s different name is ‘desk research’, because it’s possible to perform it without leaving the office. Secondary research is significantly more affordable but only provides other people’s findings. That’s why you yourself should adapt those to your requests. Even more importantly, you should verify data sources’ credibility and avoid others’ unfounded conclusions.

This type of research provides instant results. Also, the information in the reports has been already processed by professionals. Secondary research can reveal correlations between processes and facts, to help you to understand industry trends better. Often you’re able to easily find the needed information.

Secondary research covers diverse subjects and underlying surveys are executed on a larger scale. Through Google Trends research, for example, you learn about people’s internet searches not only in the US but all over the world. It means you don’t need to invest millions in interviews with everyone, everywhere to find what you seek.

If you currently lack substantial research funds or time, opt for the secondary research since it’s significantly cheaper. But primary and secondary research are beneficial and perform best in combination.

One of the popular approaches is to go from larger concepts to specifics. This means you first conduct secondary research to grasp the industry trends and existing products. And if this step had a positive outcome, go forward with the primary research to further test the idea of your startup.

Here’s how this market research process can look with a room booking app. Based on reports you or your teammates examine, you see an increase of interest in traveling and economic growth in the industry. As it’s a positive sign, you proceed to the primary research. Then your interviews and surveys reveal issues of the target audience that you’re able to solve.

Let’s get straight to the heart of it and find out how to conduct market research for a startup. Go through these eight stages to conduct insightful market research.

Create a market research plan and decide on the goal you want to achieve. Why do you need it? How will you use the collected data? Determine areas that require special attention. Some typical market research objectives are:

The following stages are identical for any market research goal. What’s different is the level of attention you give to each stage. And also in the way the results are used: internally or externally. For this article, let’s assume we intend to prove that an apartment booking service we came up with can be successful.

We’ve outlined the two most common methods: primary and secondary research. These types provide results you can interpret and apply to your product.

Most companies start by conducting secondary research. It doesn’t take up too much of your resources, as you can already access the info online. Primary research stands in stark contrast: gathering focus groups, recording interviews, and sending out questionnaires are all tedious.

We recommend sticking to the secondary research in the very beginning. It can provide the answers to most general questions regarding the business niche at first. You can expand on them in primary research later, and get research data that’s tailored to your startup’s specifics.

Start by studying the industry you plan to operate in. Focus on market dynamics and trends. Is it growing? What’s the average life cycle of projects? What’s the total annual revenue of the industry? At this stage, use the combination of primary and secondary research: read industry reports, run Google Trends search and use other instruments, ask experts for their opinion.

Here’s what is helpful to explore at this stage for an apartment booking startup:

Findings at this stage provide a clear direction for the following steps. If you discover that personalized offers are becoming a trend, you’re then able to check how successfully your competitors use them. If you discover that many people book accommodation at the last moment, you can plan to ask about it in interviews.

During this step, you define your target market’s demographic while also meeting real users. Here, primary research is key.

Firstly, outline your target buyer’s persona. Imagine a typical user of your product or service in a determined area. If it’s the initial outline of the buyer’s persona, start by thinking who can pay for your service? What’s their income? Knowing these two factors, estimate their profession and occupation. After that, determine key characteristics like:

Then find candidates for the survey and additionally check if they suit your research parameters. That preparation helps to guarantee your findings’ relevance. If your research is for the booking app, rule out those who never travel or only stay with their friends and family. If your startup will launch in the US, don’t invite people living in Europe, etc.

Previously, you learned what companies your audience view as your competitors. The next logical stage in the market research for startups is studying them. To conduct a meaningful study you should determine the competitors belonging to every category:

Limit yourself to 10 or fewer companies — approximately three in each category. That way, you can study all of them carefully. You’ll need to examine their products, prices, general strategy, approach to marketing, and reputation among your consumers. But above all, you should pinpoint their strengths and weaknesses. And then compare your startup concept to existing solutions. How will you differ from them? What potential strong and weak points does your product have?

After the market research for a startup idea is done, gather the results and analyze them. We believe it’s convenient to lay everything out in Miro. This way, it’s easy to see correlations and contradictions. Also, it might be helpful to fill in the SWOT matrix.

Based on your research, you may decide to pivot because of market saturation and other factors. Or if you have positive insights, write a draft for a business plan for your mobile app. Either way, from now on you can back up your strategic decisions with data.

Once you analyze the data, gather key insights and relay them to your team. After everyone’s goals are aligned, create a plan with actionable steps that everyone can follow.

Even if the data isn’t overwhelmingly positive, a realistic approach to development takes uncertainty out of the equation. Your team members will know what solution to include to maximize your startup’s chances of success.

Once you test your MVP and become more in tune with your audience, you can conduct research to understand it even better. Based on these new findings, you can add features, change some things to enhance the user experience, or even make a project pivot.

This is a useful step to take if the market suddenly shifts, or new instruments appear which make market research easier. You can discover trends to use later and pull new clients in. And if the startup doesn’t work, new research can shed light on ways to adjust the existing strategy.

At Purrweb, we use target audience analysis regularly. It’s a key part of our development process. We used it while creating a mental health app and a healthcare app. Let’s take a closer look at them:

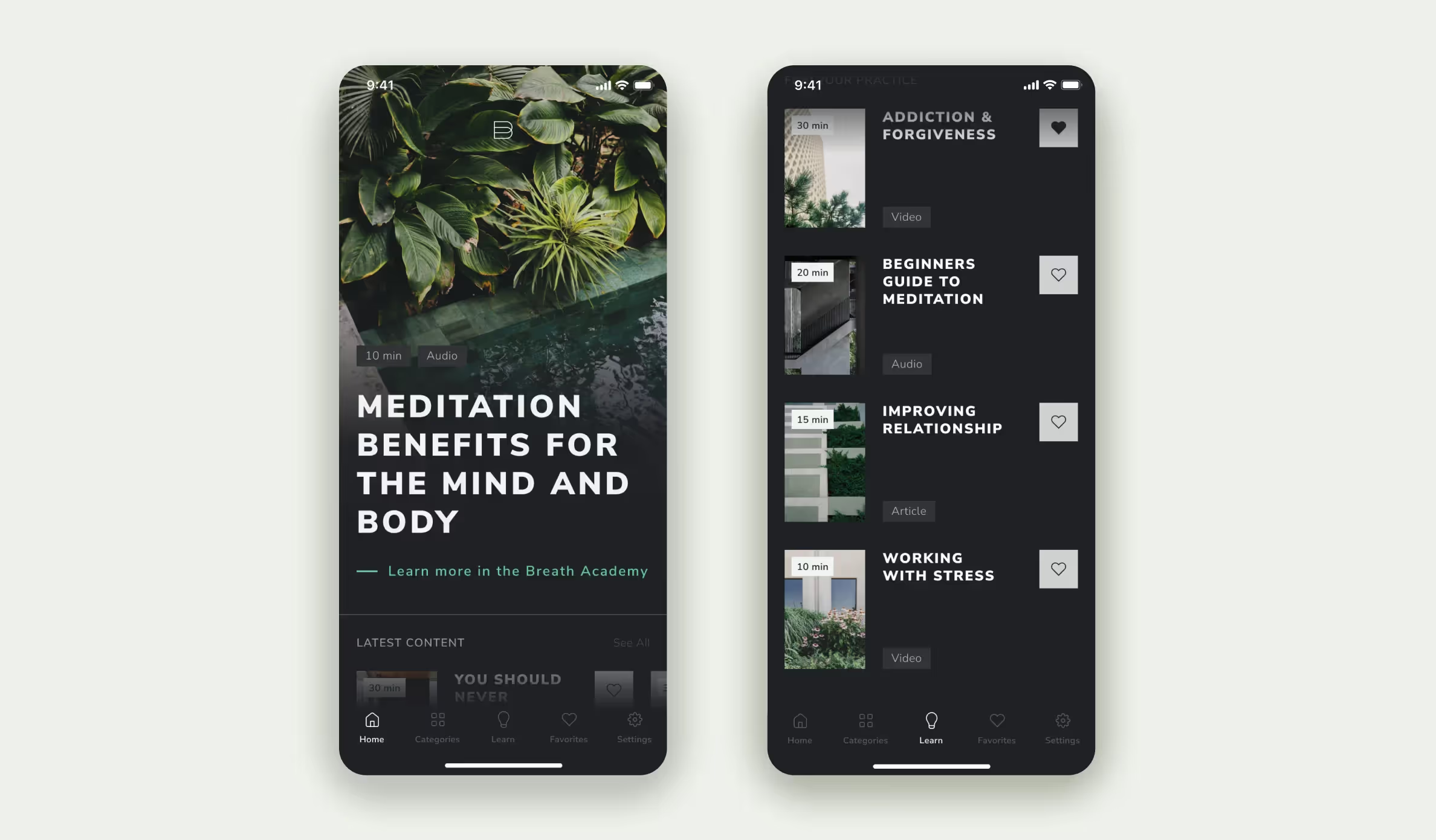

Breathmethod. A meditation app for people who never dealt with healing practices, but want to try them out.

We outlined the key demographic and their wants. These are people who’ve grown tired of big city life and its rapid pace. They’re depressed, exhausted, and somewhat anxious. These people want to get in tune with themselves, and they believe meditation to be a good way to do that.

Market research includes competitor analysis — that’s what we did in this case, too. We picked out 6 apps in the same niche, outlined their strengths and weaknesses. We later perfected the things they lacked.

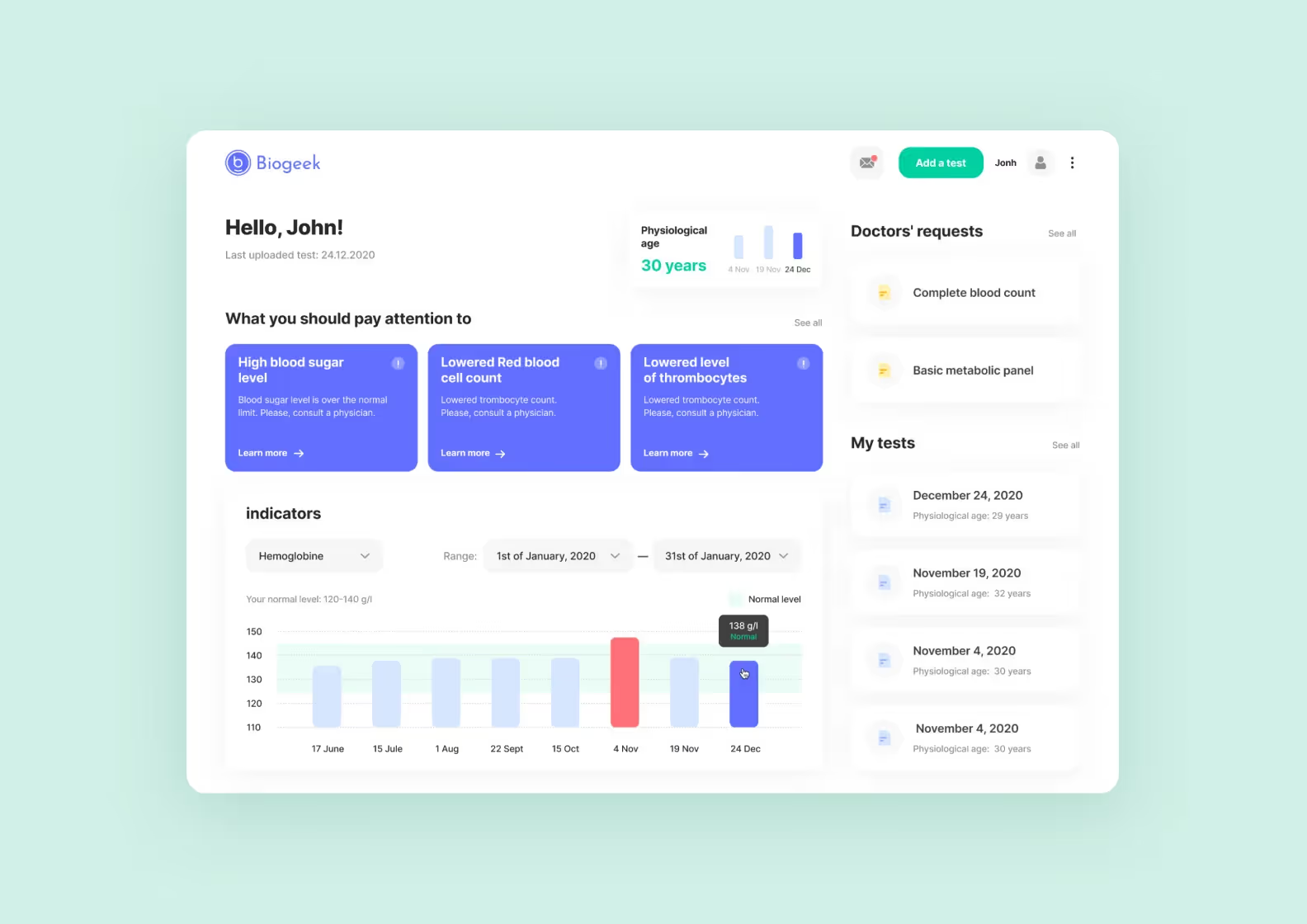

Biogeek. A healthcare app that helps monitor lab results and track key health markers.

We analyzed the target audience — these are people who’re scrupulous about their health. They want to know what happens to their bodies in full detail.

With this info in mind, we outlined key features we wanted to include. Users can input their personal data, track lab tests, and get recommendations regarding their health.

Market size estimation shows whether there’s enough demand for your product to make the business viable. It helps calculate how much to invest in product development and choose relevant pricing models.

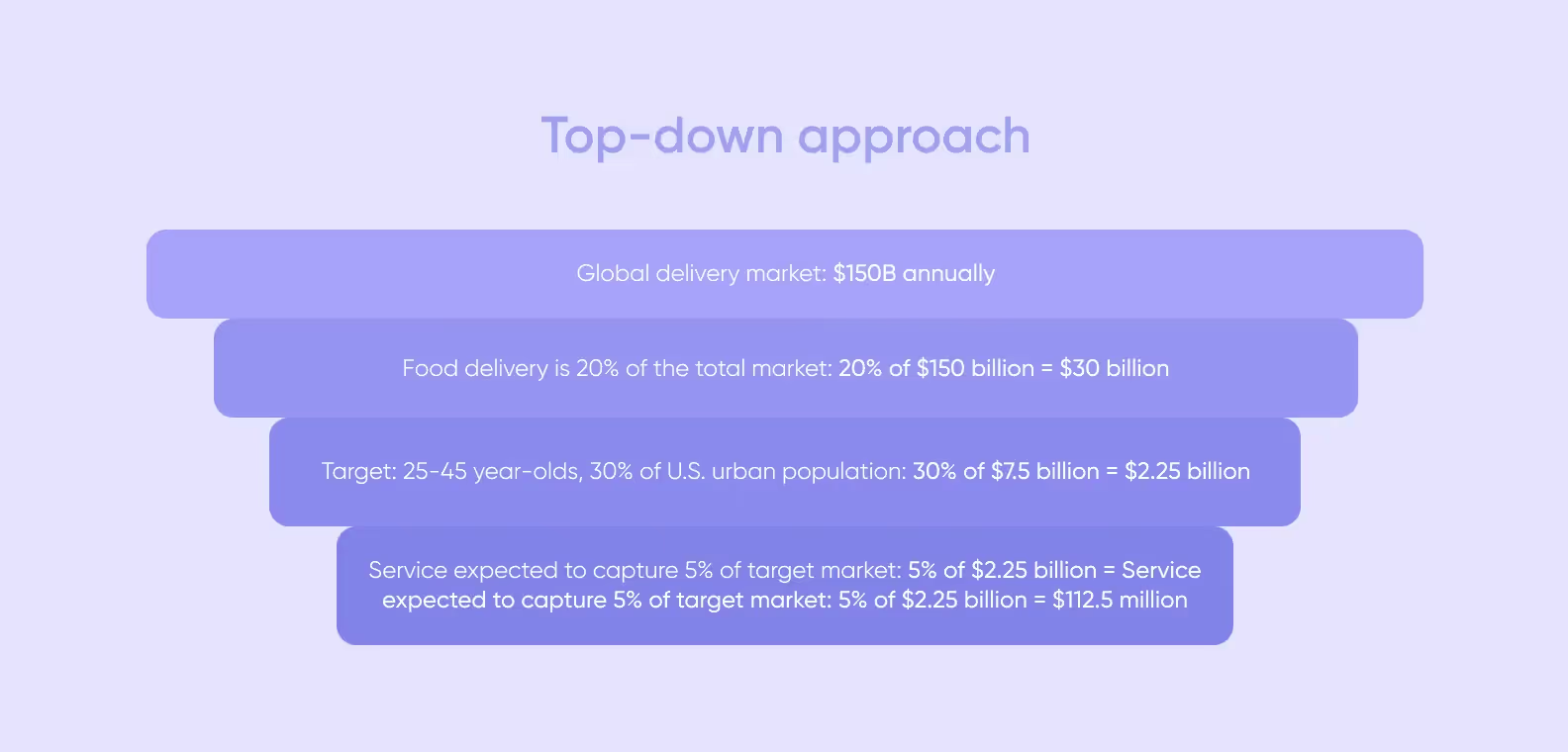

There are two main methods for calculating market size: the top-down approach and the bottom-up approach.

The top-down approach takes a broader view of the target market. This approach is useful in situations where you don’t have the time or resources to conduct market research. The top-down approach allows for quicker assessments and can be based on general reports and industry statistics.

Here’s how to calculate your market size using the top-down approach:

The bottom-up approach is more accurate, but requires data on actual sales or direct market interactions with the target audience. We recommend using the bottom-up approach as it is more realistic and provides detailed insights into customer behaviors. Also, it’s more adaptable and can be updated as your business grows or market conditions change.

Here’s how to calculate your market size using the bottom-up approach:

Market research is most common before developing a brand-new solution. Nevertheless, you can conduct one when your product has already launched. Resort to market research whenever you need new insights from the market.

At Purrweb, it costs from $1,000 to $3,000 and depends on the scale of research. If you want a personalized figure, don’t hesitate to contact us in the form below. Our estimate also includes fleshing out the startup idea and the market research itself. These factors go hand-in-hand. Let’s take a closer look at them:

Fleshing out the idea of your startup. We focus on the problems that the app aims to solve and solutions it can offer. The stage helps us:

Market analysis. This step includes analysis of the information you’ve collected yourself. If you’re just starting out, we’ll arrange detailed market research on our own. Here’s what it includes:

Interpreting data correctly is key to a startup’s success. Here’s how to do it right:

Outline key trends. Take primary research. If some respondents’ answers overlap, you can take it into account when creating your app.

Imagine a food delivery app. If the audience members say they value transparency, include features that make it easier to track orders. You can integrate a screen which shows the stages of order preparation. Users can check it out to see if the courier has already picked up the food or not.

Be wary of false-positives. This relates to interviews. Make sure that the questions remain open-ended. If they’re not, it’s possible to skew the answers in the wrong direction. These kinds of answers aren’t realistic. If the startup is based on them, chances are it won’t succeed.

So you’ve conducted market research for the startup, then what’s the next step? The MVP, of course! Rely on Purrweb’s expertise and we’ll make it for you. Whether it’s a booking app, a food delivery app, a copy trading platform, or mental health service, we’ve done it before and can do it again for you.

<a class="blog-modal_opener">Contact us</a> for all the details.