Determining a company’s value can feel like picking a number out of a hat. But below is a list four factors that will help you estimate your company’s valuation. Feel free to use it as a starting point for negotiating with investors.

1. Market size

Whether you’re talking to micro VCs or series A investors — your product idea will fail if it isn’t in a growing market. Whoever you ask for funding, you’ll hear something like “How big can your company get?” The bigger the market you’re entering, the bigger the valuation, the more attractive the startup investment.

In other words, avoid approaching investors with just a good idea. It should be a good idea plus sufficient proof (i.e., a big enough group of people who can benefit from it) that the idea will eventually turn into a viable business opportunity. And that’s where market size comes in.

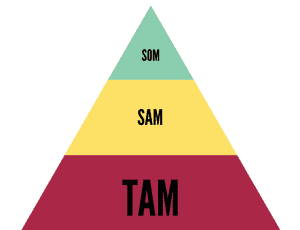

To work out the size of the market, break it down into:

- Total addressable market (TAM) — the whole market with all the participants in your niche.

- Serviceable available market (SAM) — reachable market.

- Serviceable obtainable market (SOM) — the market you’re going to reach in the nearest time.

Example: Suppose you’re selling eco-friendly school supplies.

- The TAM for eco-friendly school supplies in the USA is $1m.

- If you want to sell in areas with only 5% of the market population, your SAM is $50k.

- Your SOM will be part of that $50k, a.k.a., the realistic part you’re going to achieve in your first year — $10k, or even less.

P.S. We have no clue about school supplies sales stats — We just made it all up 😄

Bear in mind that TAM, SAM, and SOM aren’t just numbers that must be as high as possible. Highest numbers won’t necessarily wow your investors. Your idea might have a smaller market potential but if SOM is easily achievable — this still can be a very attractive investment opportunity.

To determine the market size, study articles about companies in the same niche in publications like Inc, the Wall Street Journal, or The New York Times. You can try Google AdWords Keyword Planner Tool as well to estimate how many searches related to your market take place on Google on a monthly basis. Regardless of what you choose, ensure you’ve found the closest industries and narrowed down the results by customer segment to avoid estimate inaccuracies.

2. Comparables

Even if your TAM and SAM are big enough, it doesn’t necessarily mean that your product is profitable. If you’re struggling with the competition, it will hold investors off.

To find out the baseline value for your company, pay attention to the competitive landscape. Do research to find startups operating in the same niche or geographic location you’re going into. To find such, you can try out BizQuest. Hop on Product Hunt and Angel List to see the newest players entering your niche.

If comparables are valued within a certain price range, this range becomes a steady factor. If a recently launched B2B app with 1–5 non-paying pilot users is sold for $5m, other companies in this market will be valued similarly until there are conditions that adjust startup valuation up or down.

To assess your competition, answer these four ‘How’ questions:

- How much funding do they have?

- How recognizable are they?

- What is their marketing strategy?

- How is their product perceived by the market?

If you have a high-tech or high-growth product, get advice from accountants and lawyers who are familiar with the niche in which you operate.

Establish relationships with business people to define the market rate for comparables at your stage. There are cases when lawyers tend to overvalue products, while accountants undervalue them. Try talking to both sides before making a decision.

If you struggle with researching competition and finding relevant valuation data, talk to a financial advisor. Ask him or her to help you find valuations in recent financings or M&A transactions in your niche.

Even if there is a substantial market for your product and tons of opportunities, too much competition can harm the total valuation due to over-saturation.

Your best way around this is to make a case persuading investors that users will leave competitors when you release your product. But be wary. This is rare for startups — very few people are willing to change from things they love for new ones. Accept it as a given that your product has to be 10 times better than the existing competition in order for people to switch.

3. Product state

If you only have a business plan and rough sketches, it will be tough to bring in cash. Shiny prototypes with no customer validation rarely work. It would be better if you demonstrated a rough working product version that has customers using it or ready to use it.

When pitching investors, speak in terms of people who will use your product. Share your expectations of the future based on existing user feedback.

Instead of irritating prospects with the vacuous “Would you use it” question, ask these ones:

- How will you use it?

- What will make this suitable for you?

- How you are doing this now?

Present your MVP to prospects, help them see how it solves their problem, and run through the build-measure-learn feedback loop. Gather early adopters to build your support community, gain initial traction then share it with investors as validation of your ideas.

This exercise might surprise you. Your idea might not be as good as you expect. However, it’s better to prove it first than waste money and time on polishing pretty prototypes no one wants

4. Team

The mistake tech founders often make is being focused ONLY on tech competencies and losing site of the other side of the coin that is just as valuable.

From day one, your startup will meet challenges like product and market problems, business model failures, increased competition, or running out of cash. It’s tricky and always requires certain aspects of personality that a founder doesn’t always have to manage it successfully. An effective team combines confidence, insistence, simplicity, and eagerness to learn.

In addition, a high-value team has six core traits:

- Technical or commercial competency.

- The ability to resolve conflict situations.

- Knowing when to persevere and when to stop.

- Understanding market assumptions, dynamics, and metrics.

- The ability to collaborate, fill knowledge gaps and share operational expertise.

- Equity spread between founders.

Mature founders who have previous launching results can obviously validate their pre-money valuations better than inexperienced ones. But a team of members with relevant background and skills can make up for a lack of founder experience.

P.S. “Highest valuation” never means “right investor”

Higher valuations may come with aggressive demands, such as preference shares for fixed dividend payments, information rights, and bankruptcy liquidation. The valuation may be high at first, but investor preferences may drive it down later.

Rather than considering the valuation alone, consider their experience in your niche, product expertise, and the possibility of making further investments that will help you gradually scale the company.

So, don’t always go for the highest valuation. Instead, find investors who can help you build a company with real customers and future prospects.

In valuation negotiation, there is always some level of subjectivity. Hopefully, by using these four factors — market size, comparables, product state, and team — you will have more leverage to make an argument for a higher valuation. Best wishes!