Banks are relying on cloud computing for processing and other data infrastructure-related needs. But why? And if you’re planning to launch a fintech startup, should you embrace such innovative technologies, too?

In this article, we’ll talk about cloud computing in banking: what it is, its benefits, and more.

.avif)

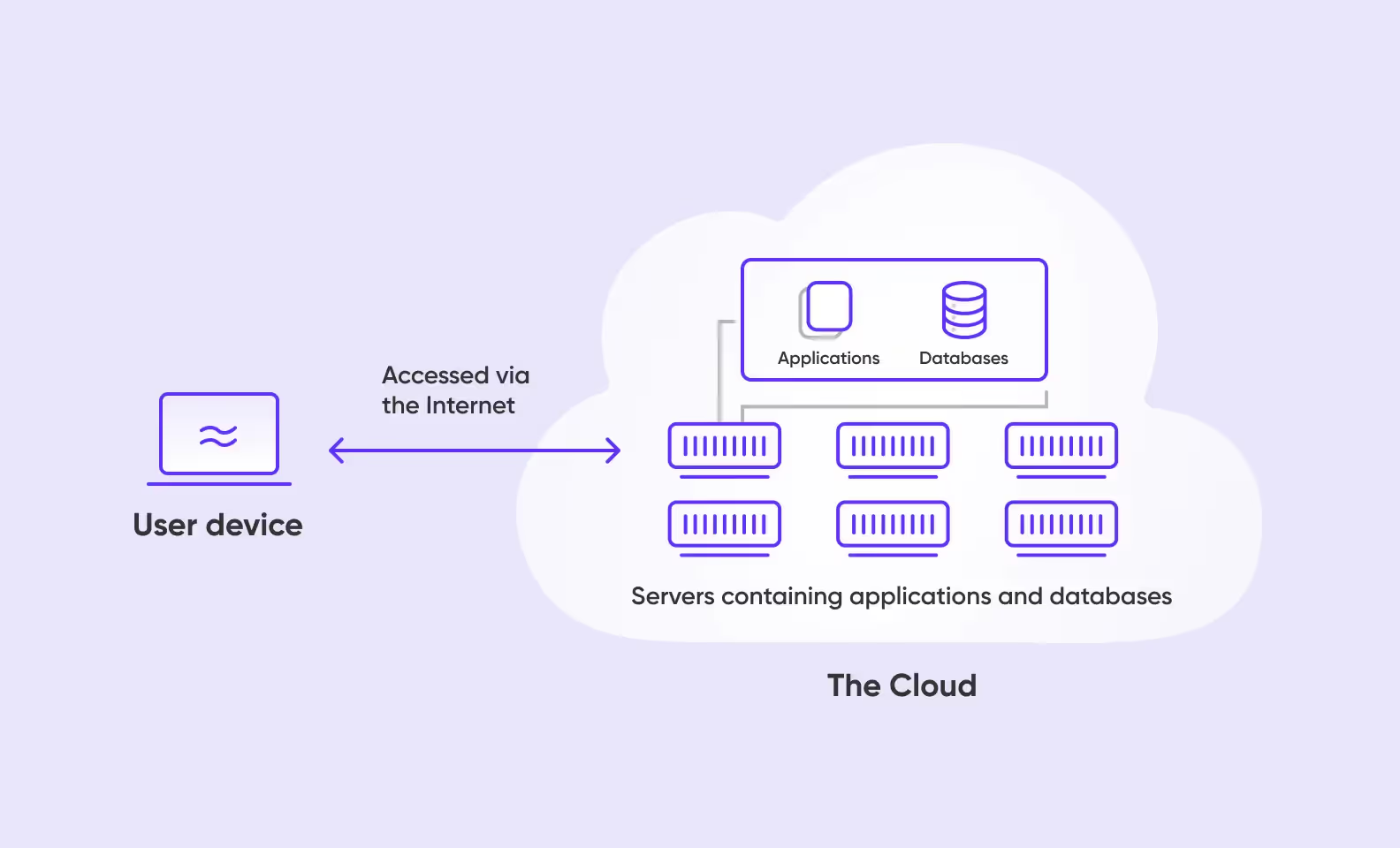

Simply put, it’s a type of technology that allows banks to store data externally.

Banks are massive in terms of data storage. They handle transactions, client details, investment data, and more for millions of people. Processing it requires specialized hardware and separate facilities. Acquiring these things, let alone maintaining them, is going to rack up a lot of money.

This makes cloud computing a great solution for banks. By moving their data to remote cloud servers, banks can offload their data processing and operations. This means they handle deposits, withdrawals, and other financial transactions externally, freeing up internal resources and reducing energy consumption.

Currently, more banks are seeing the benefit of adopting cloud computing in their business practices. According to the “Cloud Computing in the U.S. Banking Industry” survey, the use of cloud services in the financial sphere is common, and 9 in 10 banks expect to increase their cloud presence.

Now, let’s talk about some of the benefits of cloud computing for banks in detail.

Instead of building and maintaining their own data storage facilities, banks can rely on cloud servers. With cloud solutions, banks don’t have to pay for additional electric bills, server maintenance, and mainframe updates. The cloud services provider already covered these costs.

Cloud providers prioritize data security, and the last thing they want is for the data to leak. They're legally obligated to maintain high-security standards, so they invest in protecting their systems. This is because data breaches can damage their reputation.

While some banks may believe that managing their own data centers provides more security, cloud computing providers offer advanced security and expertise that are often beyond the reach of individual banks. Especially startups that only have resources for MVP development and not much else.

Take a look at the differences between cloud and traditional computing in the table.

Cloud computing allows banks to focus on their core business. Companies within the banking sector outsource key applications to cloud computing, from operations existing at the periphery, like HR, to integral ones, like payment processing. Businesses across the globe are more willing to embrace cloud computing, which is proven by Allied Market Research, for instance.

This is particularly beneficial for smaller banks that may lack the resources to manage their own data infrastructure. Cloud computing lets them focus on strategy, business models, and customer service without the need for significant investment in technology.

Data storage aside, financial institutions that partner up with cloud service providers get to enjoy different cloud-based tools. These can boost productivity and help the bank become more competitive. Some tools you can get access to include: risk management tools, CRMs, and data analytics platforms.

Take cloud CRM or customer relationship management systems. If your company doesn’t have it, chances are you’ll run into issues while self-hosting a CRM, e.g., data redundancy, where you have the same piece of data repeated within a database. It can put a strain on the transaction speed, and you have to pay more to store more data that’s functionally useless.

With private data centers, companies must buy and manage their own infrastructure. If they reach capacity, they can’t do anything but hope that their mainframe can handle the data load.

Cloud services allow banks to easily scale up storage during peak times. As demand decreases, the financial institution has the option of scaling down.

Banks prioritize data security due to the sensitive nature of the data they manage. They have to comply stringently with data and privacy laws.

Luckily, cloud service providers follow data security standards. Because of this, it’ll be easier for your bank to adhere to financial industry regulations.

Freshly launched startups often struggle with limited budgets, making it difficult to invest in high-quality private servers. They have to resort to cheaper alternatives, which can lead to performance issues and a poor user experience. Cloud computing offers a cost-effective solution, providing fast processing speeds without the need for a large upfront investment.

Although there are many benefits to integrating cloud computing, some banks remain wary of its usefulness. It’s important to note that adopting cloud technologies has some drawbacks, so here are the biggest ones.

It’s no secret that the sphere of cloud computing services is dominated by a few major players. The market is divided between Google, Microsoft, and Amazon.

Because competition is nonexistent, these giants get to dictate costs, terms, and what sort of info regarding risks can get out there. They don’t have to maintain transparency and it means that if some data breach were to occur, the provider could simply choose to remain silent about it.

An overreliance on a cloud service provider may pose hazards when it comes to data security and good UX. If a cloud computing service experiences a power outage, the partnering bank would have to stop its operations too.

Many financial institutions, especially those that have been in the game for a long time, stick to a philosophy that sounds something like, “you want something done right, you better do it yourself.” They don’t have faith in cloud computing due to both objective and subjective reasons. As time passes, however, they’ll feel the market embracing the cloud, so they’ll have to migrate to a cloud infrastructure slowly.

If you’re a banking startup, and you want to integrate cloud computing into your work processes, you might experience some legal issues. The majority of financial institutions are mandated by law to store and process clients’ data within their place of residence. So if a cloud provider has data centers that handle information overseas, working with them can be challenging.

Although there aren’t that many cloud computing service providers, there are still a few that you can choose from. Whether one is more beneficial to your banking startup than the other depends on different things. We’ve outlined some of them so that making the correct choice is easier.

Don’t feel pressured to move your data to the cloud immediately. You can choose to migrate gradually or even keep some of your legacy systems on-premises. If you have concerns about data security, you don’t need to rely solely on public cloud providers. There are various cloud deployment models available, allowing you to tailor the solution to your specific needs.

Private cloud computing. You can choose to build your own private cloud and hire specialists to maintain it. This type of cloud deployment model provides a better sense of security, as the cloud operates solely within your company’s firewall, and technically no third party could gain access to it.

Public cloud computing. Instead of creating a cloud computing space in-house you could look for a major provider and offload your data to them. This model is usually cheaper and more hassle-free than private clouds because you don’t have to worry about processing data, maintaining a data center, paying for storage space, and so on.

Hybrid cloud computing. This is a mix between public and private cloud computing. You can be sure that only you'll get access to the most important and confidential data. The rest can be offloaded to the public cloud, for example, data that requires higher processing power than you have at the moment.

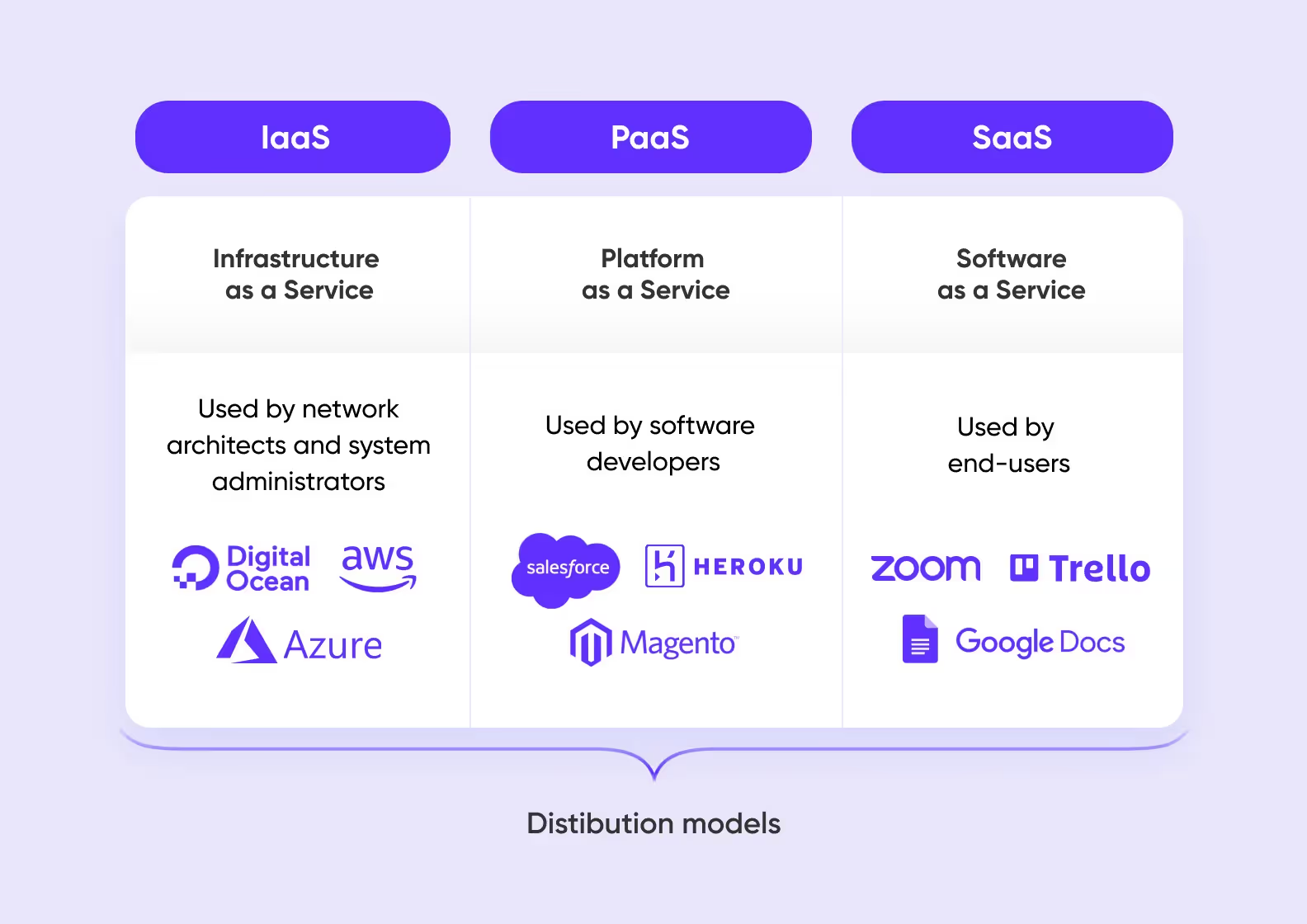

During this step, deciding on the type of data you want to store in the cloud is crucial. You can offload different parts of your IT infrastructure to the cloud, and the part you choose will dictate the service model.

SaaS (Software as a Service). You can host different services in this specific service model, from accounting, CRM systems, and service desks to invoicing and content curation.

PaaS (Platform as a Service). In order to make your banking app more appealing to users, you can add PaaS tools. Don’t want to deal with web servers? Integrate a PaaS tool and use it instead, hassle-free. The integrations you choose can act as the building blocks of your banking app.

IaaS (Infrastructure as a Service). When you subscribe to this model, you can transfer the entire infrastructure to the cloud. An outside company provides computing resources needed to handle your data, and you don’t have to maintain any sort of data center at all.

Lastly, it’s time to decide who’s going to be in charge of the cloud-related tasks in your company. This can go two ways:

Staff augmentation. It’s a great solution if you have a private data center and some specialists that maintain the upkeep, or if you wish to integrate cloud computing but lack developers. Just hire the talent with expertise you don’t have yet.

Outsourcing. This option is for you if you don’t have a team to work with cloud computing integration. You get an expert team that does its job and manages operations, resources, and so on. There is no need to pick specialists yourself, onboard them, and pay for their insurance and salaries.

Many neobanks have benefited from cloud computing. Some of the pros they noted were: better operational efficiency, and cheaper data handling and storage. Let’s take a closer look at some of these success cases:

Starling Bank. Developers from this bank stated that cloud solutions allowed them to send notifications to clients more efficiently. In turn, customers get data regarding transaction history almost instantly.

Varo Bank. Some benefits the founders attributed to cloud computing technologies were reduced operational costs, ease of scaling, and increased speed of feature development.

Revolut. CTOs from Revolut have found that cloud services allowed them to store terabytes upon terabytes of data safely and efficiently. That reduced the costs of data processing. Instead of creating full data backups each time they need to save their data, Revolut implemented incremental updates, which are more efficient in terms of time and storage.

Monzo. This is a bank with ~13mln clients. One of the things cloud adoption in banking has helped with is data analytics. Given that the data is properly stored with no redundancies or inconsistencies, the team of data scientists at Monzo could get easy access to it for analysis and extraction. Because of this, the company can acquire deeper insights into its clients.

We have experience when it comes to cloud computing in banking.

If you’re looking to adopt cloud solutions, we can help. Our developers have expertise in utilizing established cloud providers like Amazon Web Services (AWS), specifically their EC2 service for virtual servers. They can also use DigitalOcean and Heroku to host web app backends. We'll choose the cloud service for your needs.

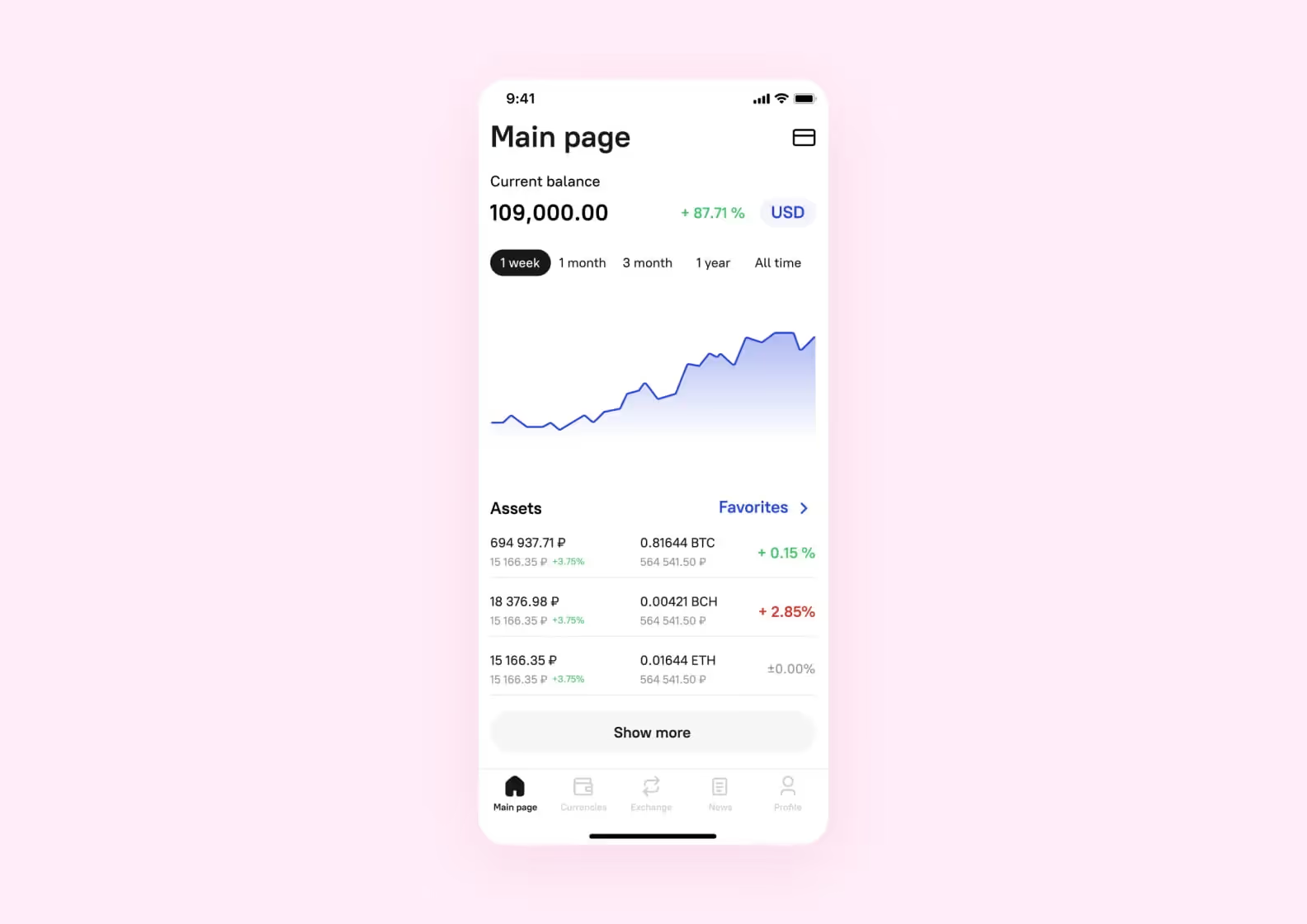

If you want to develop a banking app from scratch, we can do that too. At Purrweb, our specialists develop fintech MVPs in about 4 months.

One case that comes to mind is Broex, a multi-currency crypto wallet. This app was designed for people who had never used crypto before. The company already had a web version of the wallet but lacked a mobile counterpart. We built a brand-new mobile version from scratch, and because Broex processes up to 10,000 transactions daily, we designed it to handle massive volumes of data without any hiccups.

➡️ If you want your own banking app that uses cloud computing — don’t hesitate to <a class="blog-modal_opener">contact us via the form</a>. We’ll return to you in 48 hours to schedule a call and discuss pricing.